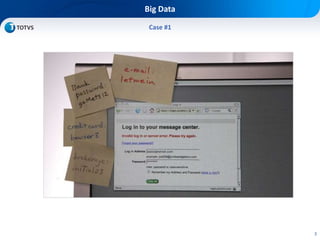

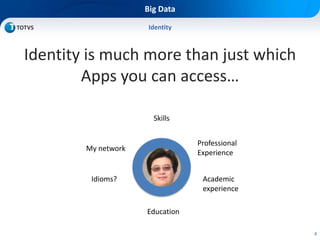

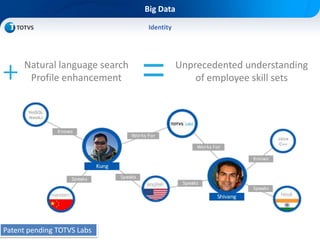

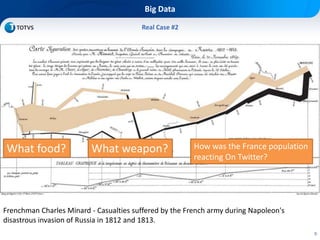

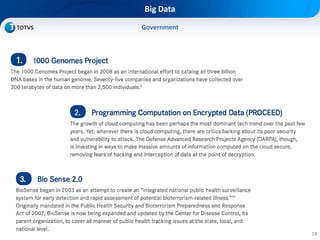

The document discusses various use cases of big data, highlighting the importance of identity and data integration for companies to leverage their existing data. It presents examples including historical analyses, social media reactions, and innovative applications in credit scoring and agro-insurance. Additionally, it mentions tools and resources for data visualization and analytics.