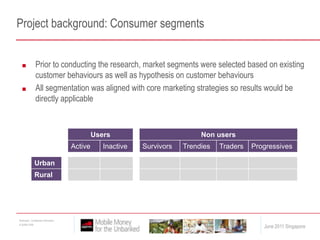

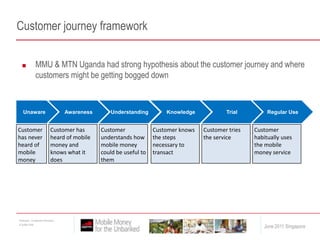

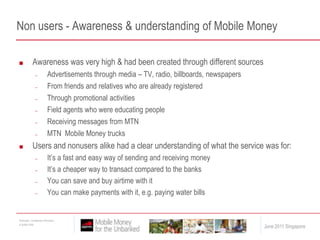

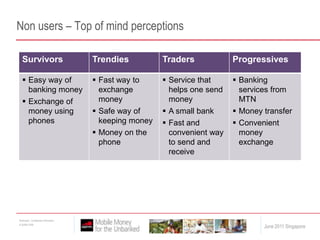

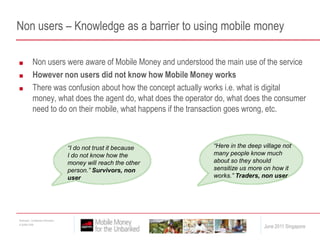

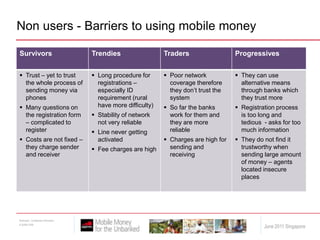

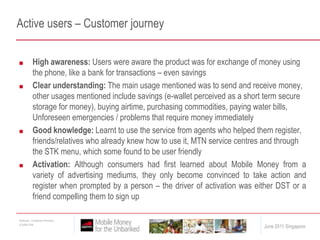

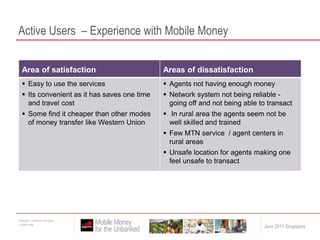

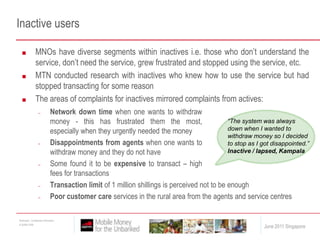

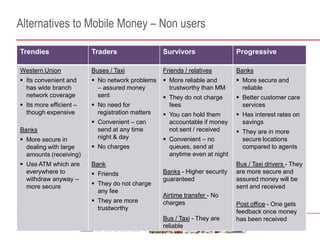

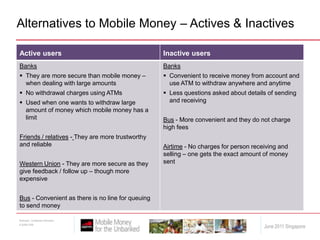

This document summarizes research conducted by MTN Uganda and MMU to understand barriers to customer activation for their mobile money platform. It identifies key barriers for non-users (lack of knowledge around how mobile money works), inactive users (network issues, agent liquidity problems, high fees), and areas for improvement according to active and inactive users (improving education, agent network, customer service, and transaction limits). The conclusions recommend MTN focus on improving knowledge of mobile money through education campaigns, boosting the agent network in rural areas, enhancing customer service and addressing issues causing network downtime and agent liquidity problems.