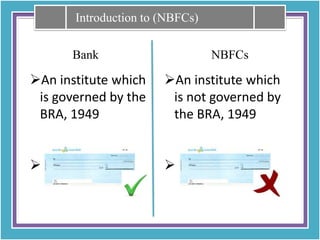

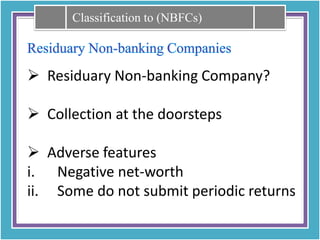

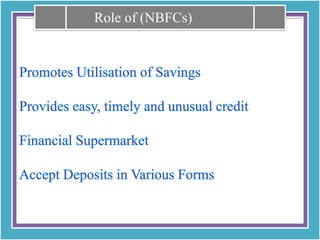

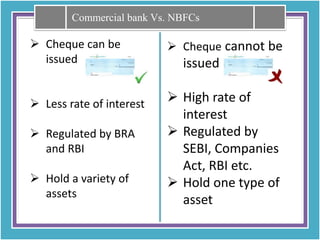

Non-banking financial companies (NBFCs) provide financial services like banks but are not subject to the Banking Regulation Act of 1949. NBFCs engage in activities like equipment leasing, hire purchase, housing finance, and investment/loans but have some limitations compared to banks. The document discusses the roles and various classifications of NBFCs such as leasing companies, housing finance companies, investment companies, loan companies, mutual benefit companies, chit fund companies, and residuary non-banking companies. NBFCs generally charge higher interest rates than banks and have regulatory oversight from bodies like SEBI and RBI rather than just the Banking Regulation Act.