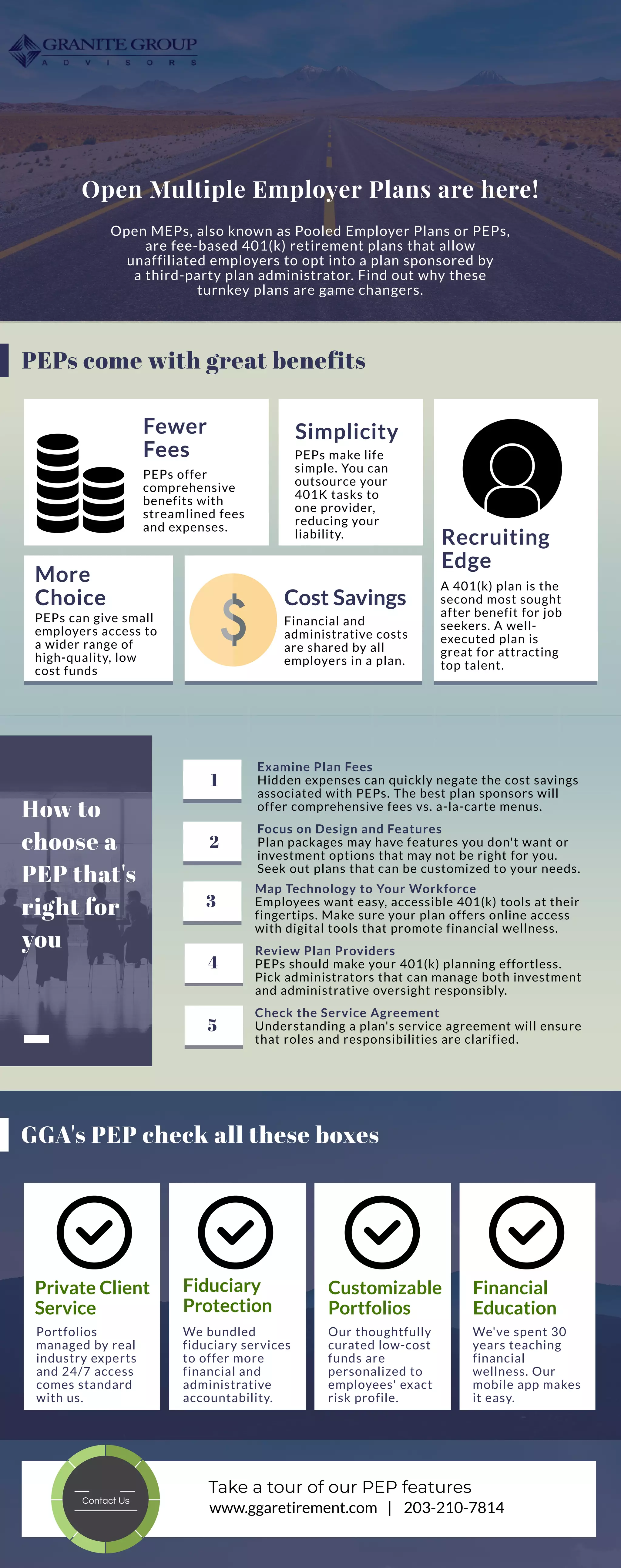

PEPs (Pooled Employer Plans) allow unaffiliated employers to join a 401(k) retirement plan sponsored by a third-party administrator. PEPs offer lower fees through cost sharing among participating employers. They also provide simplicity by outsourcing 401(k) tasks to a single provider and reducing employer liability. When choosing a PEP, employers should examine plan fees, available technology and tools, provider reputation, service agreements, and customization options to find the best fit.