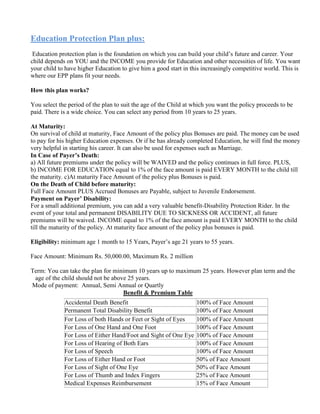

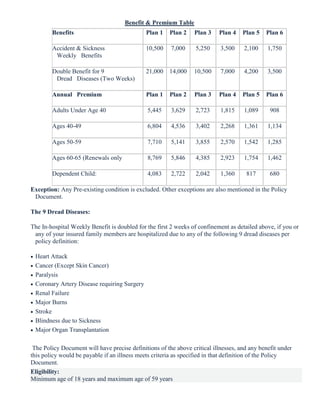

MetLife is a global insurance company founded in 1868. It has over 90 million customers in 50+ countries. In Bangladesh, MetLife has been operating since 1952 and is the largest life insurer with a 33% market share and over 1 million insured members. MetLife's key products in Bangladesh include Three Payment Plan Plus, Education Protection Plan Plus, Critical Care, Hospital Care, and Future Care - DPS which provide life insurance, health insurance, and savings opportunities to customers.