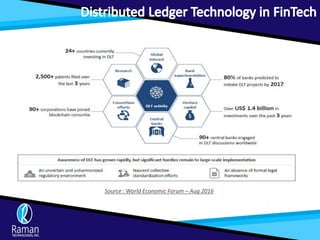

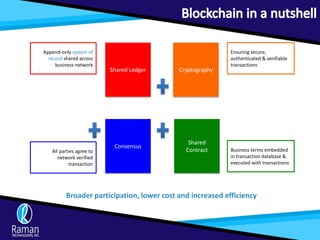

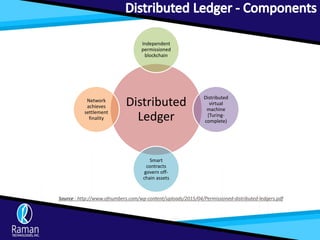

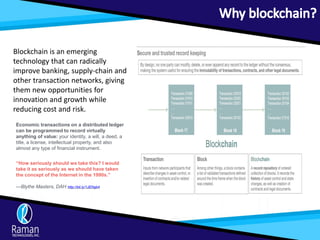

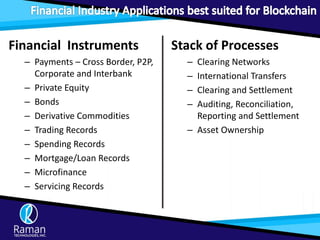

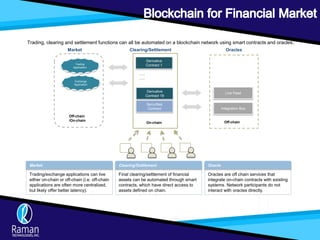

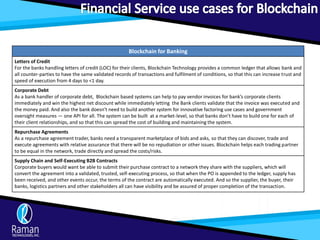

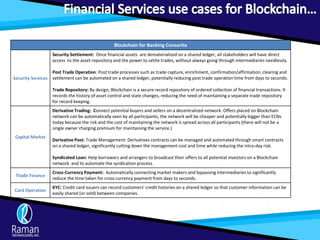

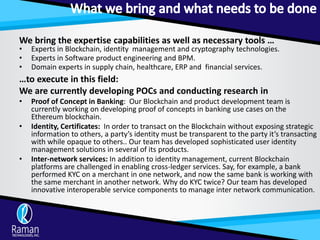

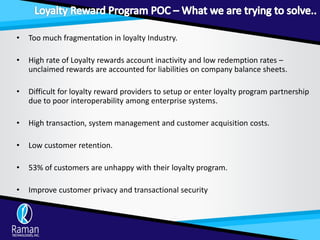

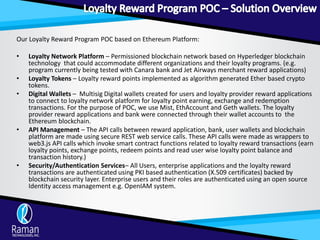

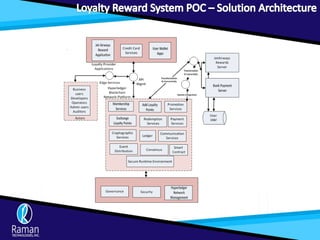

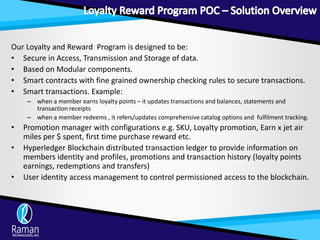

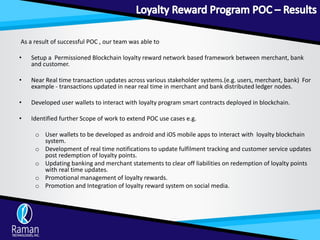

Raman Technologies Inc. offers blockchain solutions for fintech, focusing on agile transformation services to help organizations innovate and improve operational efficiency. Their offerings include proof of concepts in banking, identity management, and a loyalty rewards program, utilizing blockchain technology to reduce transaction times and enhance security. The company aims to empower businesses through agile methodologies and transparent, collaborative environments while leveraging emerging technologies for significant growth opportunities.