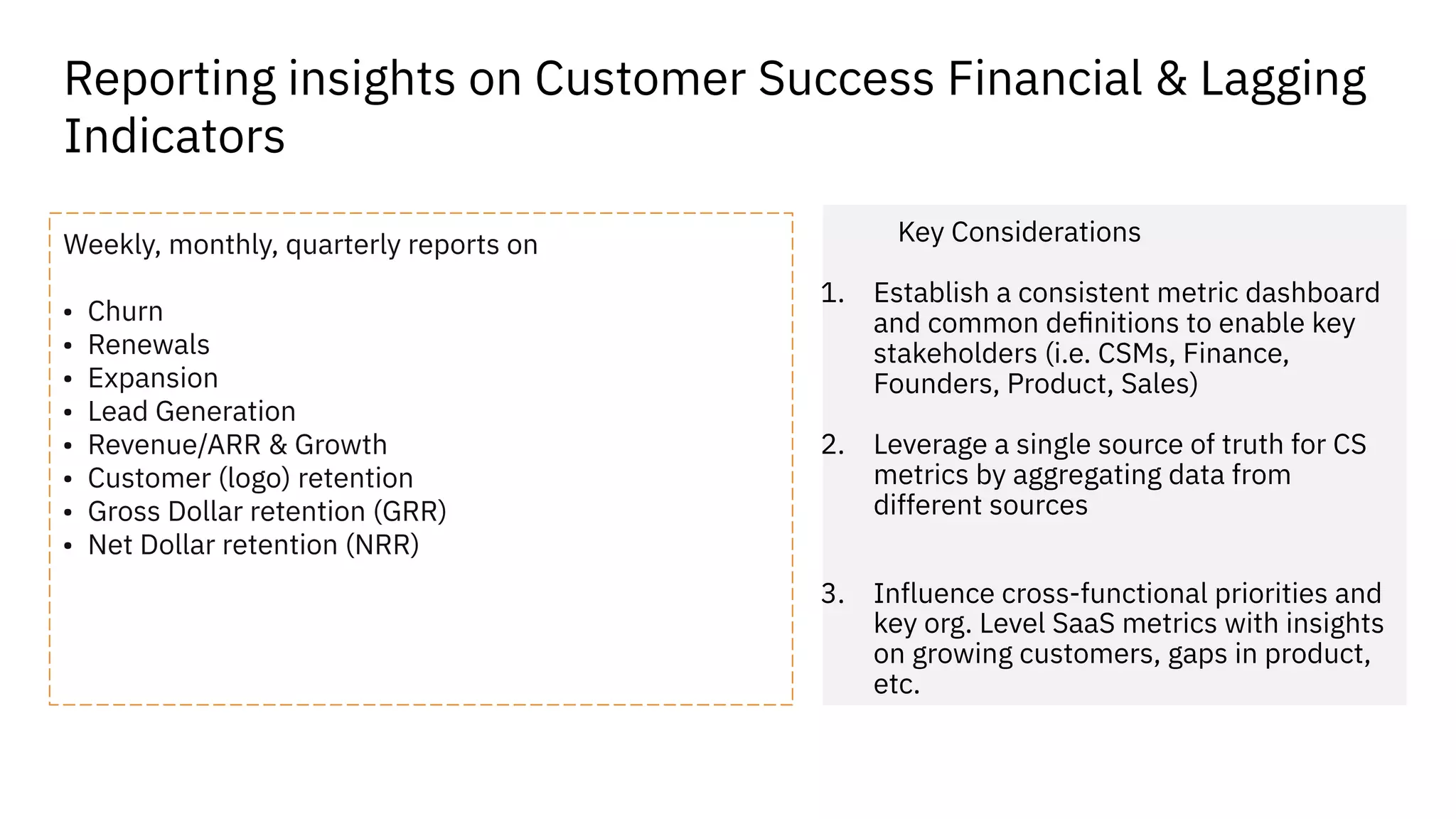

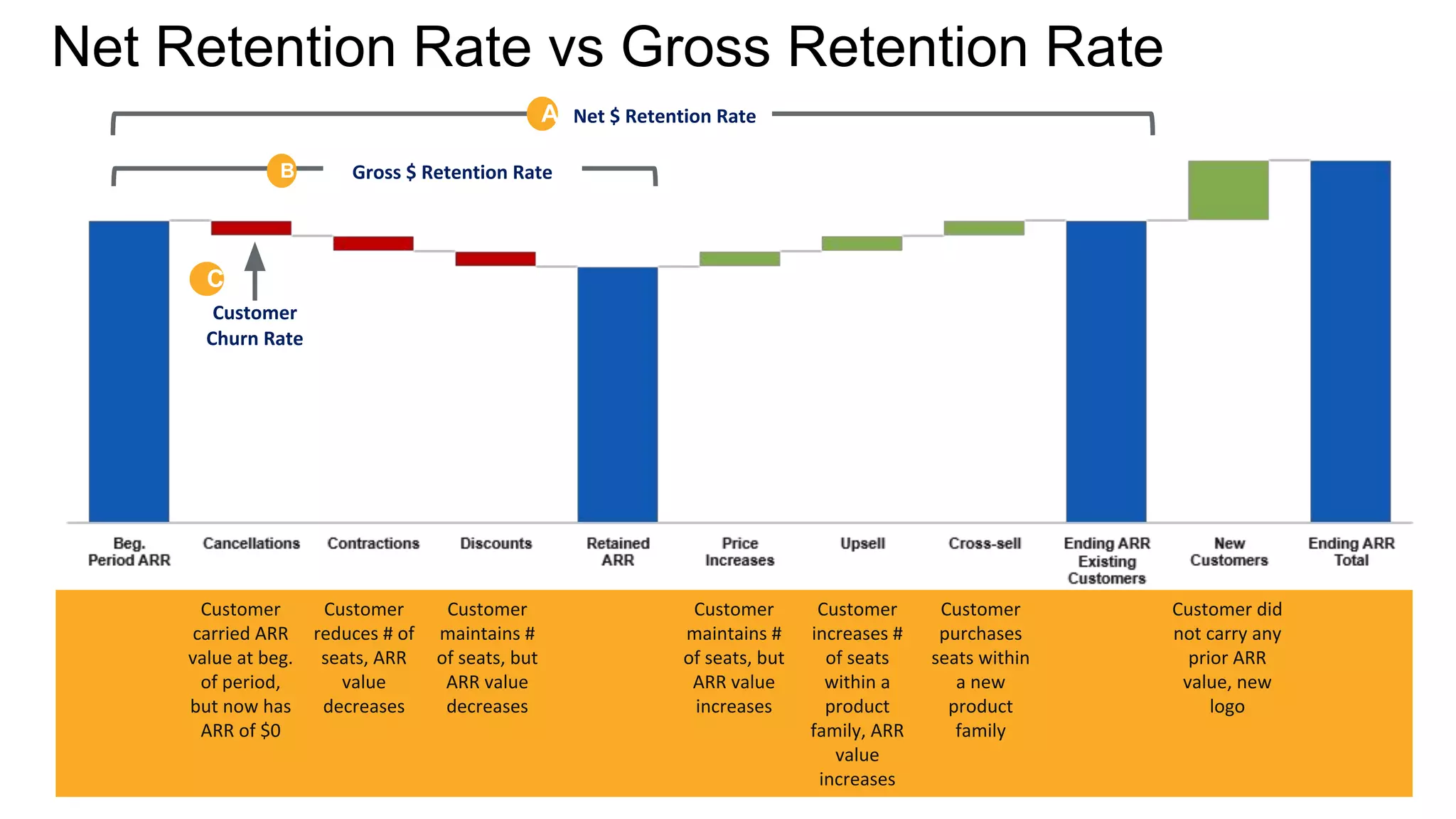

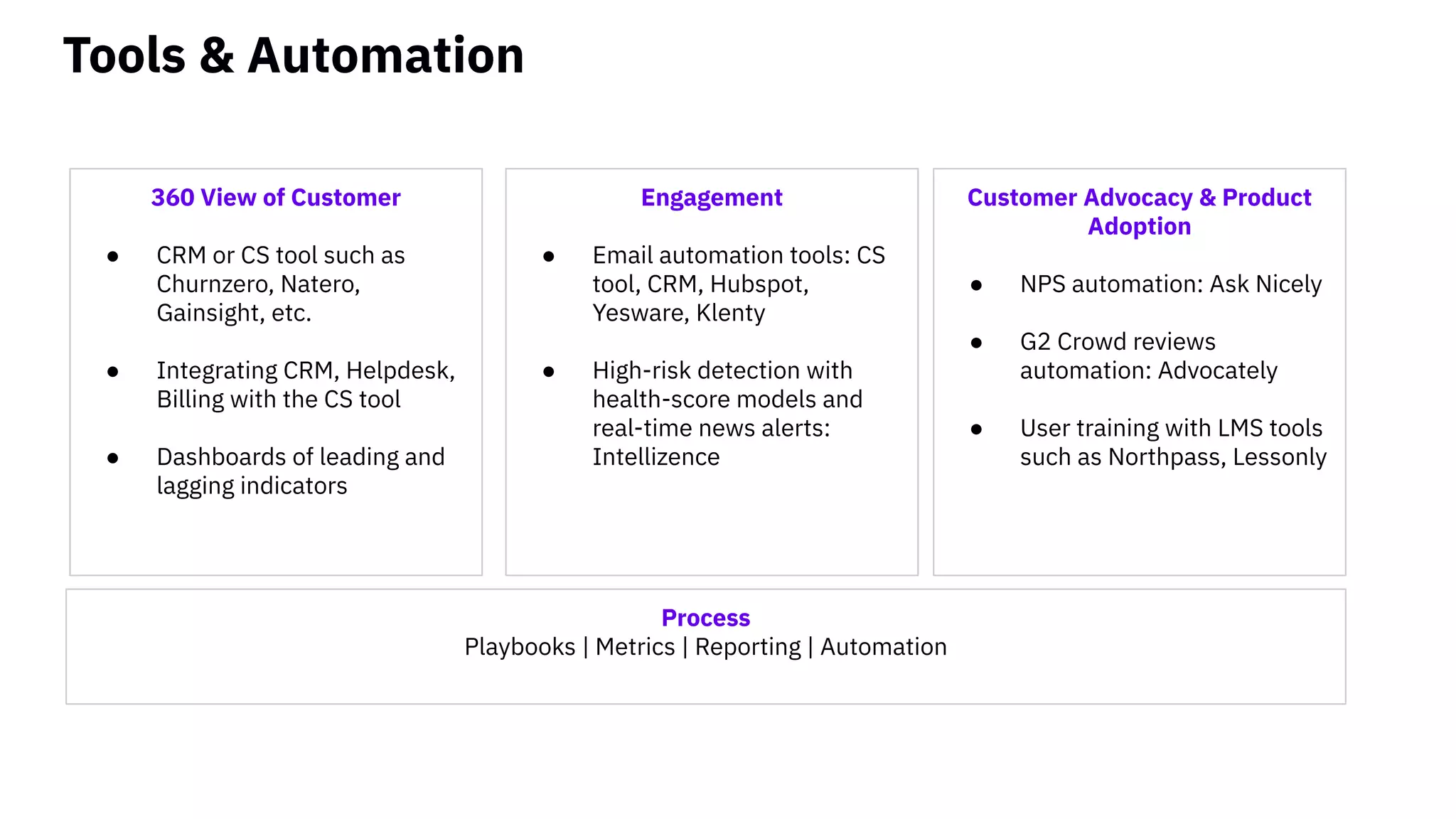

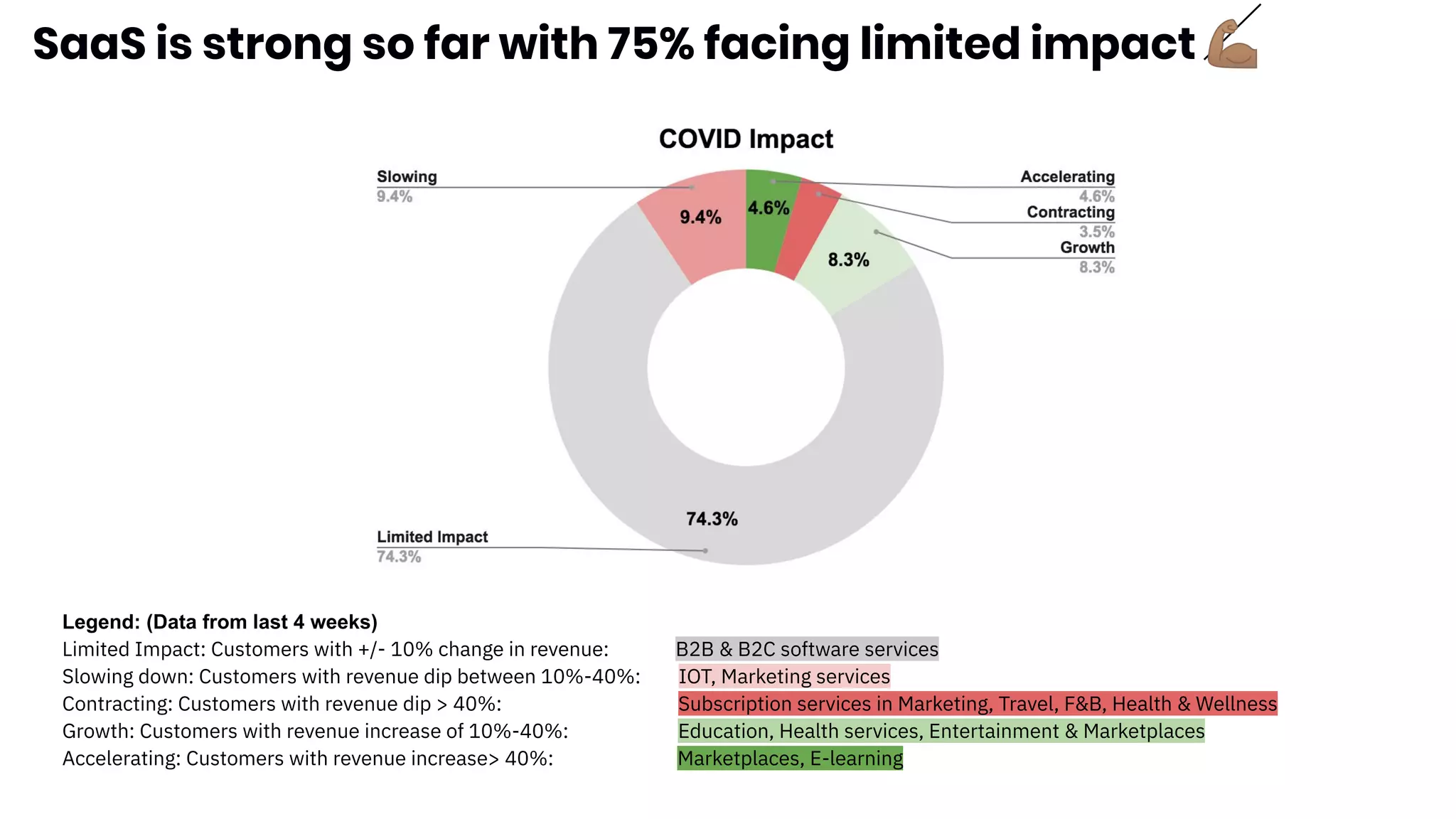

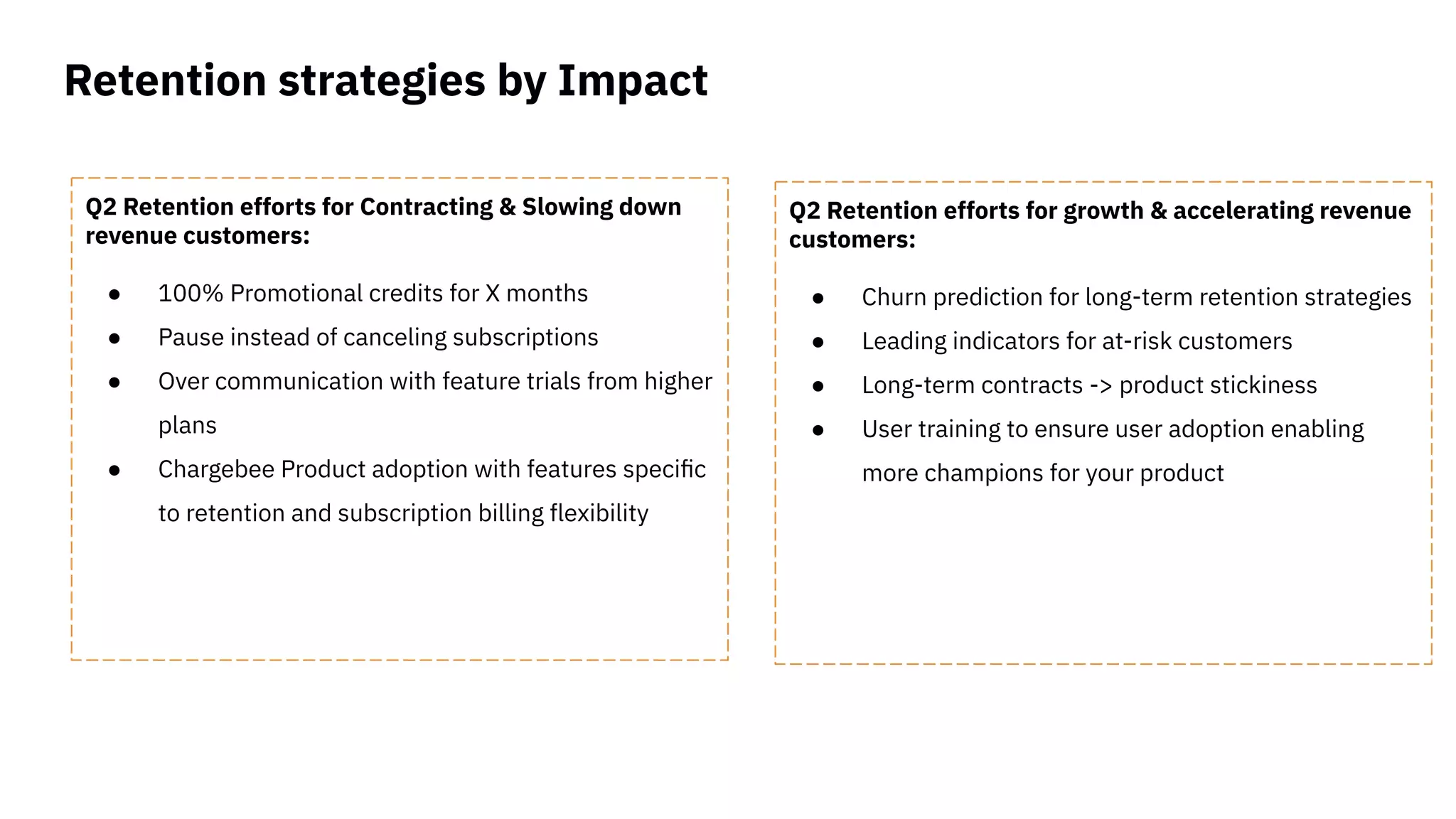

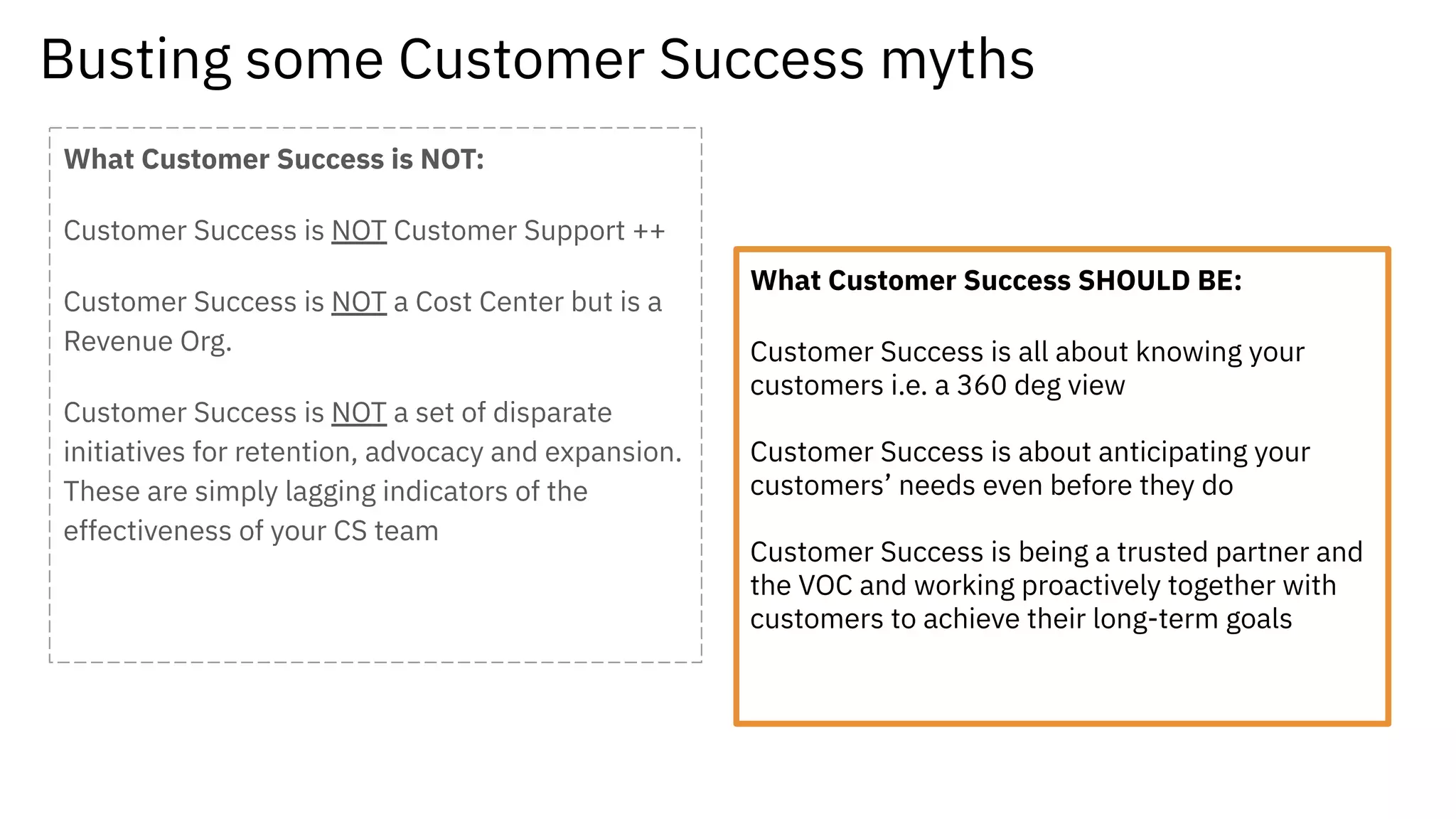

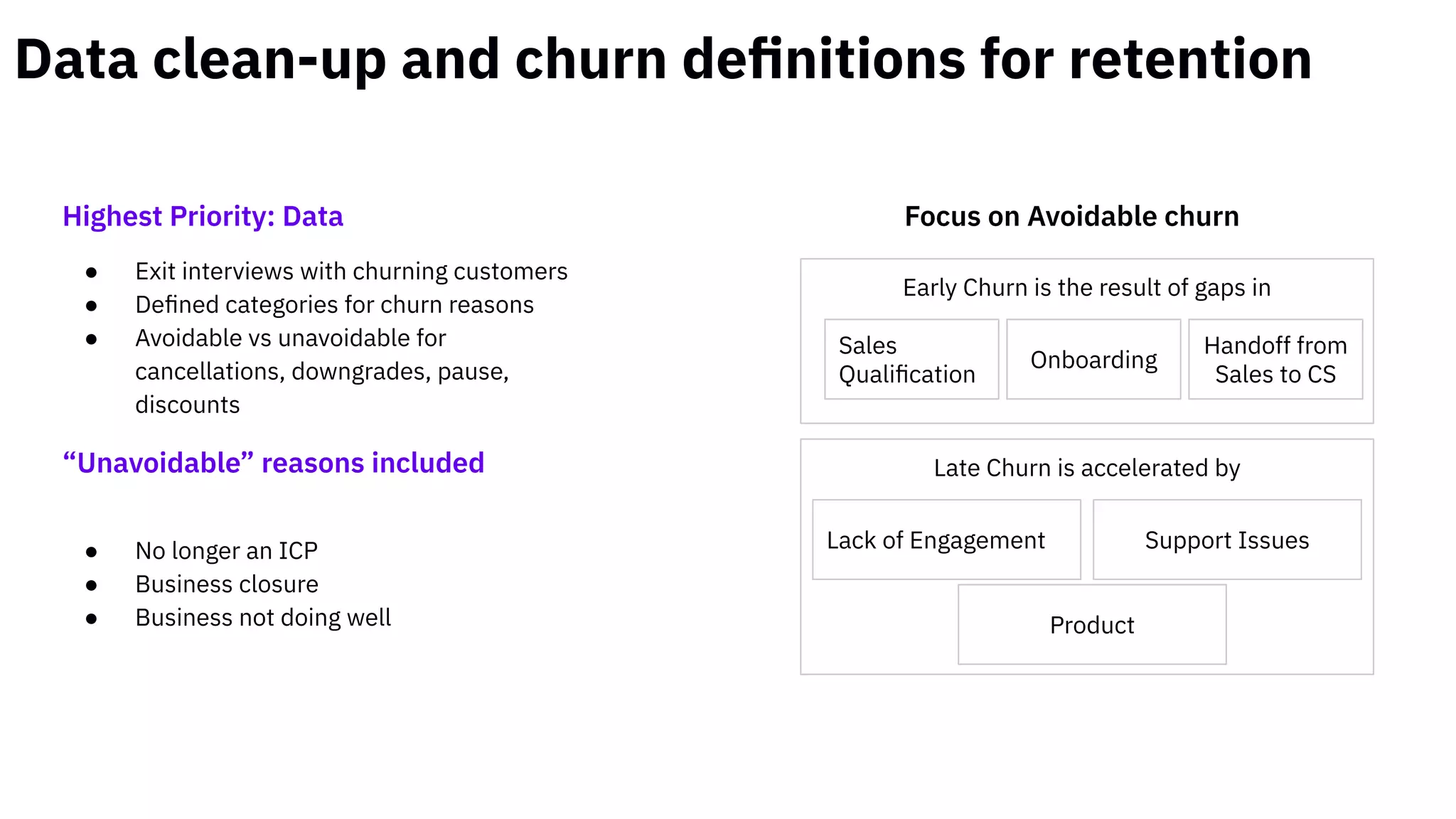

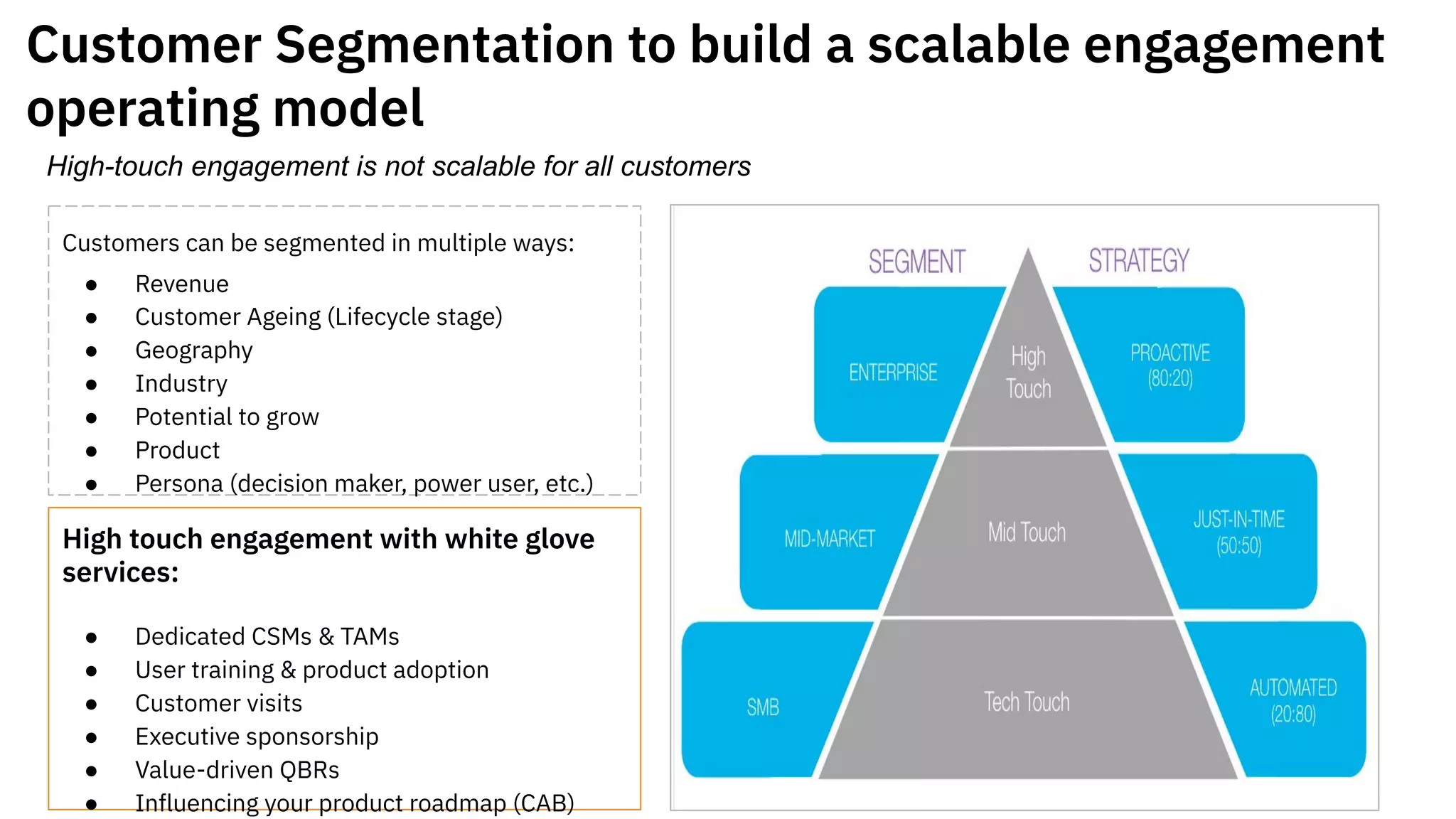

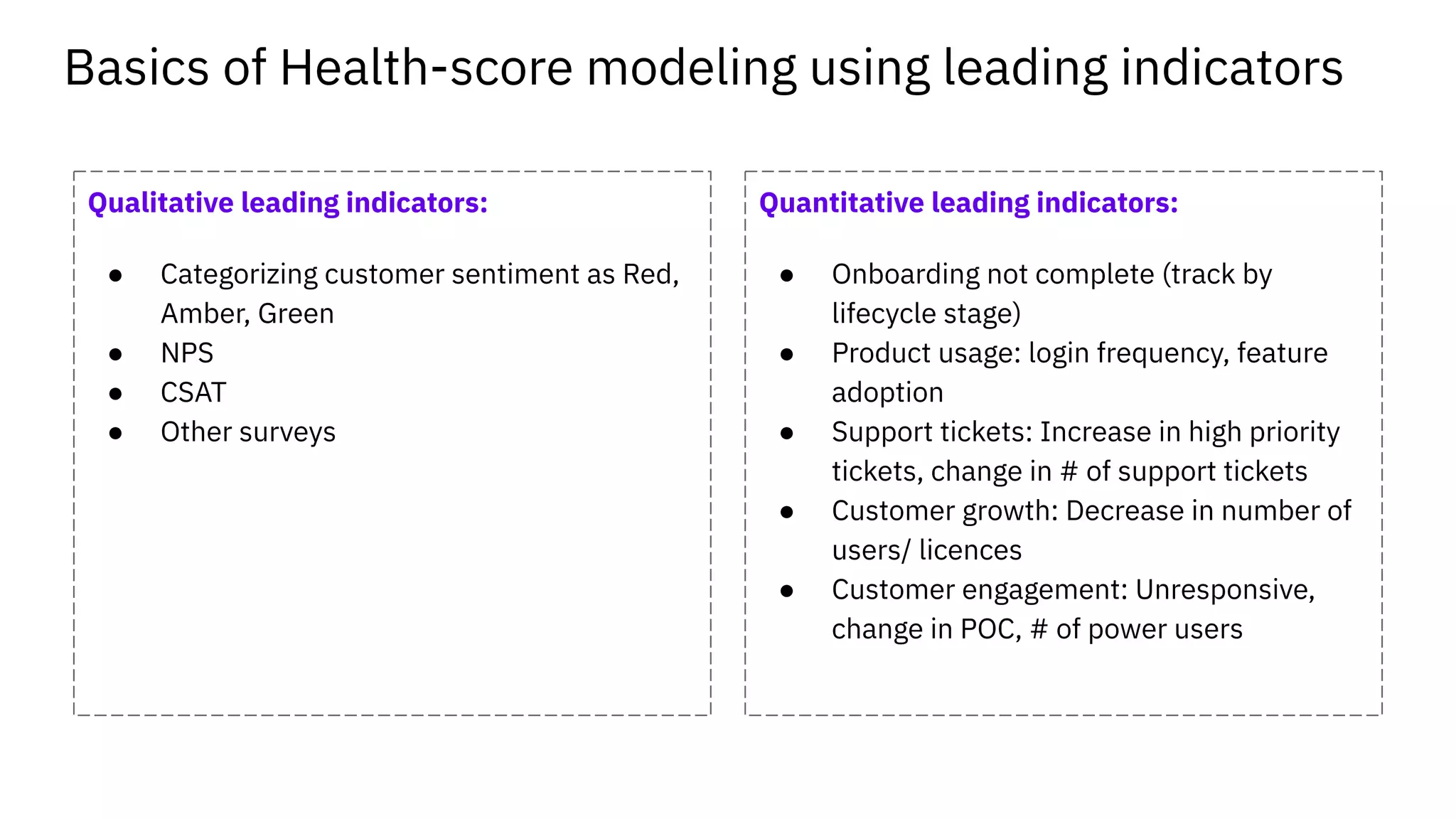

The document discusses strategies for building and scaling a data-driven customer success team, focusing on the distinction between customer success and customer support. It emphasizes data utilization, high-touch onboarding, customer segmentation, engagement models, and metrics for retention, while outlining the importance of effective team structure and customer success operations. It also addresses the challenges posed by recent economic changes and the need for proactive retention strategies.

![Transforming a 5 member CS team to 25 in 15 months @ Chargebee

Lead - NAMER Lead - APACLead - EMEA

Success Operations & Enablement

[3/3]

Pooled resources of

SMB CSMs

India CSM

[2]

Pooled resources of

SMB CSMs

India-CSM

[2/2]

Pooled resources of

SMB CSMs

India CSM

[1/1]

Account Management

[2/2]

TAM

[1/1]

TAM

[2/2]

TAM

[2/3]

US -CSM

[2]

Senior Director - Customer Success

EU -CSM

[0/1]

Manager - NAMER Manager - APAC+EMEA

Account Management

[1/2]

Director - Support & Success

SMB CSMs

Enterprise CSMs](https://image.slidesharecdn.com/copyofsaasbhoomicustomersuccessarundhati-200603110458/75/Best-Practices-Process-Tools-for-Setting-Customer-Success-Process-with-Arundhati-Balachandran-Chargebee-14-2048.jpg)