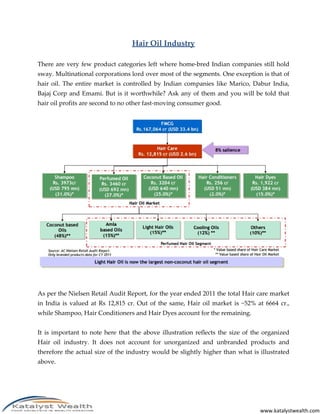

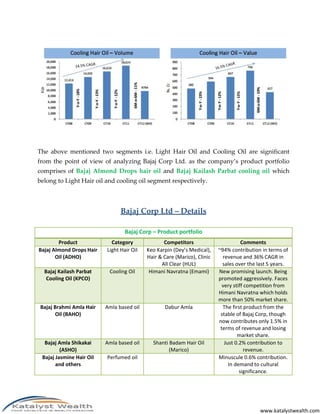

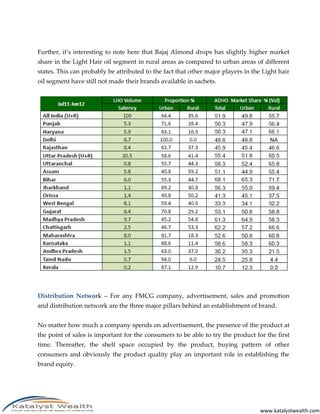

Bajaj Corp Ltd is an Indian company that manufactures hair oils, including its flagship Bajaj Almond Drops hair oil brand. It has the largest market share in the light hair oil segment in India, estimated at 54% as of FY2012. The document discusses Bajaj Corp's business, financials, brands, and performance, as well as the broader Indian hair oil industry which is dominated by local companies and valued at Rs. 6,664 crore as of 2011. It recommends buying Bajaj Corp shares with an initial 4-5% portfolio allocation.