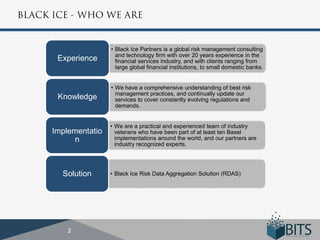

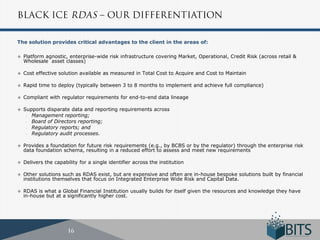

Black Ice Partners is a global risk management consulting firm with over 20 years of experience in the financial services industry, offering clients a comprehensive understanding of best risk management practices and continually updated services to address evolving regulations through practical industry experts who have implemented Basel standards around the world.