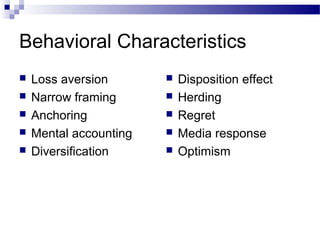

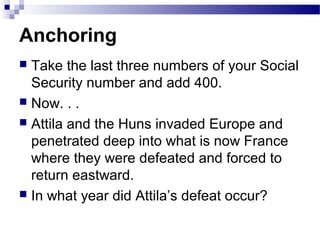

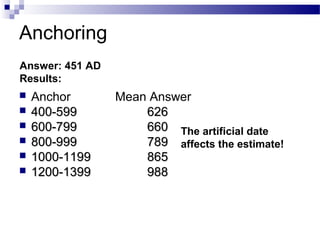

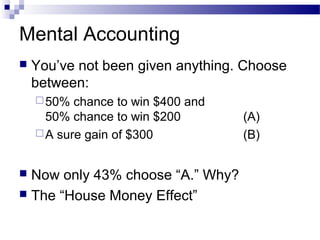

The document outlines behavioral finance concepts and how they relate to standard financial theory. It discusses how behavioral finance provides an overlay to traditional models by recognizing that investors are not perfectly rational and there are cognitive biases. It then surveys various behavioral characteristics like loss aversion, narrow framing, anchoring, and herd behavior that can influence investor decisions in systematic ways. The document emphasizes developing a long-term investment strategy and working with advisors to overcome cognitive biases.