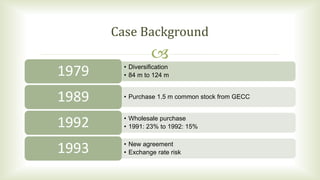

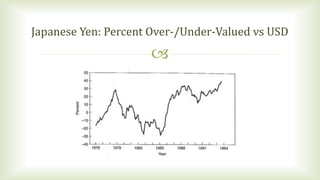

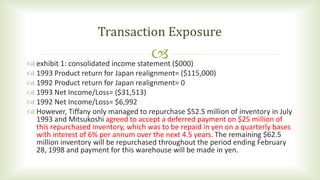

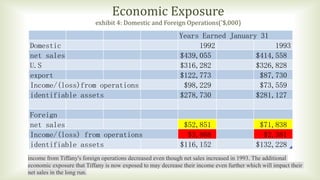

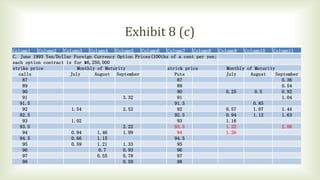

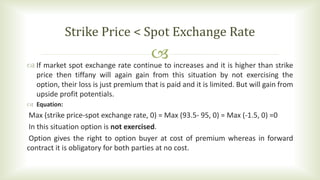

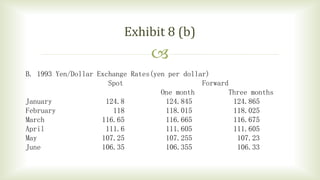

Group members for this case analysis are Ma Yun and Zhang Zuodong. The document discusses Tiffany & Co.'s exchange rate risk issues in Japan. Tiffany faces transaction, economic, and translation exposure due to a new agreement with its Japanese partner. It is exposed to yen volatility which could impact profits. A 3-month put option is recommended to hedge risks as the yen may depreciate against the dollar. Joining a Japanese keiretsu group could also help decrease exchange rate risk through stronger liquidity.