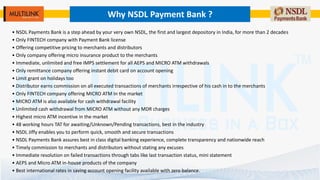

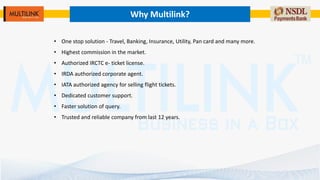

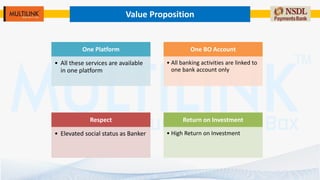

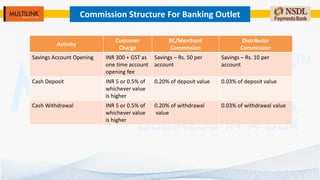

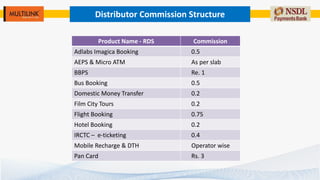

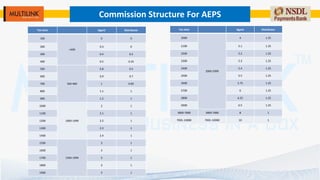

The document presents a proposal for NSDL Payments Bank's kiosk banking services, highlighting its competitive features like free IMPS settlements, instant debit cards, and various banking services including micro ATM and AEPS. It emphasizes the advantages of partnering with MultiLink, which offers a comprehensive platform for banking, travel, and utility services, along with attractive commission structures for distributors and agents. Additionally, it outlines support and promotional resources provided to boost sales and enhance customer engagement.