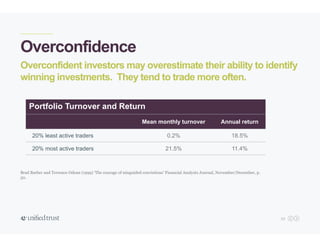

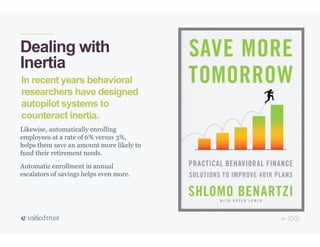

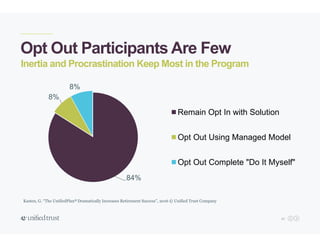

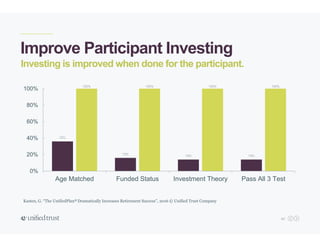

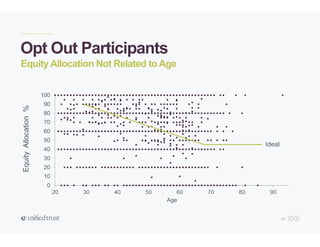

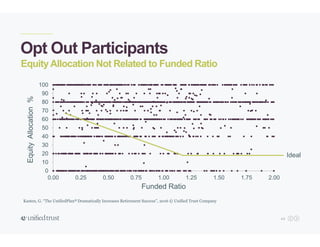

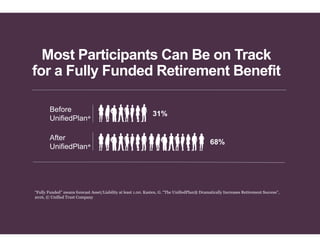

The document presents research on behavioral finance, highlighting that most 401(k) participants are passive in decision-making, influenced by traits like inertia, procrastination, and choice overload. It outlines the inefficacy of current retirement strategies and suggests the implementation of automatic enrollment and personalized strategies to improve retirement outcomes for participants. The aim is to enhance both participant success and adviser value through proactive engagement and solution-oriented approaches.