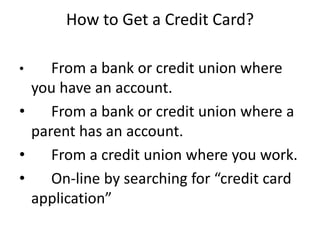

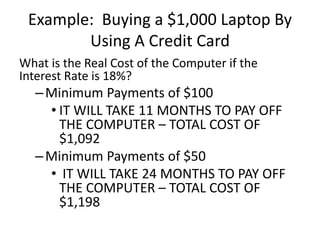

This document provides a basic overview of credit cards and credit. It discusses that a credit card is a loan based on a person's credit history and character. For those without credit history, income can be used to qualify for a first credit card. Credit cards differ from debit cards in that credit cards provide revolving credit with a monthly balance, while debit cards deduct funds immediately from a linked bank account. The document outlines factors that can help qualify for a credit card like good credit and a job, and explains how credit reports track payment history to determine credit scores. It warns that only paying minimum payments on credit cards can result in paying significantly more in interest over time due to compounding.