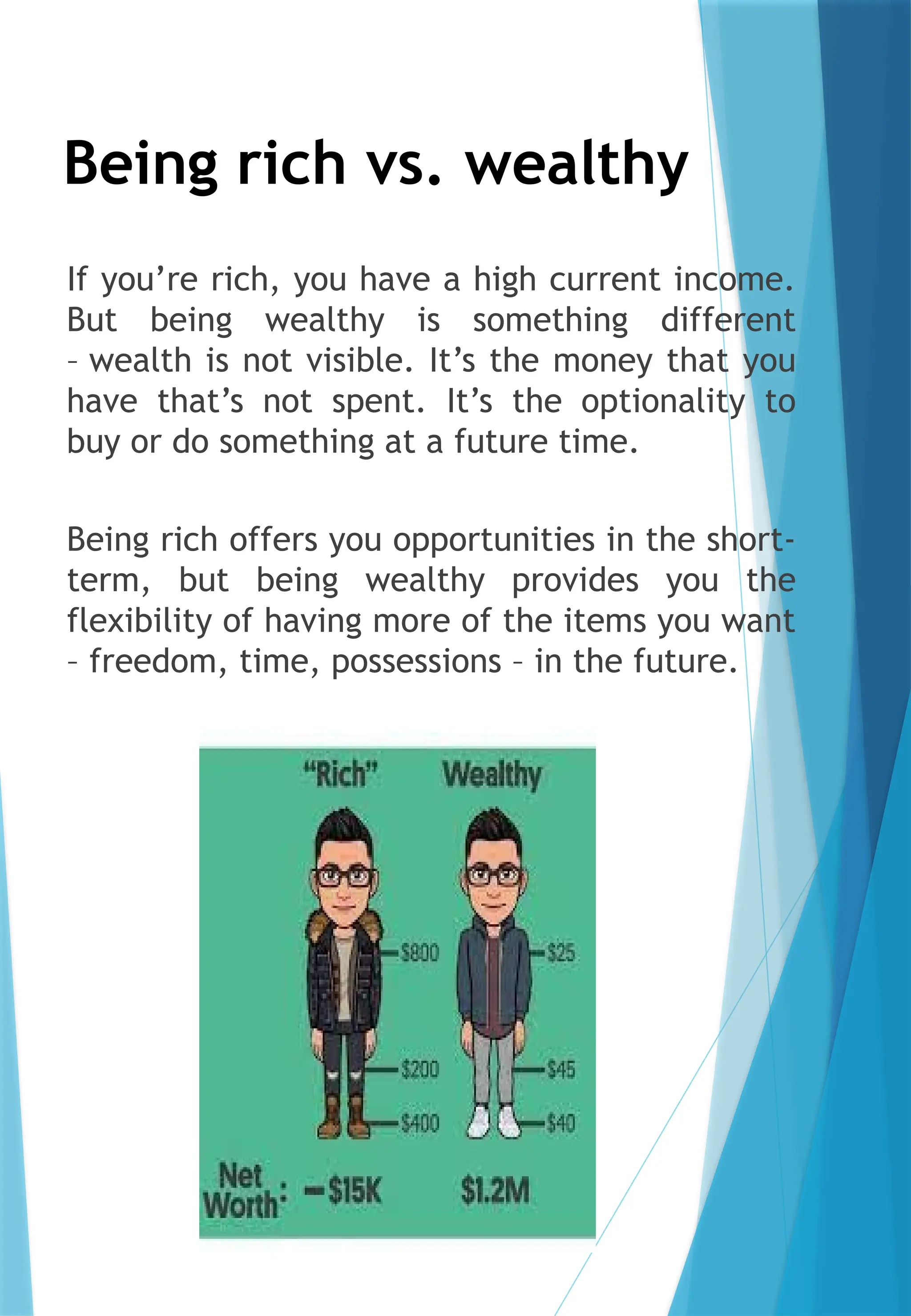

The Psychology of Money by Morgan Housel explores how personal attitudes, experiences, and emotions shape financial decisions rather than purely mathematical principles. It emphasizes the importance of understanding risk, the long-term impact of decisions, and the difference between being rich and being wealthy. The book highlights the subjective nature of financial well-being and urges readers to align their investments with their personal goals and values.