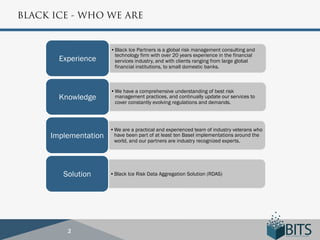

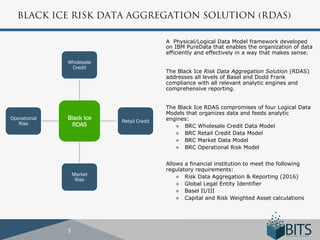

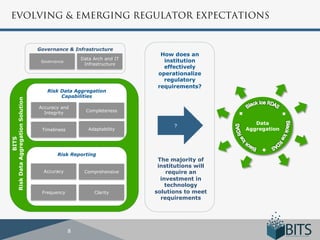

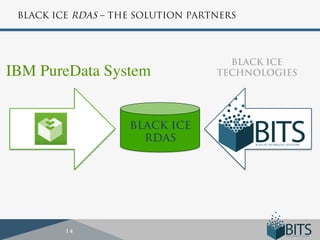

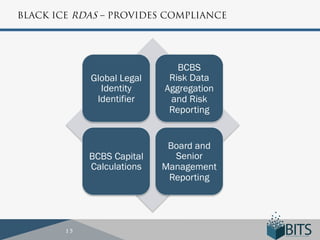

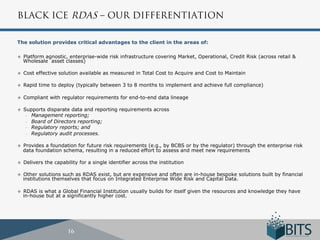

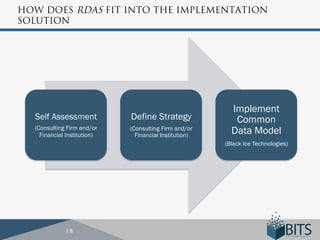

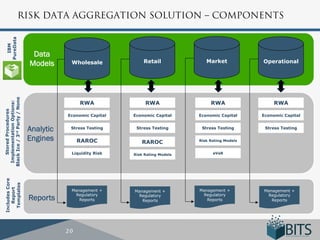

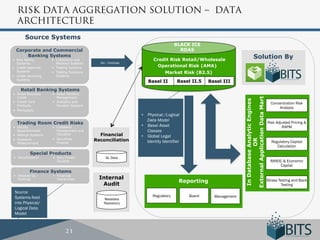

Black Ice Partners is a global risk management consulting firm with over 20 years of experience in the financial services industry. They have a team of industry veterans who have experience implementing Basel regulations around the world. Their Risk Data Aggregation Solution addresses all levels of Basel compliance through logical data models that organize data and feed into analytic engines for credit, market, and operational risk. Black Ice has worked with numerous banks globally on projects such as ICAAP gap analysis, enterprise risk management, and roadmaps for Basel compliance.