AssignmentMarginal Revenue ProductMarginal revenue product i.docx

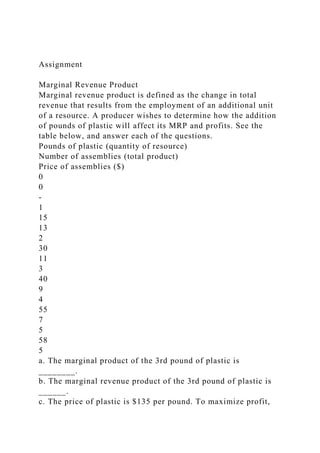

- 1. Assignment Marginal Revenue Product Marginal revenue product is defined as the change in total revenue that results from the employment of an additional unit of a resource. A producer wishes to determine how the addition of pounds of plastic will affect its MRP and profits. See the table below, and answer each of the questions. Pounds of plastic (quantity of resource) Number of assemblies (total product) Price of assemblies ($) 0 0 - 1 15 13 2 30 11 3 40 9 4 55 7 5 58 5 a. The marginal product of the 3rd pound of plastic is ________. b. The marginal revenue product of the 3rd pound of plastic is ______. c. The price of plastic is $135 per pound. To maximize profit,

- 2. the producer should produce __________________. d. The price of plastic is $135 per pound. To maximize profit, the producer should buy and use: ________________. Grading Criteria Assignments Maximum Points Meets or exceeds established assignment criteria 40 Demonstrates an understanding of lesson concepts 20 Clearly presents well-reasoned ideas and concepts 30 Uses proper mechanics, punctuation, sentence structure, and spelling 10 Total 100 Case Study C&MDS, Inc. Some time ago, at the beginning of 2010, an entrepreneur named Richard Alestar started a small business as a sole proprietor in Oregon - a business that manufactured sensors for cameras that could be used in motion detection systems. The business was very successful and he decided to incorporate in the latter part of 2011 under the name C&MDS, Incorporated. He wanted to name it Camera and Motion Detection Systems, but his marketing manager convinced him it was too difficult to remember. Alestar’s long-term plan was to obtain public funding to support growth anticipated in about 4-6 years. In the meantime, he hired electrical engineers and a solid management

- 3. team capable of building an organization that would enable the company to eventually go public. He thought his proprietary sensors and equipment could not be duplicated for a number of years. There was only one competitor in the market niche where he competed that had a significant market share, but they were a follower, not a leader. Besides, he planned to grow the market himself, based on the increased focus and attention in the public arena on crime prevention, detection and surveillance using cameras with his sensors. He also was developing a host of other potential applications. Alestar had developed a good relationship with his investment banker Sophia Pound, and had just begun discussions with respect to obtaining additional capital required to position the company to go public. These discussions also involved the chief financial officer (CFO), Mitch O. Dinero, who had brought up the issue of the appropriate capital structure (target capital structure) that C&MDS should consider. They both thought the current mix in the capital structure was close to optimal, and that only minor changes would be necessary. However, they would defer to the investment banker before they made any final decisions, and there were several tasks to be done before talking to her. The initial work involved determining the firm’s cost of capital, and they would use the current balance sheet presented in Figure 1 to assess the weights of each of the capital components. Given that they were very close to the target capital structure, the difficult task would involve determining the appropriate cost to assign to each of the elements in the capital structure – debt, preferred stock, and common equity. And they thought the starting point was to gather data about the historical cost for issuing debt and preferred stock. That information is provided in Figure 2. Figure 1

- 4. C&MDS Inc. Statement of Financial Position: Balance Sheet December 31, 2015 Assets Current assets: Cash $ 500,000 Marketable securities 100,000 Accounts receivable $ 2,450,000 Less: Allowance for bad debts 250,000 2,200,000 Inventory 5,400,000 Total current assets $ 8,200,000 Fixed assets: Plant and equipment, original cost $ 31,300,000 Less: Accumulated depreciation 13,100,000

- 5. Net plant and equipment 18,200,000 Total assets $ 26,400,000 Liabilities and Owners’ Equity Current liabilities: Accounts payable $ 5,800,000 Accrued expenses 1,850,000 Total current liabilities $ 7,650,000 Long-term financing Bonds payable $ 6,250,000 Preferred stock 1,120,000 Common stock Retained earnings { Common equity 6,230,000

- 6. 5,150,000 Total common equity 11,380,000 Total long-term financing 18,750,000 Total liabilities and owners’ equity $ 26,400,000 Although they felt they were making real progress in determining the cost of capital for the firm, they were not confident about component costs that they had identified and decided a call to Sophia was in order to make sure they were on the right track, and they set up a conference call for the following day. During the conference call with her, they explained what had been accomplished and raised the issue about historical costs for each of the elements in the capital structure. She voiced a concern about using historical costs that were somewhat dated. She reported that she knew of a comparable firm in the industry (that needed to remain unnamed), in terms of size and bond rating (Baa), that had issued bonds less than a year ago at a coupon rate of 8.7% at $1000 par value, and further reported that the bonds were currently selling for $930 and had 20 years remaining to their maturity date. This firm more recently had issued preferred stock for $60 per share, and was paying a $4.50 dividend. She also indicated that underwriting a new issue of preferred stock would cost $2.25 per share (underwriting fee or flotation cost). Figure 2Historical issue cost of debt and preferred stock Security

- 7. Year of Issue Amount Yield Bond 2012 $ 1,250,000 6.1% Bond 2012 2,800,000 13.8% Bond 2015 2,200,000 8.3% Preferred stock 2011 595,000 12.0% Preferred stock 2014 525,000 7.9% After finishing the discussion about debt and preferred stock, their attention naturally progressed to the question about how to determine the cost of common equity. The CFO suggested that one approach would be to use the dividend valuation model. In reviewing the financial statements, he noted that earnings were $3.00 a share (EPS) and 40% of the earnings will be paid out in dividends (D1). Sophia also noted the dividends during the last four years had grown from $.85 per share to the current level, and the stock price was now (P0) $25 per share. She estimated the flotation costs for newly issued common stock would be $2.00 per share. Alestar and the CFO thanked her for the information and the assistance and told her they would get back

- 8. with her after they had completed the preliminary calculations. There were several other factors that needed to be considered, and they relate to the following discussions: · Whether to use the historical weights for the capital structure components, or try to estimate or compute new market weights. · Should they use an estimated growth rate, compute the simple average growth rate, or use time value of money (TVM) concepts to determine a more accurate growth rate to use in cost of common equity calculations (dividend valuation model)? You have been chosen to assist the CFO in the analysis. Furthermore, several questions have been developed to help guide you, and they are listed below. However, there may be other issues that they have not thought of and that they want you to identify and address. Case Questions (show all of your work) 1. Determine the weights of each component in the capital structure: Use the amount of retained earnings provided. The percentage composition (weights) in the capital structure for bonds, preferred stock, and common equity should be based on the current capital structure long-term financing section as shown in Figure 1 (indicated as $18.75 million). Common equity will remain at the current weight throughout the case, and the combined tax rate is 35%. 2. Determine the cost for each component in the capital structure (after-tax cost of debt, cost of preferred stock, cost of equity). Use your calculator to solve for the interest rate (I). 3. Given your results from questions 1 and 2 above, calculate the weighted average cost of capital (WACC).

- 9. 4. Now assume that new common stock will be used in the capital structure (you will obtain new common stock with flotation costs). Also assume all the weights remain the same; common equity is now supplied by new common stock, rather than by retained earnings (debt and preferred stock costs remain the same). Recalculate the weighted average cost using new common stock in the capital structure. Remember to consider flotation costs. 5. The increase in the cost of capital will take place at a certain level of financing, where the cost of financing increases (known as the marginal cost of capital): What is this level of financing (dollar amount)? Determine this by dividing retained earnings by the percent of common equity in the capital structure (as noted in Question 1). 6. You have been told that the investment banker wishes to use the capital asset pricing model (CAPM, as shown on p. 388 in the 15th edition of the text), to compute the cost (required return) on common stock. Assume the risk free rate (rRF) is 4.9%, beta for the firm is 1.30, and the market risk premium (RPM) is 6.8%. a. What is required rate of return for common equity using this method? b. Secondly, how does it compare to the required rate of return computed in Question 1 above? Rev. Dec 2017 Ver. A © Example of Case Study Write-upCase Study: Gilbert Enterprises

- 10. Submitted by: James Bunsa For: FINC 5880 Date: 11 Apr 2014 a. Current Situation Company I nformationGilbert Enterprises, the third largest publicly traded firm in the auto parts replacement industry, had experienced a decline in its stock price over the past five months. Its founder and chairman, Tom Gilbert, along with the Finance VP, were considering a stock repurchase, thinking the announcement would send a message to investors about the current market undervaluation of the stock. Industry and Economic InformationResearch had indicated that auto owners were keeping their vehicles longer (8 years on average, up from 6.8 years twenty years earlier), and new vehicle price increases had surpassed the rise in consumer incomes. The trend of investing in older vehicles to keep them on the road longer would bode well for Gilbert. In addition, Gilbert had invested in an industry-leading JIT inventory management system and as a result expected supernormal growth over the next several years. b. Major Issues Several significant issues that Gilbert faces include: · Develop these issues preliminarily, and readdress/refine them after answering the case-specific questionsDoes the growth rate

- 11. seem reasonable, given the current and expected circumstances (economic and industry)? · Does the current stock price fairly represent Gilbert’s value in the market? · What is the “real” value of Gilbert’s stock? And how should it be determined (methods, process)? · What other data should be considered in the valuation? · What decision should they make – repurchase stock or do something else? · What are the possible investor and market reactions to an announcement? · Other issues …. c. Approach Identify the appropriate analytical techniques (dividend valuation model) to evaluate Gilbert’s value in the market; use a price-earnings approach to supplement the dividend model results; and use selected ratio comparative analysis to fairly position Gilbert against its competitors; and specifically answer the case questions. d. Case-specific Questions 1. Supernormal growth valuation – does the firm seem to be under or overvalued? Three steps to find intrinsic value, and then compare to market. · Find present value of supernormal dividends Discount future supernormal dividends back to present at 10% (required rate of return) Current dividend D0 =

- 12. (given) 1.20 Future dividends D1 = (D0 * 1.15) 1.38 X 0.9091 1.25 D2 = (D1 * 1.15) 1.59 X 0.8264 1.31 D3 = (D2 * 1.15) 1.83 X 0.7513 1.37

- 13. Total 3.94 Present value of dividends during the supernormal growth period = 3.94 These are calculations to answer the questions · Find the present value of the future stock price Find PV of future stock price P3 = stock price when supernormal growth ends D4 = dividend at time 4 when constant growth is 6%

- 14. Ke = required rate of return (cost of equity = 10 percent 10% g = 6 percent (constant growth) 6% P3 = D4 Ke - g

- 15. D4 = D3 (1 + g) = 1.935 P3 = 48.363825 Must discount stock price back to current - find PV at 10% Est of P0 $36.34

- 16. · Find total value (stock price plus value of dividends) Add price of stock and value of dividends to get total value Estimate of P0 = $36.34 If rounding earlier in the problem Add PV of dividends = 3.94 total is as high as $40.37 Total $40.27

- 17. Conclusion: Because the stock is selling in the market for 35 1/4th, it appears to be undervalued. 2. Gilbert’s P/E ratio is currently is the second lowest of all firms in the industry. However, based on the financial information provided in Figure 1 this does not appear to be appropriate, given that Gilbert currently has the highest growth rate of EPS and growth is expected to accelerate to 15% (supernormal) growth over the next three years. This is financial ratio a nalysisIt also has the second highest return on stockholder’s equity, and the firm leading this category has a very high debt ratio (resulting in a relatively smaller proportion of equity over which to spread the earnings – it is possible to generate a high return on equity using debt, but still have relatively low profitability, as Reliance has in this case as indicated by its lowest return on total assets ratio in the industry). In evaluation debt utilization as a separate issue, Gilbert once

- 18. again looks attractive with a debt to total asset ratio of 33%, with Standard Auto being the only firm with a better (lower) ratio. Market Values Market Book Replacement Market Market to Value Value Value to Book Replacement Gilbert Enterprises 35.25 16.40 43.50 2.15 0.81 Relaince Parts 70.50 50.25 68.75 1.40 1.03 Standard Auto

- 19. 24.25 19.50 26.00 1.24 0.93 Allied Motors 46.75 50.75 27.50 0.92 1.70 Evaluation of market to book values and market to replacement values will provide additional insight about Gilbert’s financial position in the industry. Although pro forma market value to book value ($40.27/$16.40 = 2.46) is high compared to others (1.40 to .92), this is not an especially meaningful value, because book value is based on historical cost. A more meaningful value is market to replacement, in which Gilbert is much more conservative ($40.27/$43.50 = .93), and is comparable to Standard Auto ($24.25/$26.00 = .93). Dividends are another area where Gilbert is excelling, second only to Standard in dividend yields. Finally, how would Gilbert’s pro forma P/E ratio compare with the industry? One must first calculate the EPS, since it is not provided. P/E = Stock Price/EPS 16.8 = $35.25/EPS EPS = $35.25/16.8 = $2.098 per share

- 20. Now, calculate the pro forma P/E ratio given the estimate of the intrinsic stock price of $40.27 in the earlier analysis. P/Epf = $40.27/$2.098 = 19.2, still within the appropriate range for the industry (industry average is now 18.9). In summary, Gilbert appears to be undervalued compared to its competition, considering all of the findings previously reported. 3. Recommendations to Albert Roth: Based on the answers to Questions 1 and 2, Gilbert Enterprises appears to be undervalued, and Roth should seriously consider recommending the firm repurchase part of its shares in the marketplace. However, there is reason to be cautious: · Be creative here; you get credit for thinking outside the box (but not too far out)Markets are efficient in their pricing of securities (Efficient Market Hypothesis), and there may be some information that we are not aware of that justifies Gilbert’s lower valuation. · Secondly, even if the stock is undervalued in the marketplace, management must make certain that this is the best use of its limited investment funds (examine alternative uses). e. Other options? Although there are no indications in the case that Gilbert has alternatives to this repurchase plan, it should exhaust the possibilities of purchasing another firm or firms in the industry that might provide positive synergies, add sales in areas that Gilbert is lacking, cover geographic areas currently underserved, or focus on a firm that provides a good “fit” with

- 21. its state-of-the-art inventory management systems. As an alternative, it could significantly reduce the number of shares it in considering (up to one million shares), and use the remainder for other investments. f. Prediction I believe that Albert Roth will recommend the repurchase, and that it will be successful. After all, Roth in an investment banker and is there to serve his client while earning profits from additional revenue for his firm – Baker, Green and Roth. Rev. Jan 2017 Circular Flow of Economic Activity Using the Circular Flow of Economic Activity model, we can determine how an economic system works to allocate scarce resources. Households, who own factors of productive resources like land, labor, and capital, are used by firms to produce goods and services which households need and desire. For the use of the factor resources, firms pay households income, wages, rent, and interest, which households use to purchase those goods and services. But how do households and firms in resource markets determine the proper allocation and price for those productive resources? Demand for resources is derived demand. Demand is derived according to the demand for the end product. The demand curve (demand for a productive resource) will be downward sloping and negatively sloped. A change in demand for the end product will lead to a change in demand for a productive resource. With respect to the price elasticity of demand for a productive resource, the greater the number of substitutes and complements, the higher the price elasticity will be for the productive resource. Thus, the slope will be lower when the demand for a productive resource is more price elastic. Firms use productive resources to produce goods and services. Output is the result of using productive resources. In

- 22. economics, we differentiate and define output according to the following: Total Product (TP): Total output produced from an input resource. Average Product (AP): Average output produced per input resources. AP = TP / (# of units of input) Marginal Product (MP): Change in total product when one more unit of input resources is used. MP = (change in TP) / (change in units of input) Margin Revenue Product (MRP): Change in total revenue when one more unit of input resources is used. MRP = (change in TR) / (change in units of input) Value Marginal Product (VMP): Value of the marginal product of labor the next unit of input resource brings to the firm. VMP = MP X selling price In product markets, we know that firms - all firms - produce optimal output at the point where marginal revenues equal marginal costs. But in productive resource markets, at what point will a firm find equilibrium and optimal marginal resourcing? Marginal revenue product (MRP) equals marginal resource cost (MRC), or MRP=MRC. In aggregate resource markets, demand for labor and supply of labor converge to an equilibrium point for price and quantity. For individual firms, the demand for labor (MRP) will be a downward-sloping curve, indicating that as quantity demanded for a resource rises when the price of labor falls. The MRC will entail how much a firm pays to secure one more unit of a productive resource. Labor Curve What causes a differential between the wages of one type of job versus another? · Between skilled and non-skilled? · Can price floors or minimum wages be instituted to benefit low-wage earners to lift them up and reduce poverty? · Are there negative effects of minimum wages? · How technology play a part in all of this?

- 23. When we analyze how productive resource markets operate, we are more equipped to answer those questions. · For example, individuals are different, and they have different sets of skills and motivations. · Jobs are different and are not all the same. · Higher paying jobs tend to require higher productive and skilled individuals. · There is a separate demand for labor skilled curve and demand for labor unskilled curve; there is a separate supply of labor skilled curve, as well as a separate unskilled labor supply curve. The demand for labor skilled curve and demand for labor unskilled curve are parallel, with the demand for labor skilled farther rightward than unskilled. As for the supply side, the supply of labor skilled curve and supply of labor unskilled curve are also parallel, with the supply of labor skilled farther leftward than unskilled. How do we read that, and what are the implications? When you put the four curves together, what is ascertained is the gap between the demand curves is the marginal product difference, or the additional total product attained by adding one more unit of skilled labor; the gap between the supply curves indicates skilled labor is more costly and is less plentiful as unskilled. Ultimately, what is ascertained about the price of labor is the gap between the equilibrium points of the demand for labor unskilled and supply of labor unskilled versus the equilibrium points of the demand for labor skilled and supply of labor skilled is the wage difference (or otherwise known as the "wage gap"). Can this wage gap be closed a bit to offer better pay conditions for a low-wage earner? What, if any, are the negative aspects of a minimum wage? A minimum wage, which is a price floor set by firms or government, is the price that is the least a firm can pay for use of a labor resource. The price is set above the equilibrium price where the demand for labor and supply of labor meet. The Law of demand and Law of supply come into play. At the

- 24. higher price, quantity demanded is less, while quantity supplied is higher. Since quantity demanded is less than quantity supplied, surpluses ensue. More productive resources are available to be hired, while fewer buyers of productive resources exist. Increases in unemployment can occur from this imposed price floor. Can technology actually lead to higher productivity and even wider gaps between skilled and unskilled. Yes for both. The aggregate production function curve represents how productivity depends upon the physical capital per worker, human capital per worker, and relative technology. · As newer and better technology is used, productive resources tend to achieve exponentially higher productive levels relative to older and less advanced technology. As workers who achieve higher levels of skill and utilize technology to increase efficiency and productivity increase when unskilled workers do not, the wage gap and demand for supply of unskilled labor widens.