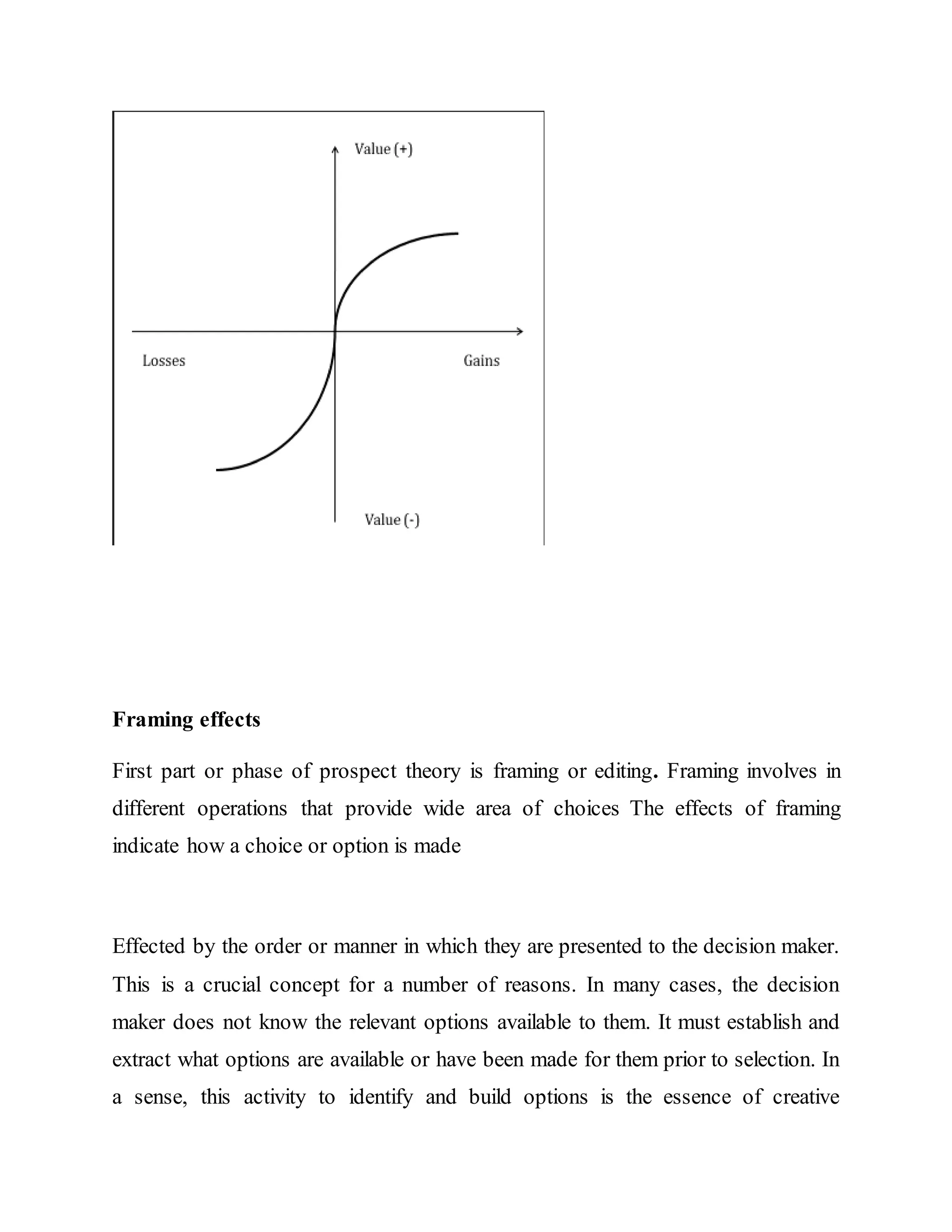

This document discusses a study on the impact of behavioral biases on investment decisions and the moderating role of financial literacy. It provides background on behavioral finance theories like prospect theory which suggest that individuals weigh gains more than losses. The literature review discusses previous research finding that overconfidence, loss aversion, availability, optimism, and regret aversion influence investment decisions. However, these factors were not examined together previously in Pakistan with financial literacy as a moderator. The research aims to examine the impact of these behavioral biases and the moderating role of financial literacy on individual investor decisions in the Pakistan stock exchange.