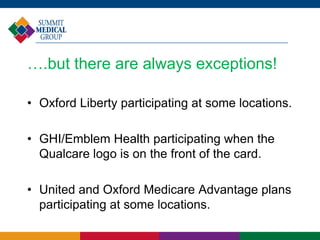

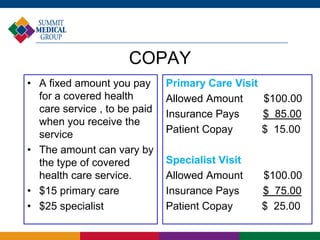

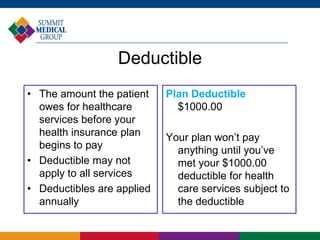

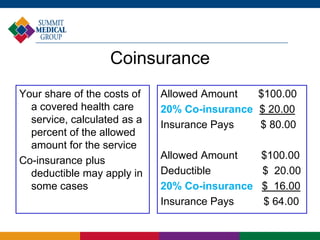

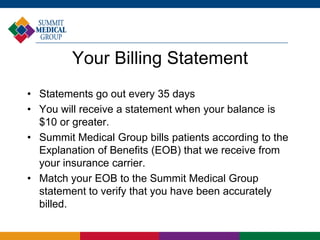

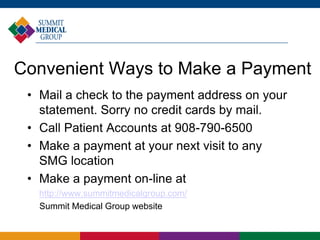

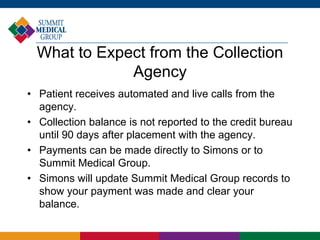

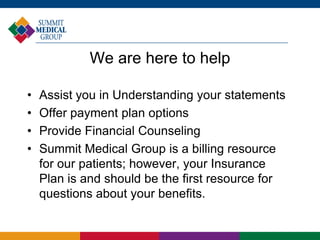

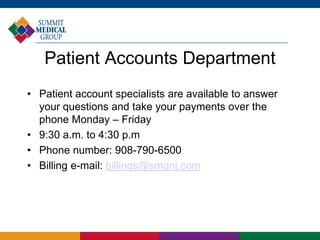

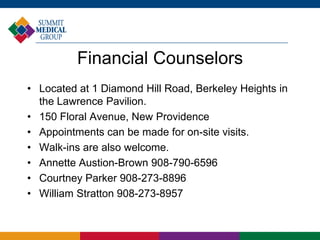

The document provides an overview of the billing and insurance procedures at Summit Medical Group, highlighting the importance of accurate insurance information and the need for patients to bring current insurance cards to every visit. It details the types of participating and non-participating insurance plans, the coding of services, and explains cost sharing components such as copay, deductible, and coinsurance. Additionally, it outlines the billing process, including statement generation, payment options, and the potential for accounts to be sent to collections if unpaid after due notifications.