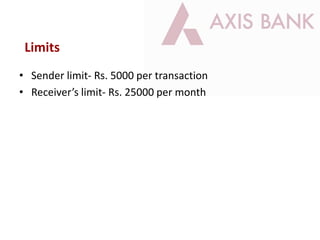

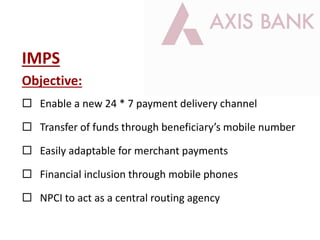

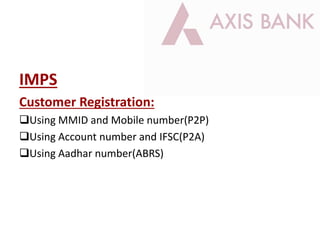

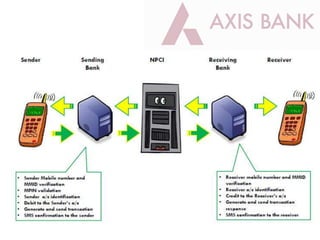

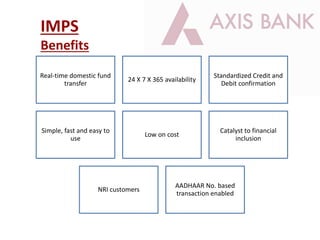

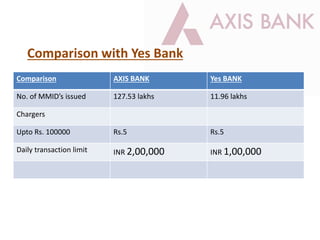

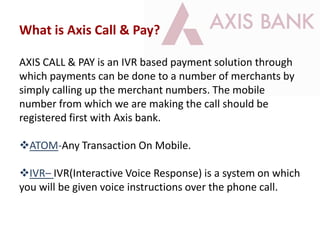

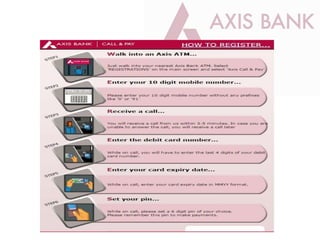

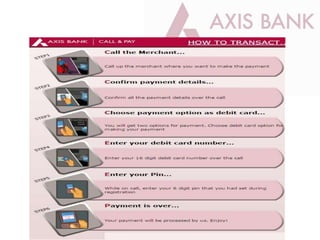

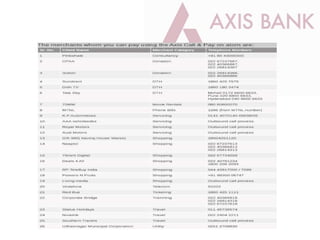

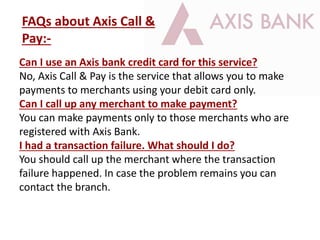

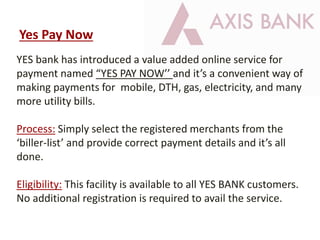

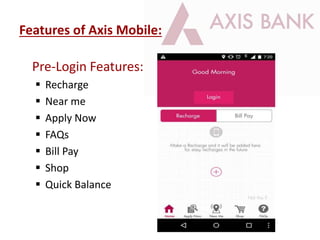

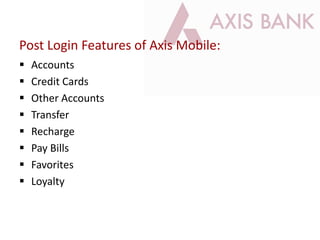

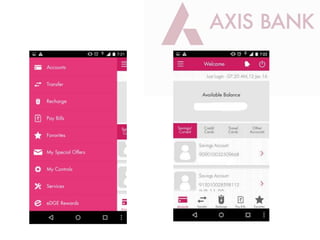

This document compares financial services from Axis Bank and Yes Bank. It summarizes Axis Bank's Instant Money Transfer service, IMPS service, and Call and Pay service. It also summarizes Yes Bank's Pay Now service. Finally, it describes Axis Bank's NGPAY digital wallet and Axis Mobile app, comparing some features to Yes Bank's mobile app.