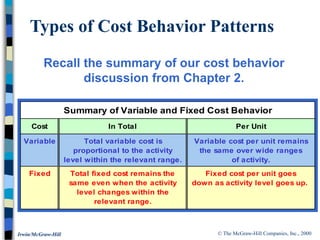

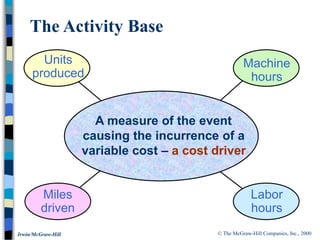

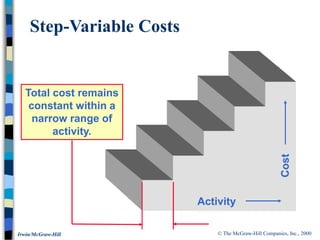

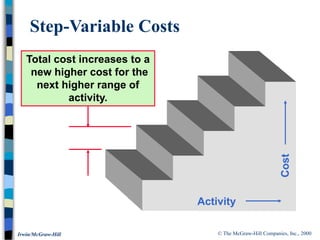

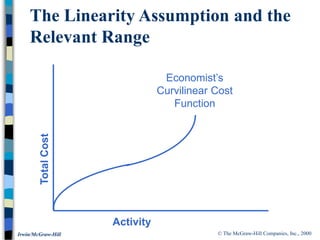

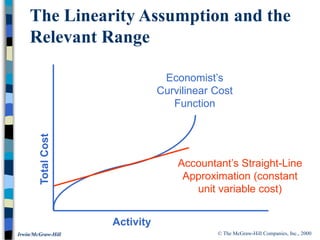

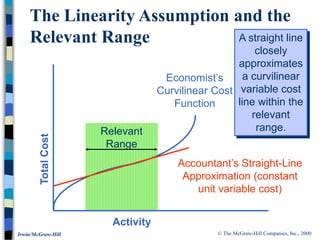

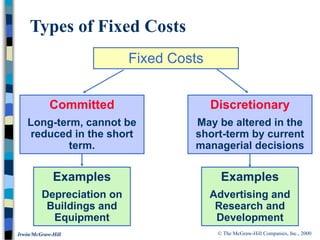

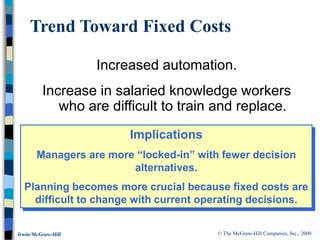

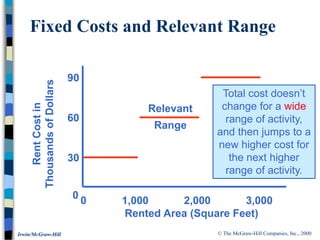

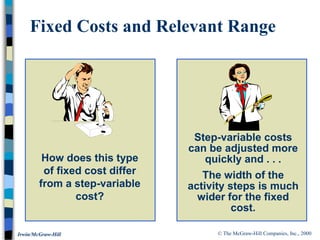

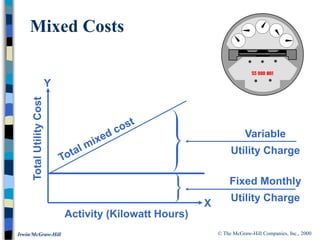

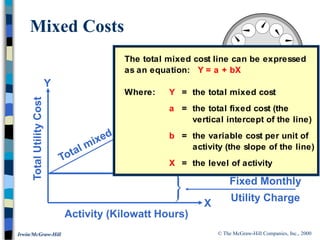

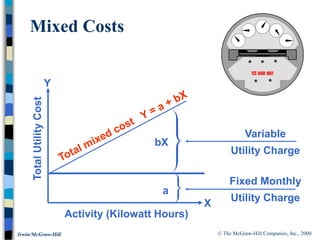

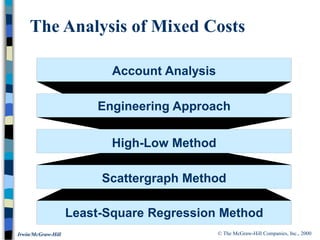

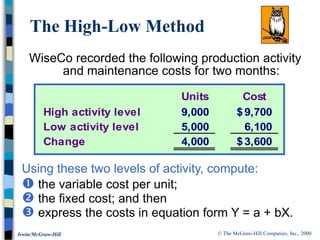

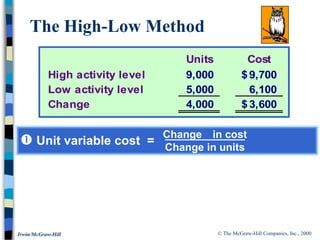

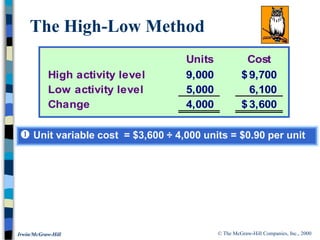

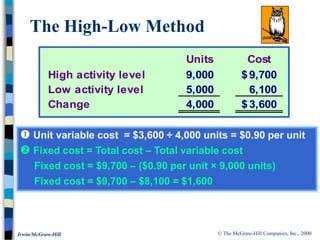

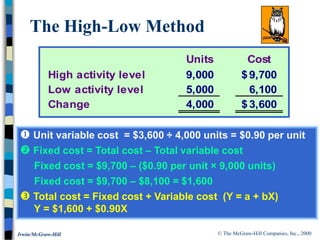

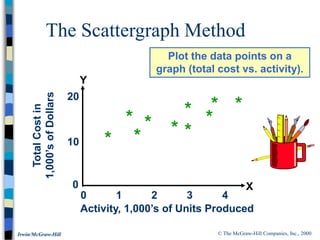

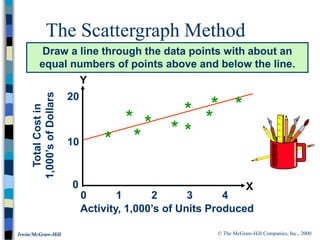

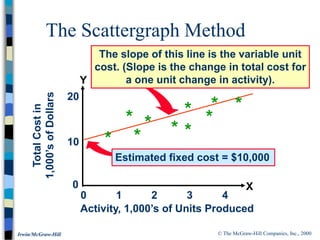

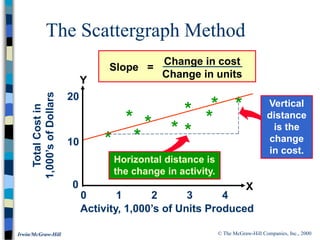

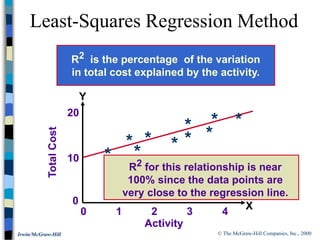

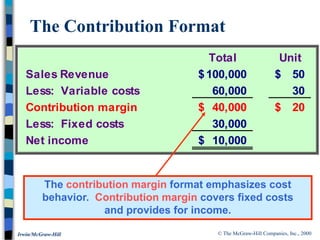

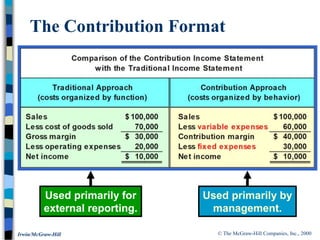

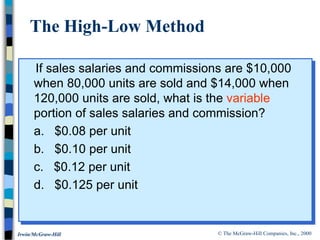

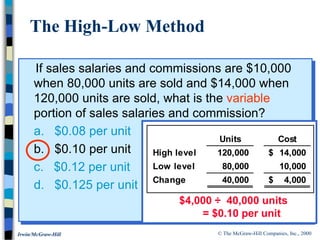

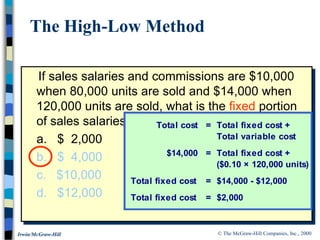

The document discusses cost behavior patterns and analysis. It defines variable and fixed costs, and how their total and per unit costs change with activity levels. Mixed costs that have both fixed and variable components are also examined. Methods for analyzing costs are presented, including account analysis, engineering estimates, high-low analysis, scattergraph analysis, and least squares regression. The contribution format income statement is introduced as a tool that emphasizes cost behavior for management decision making.