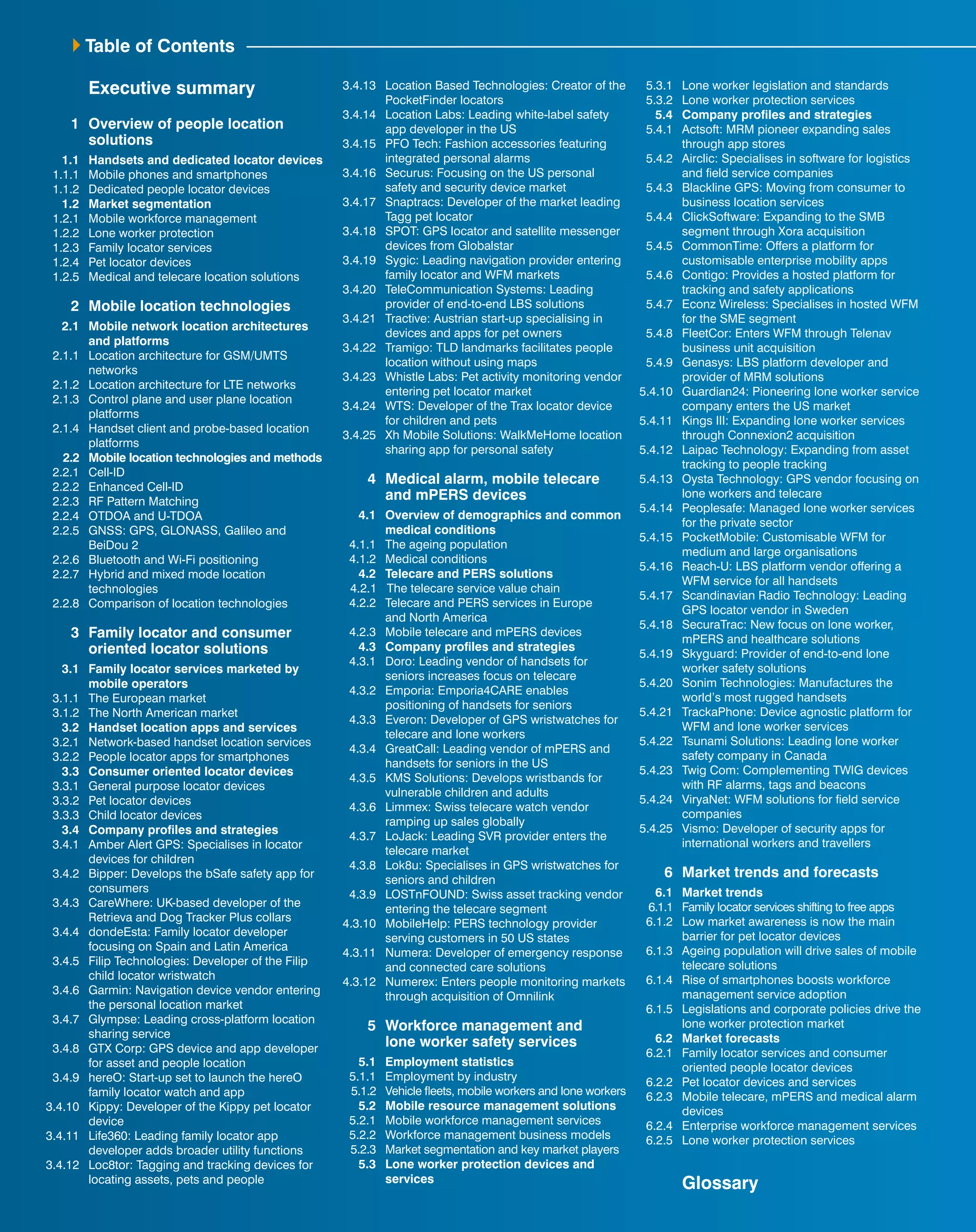

This report analyzes the latest developments in the people tracking market in Europe and North America. It provides 150 pages of business intelligence including market forecasts through 2020 and insights from executive interviews. The report examines key segments like family locator services, pet tracking, mobile workforce management, and lone worker protection. It also explores the technologies and major players in each segment.