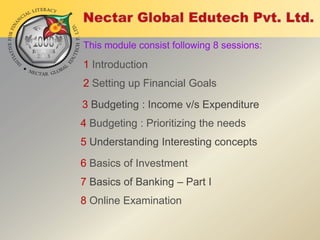

The document discusses the importance of financial literacy in India. It notes that even after 65 years of independence, India has failed to achieve a satisfactory level of financial literacy among its citizens. Both the President of India and former RBI Governor have emphasized the need to improve financial literacy in the country in order to ensure that citizens can make informed financial decisions. The document advocates for improving financial education through programs that aim to increase financial awareness, especially among average Indians. It presents the objectives and structure of a "Financial Literacy Awareness Program" launched by Nectar Global Edutech to enhance financial knowledge across different sections of society in India.