The document summarizes Peru's first truly interoperable mobile money solution called Bim, which aims to increase financial inclusion. A unique public-private partnership called Modelo Peru between the government, banks, telecoms, and Ericsson collaborated to design and launch Bim. Bim allows users across Peru's major mobile networks to deposit, withdraw, transfer money, and pay bills using their mobile phones, even without bank accounts or internet access. This partnership and interoperable platform could potentially provide secure financial services to millions of Peruvians, especially those in remote areas, and support Peru's socioeconomic development.

![[Bim] will mean welfare for the country,

welfare for our population, and it

will improve their economic and

educational level.”

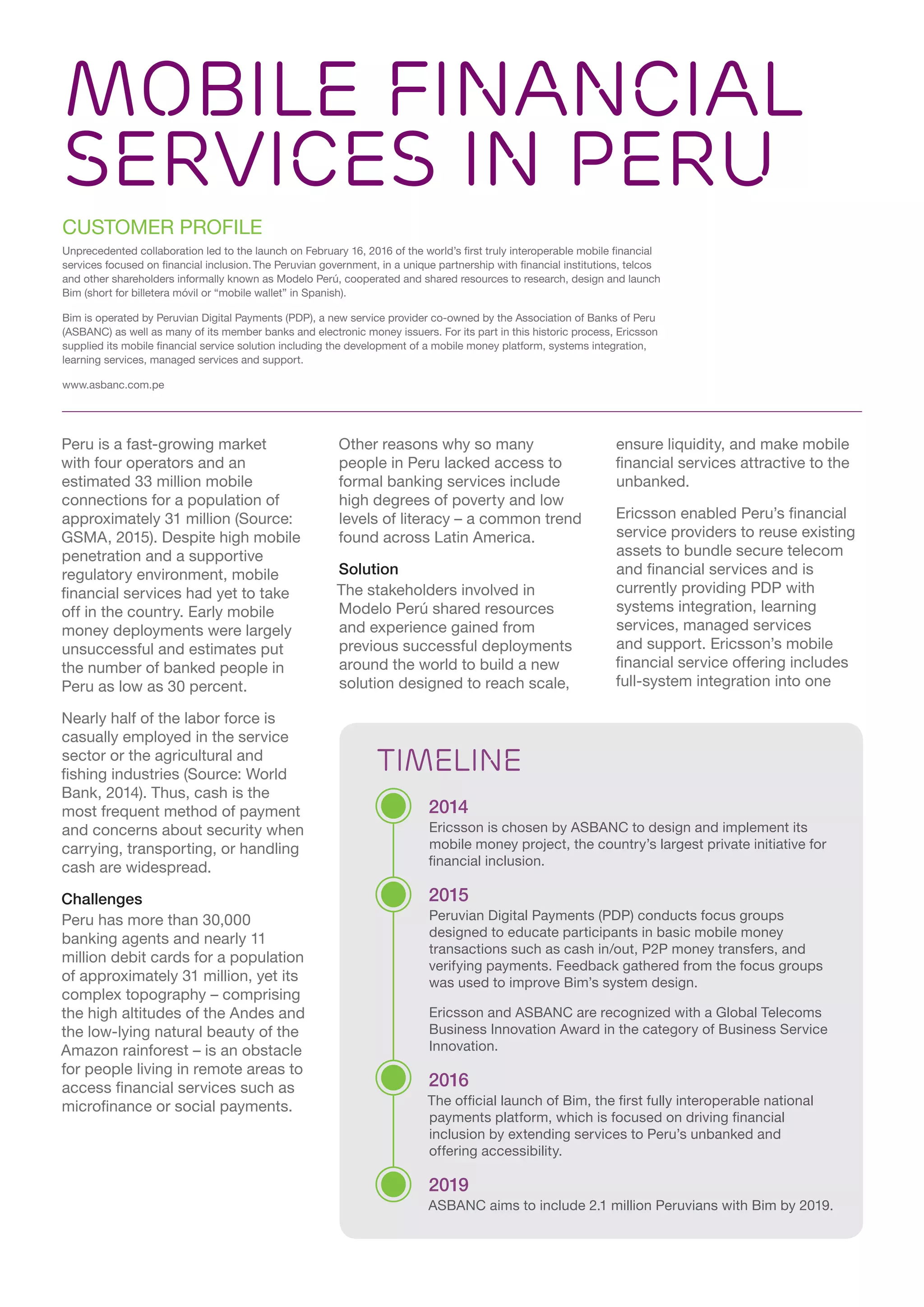

Oscar Rivera,

President of ASBANC](https://image.slidesharecdn.com/3220a49d-a941-4912-8d1c-b40fa4b2738f-161111105016/75/asbanc-success-story-3-2048.jpg)