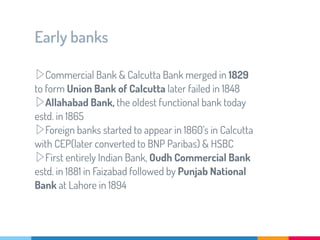

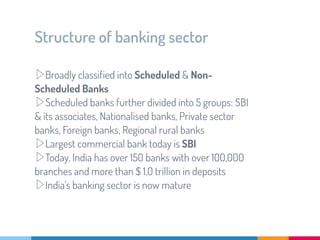

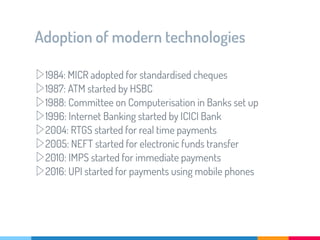

The document provides an overview of the banking sector in India from pre-independence to current times. It discusses the early banks established in India in the 19th century during British rule. After independence, the government nationalized major banks in 1969 and 1980 to gain greater control over credit. Banking was liberalized in the 1990s, allowing private banks like HDFC and ICICI to form. Today India has over 150 banks with modern technologies like internet banking, ATMs, and UPI payments widely used. The future of Indian banking is expected to include consolidation and global expansion.