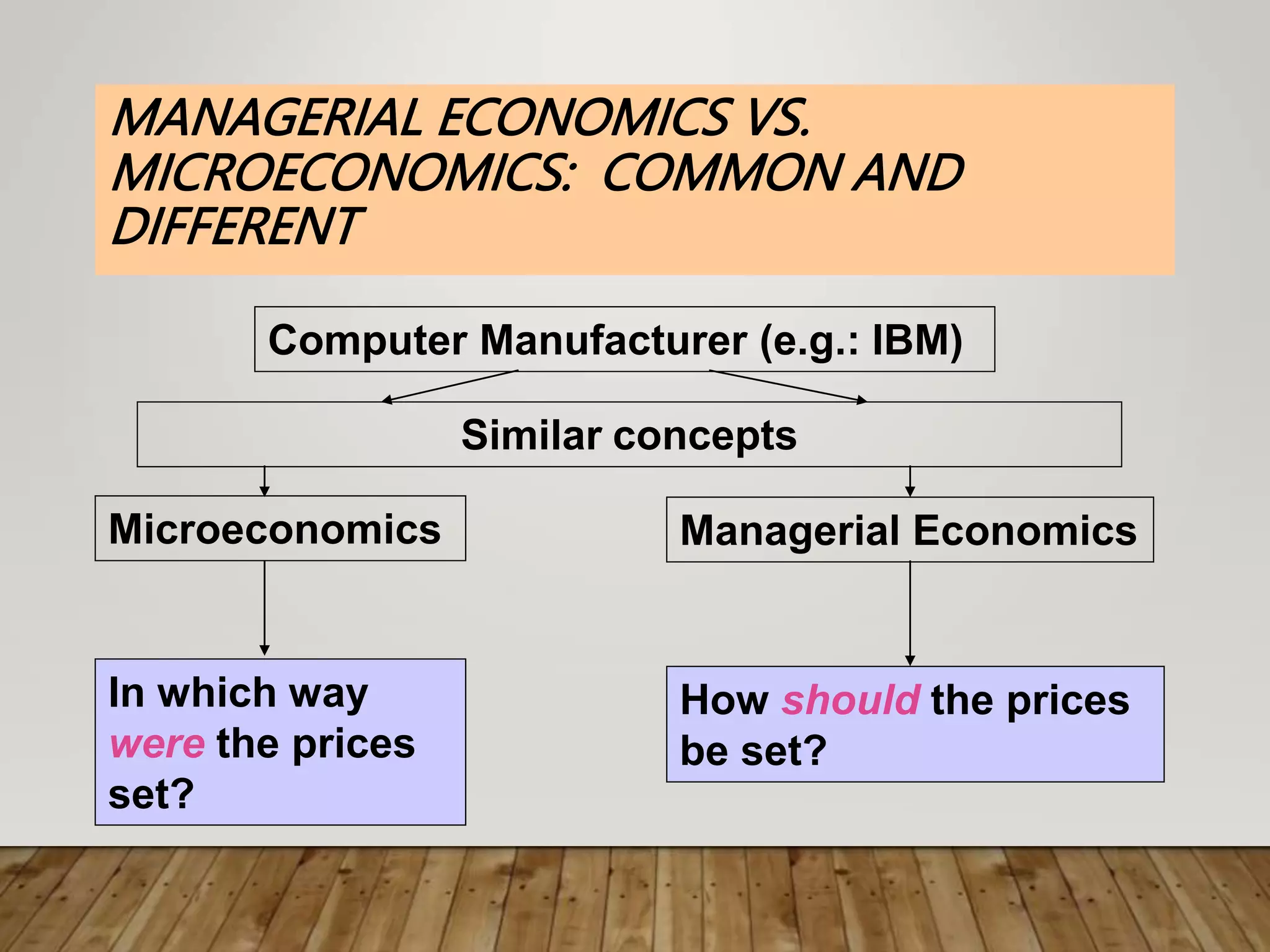

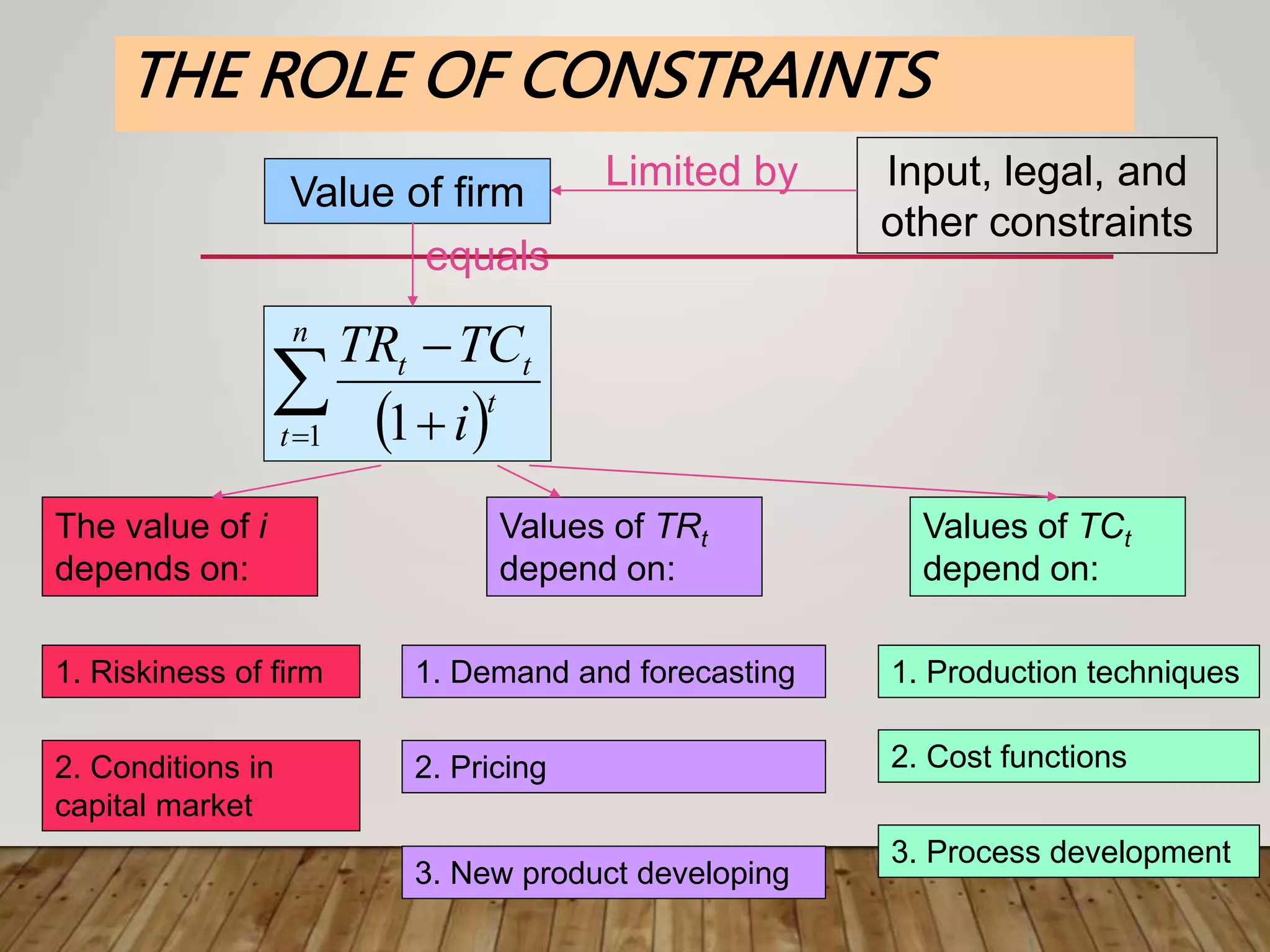

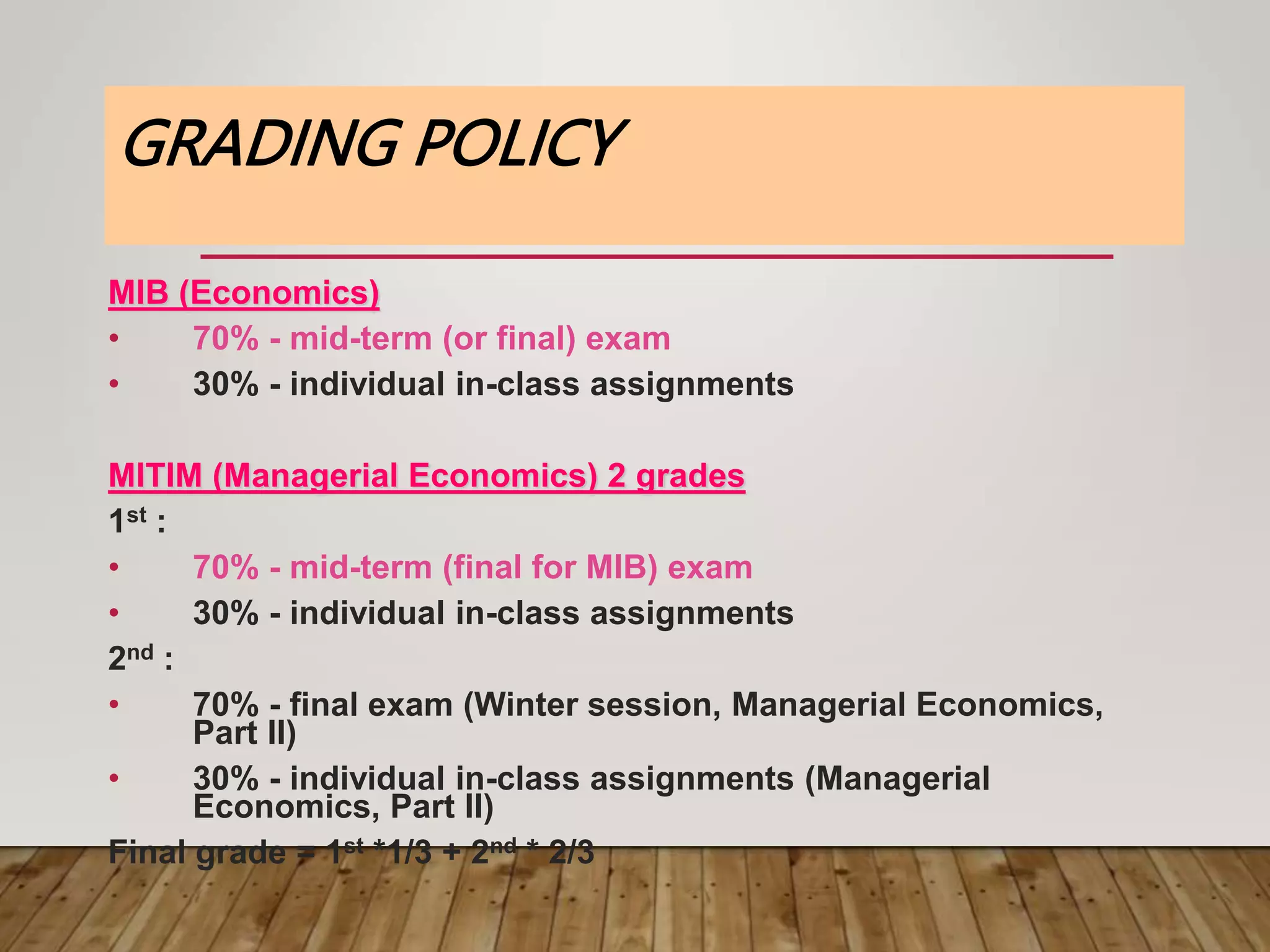

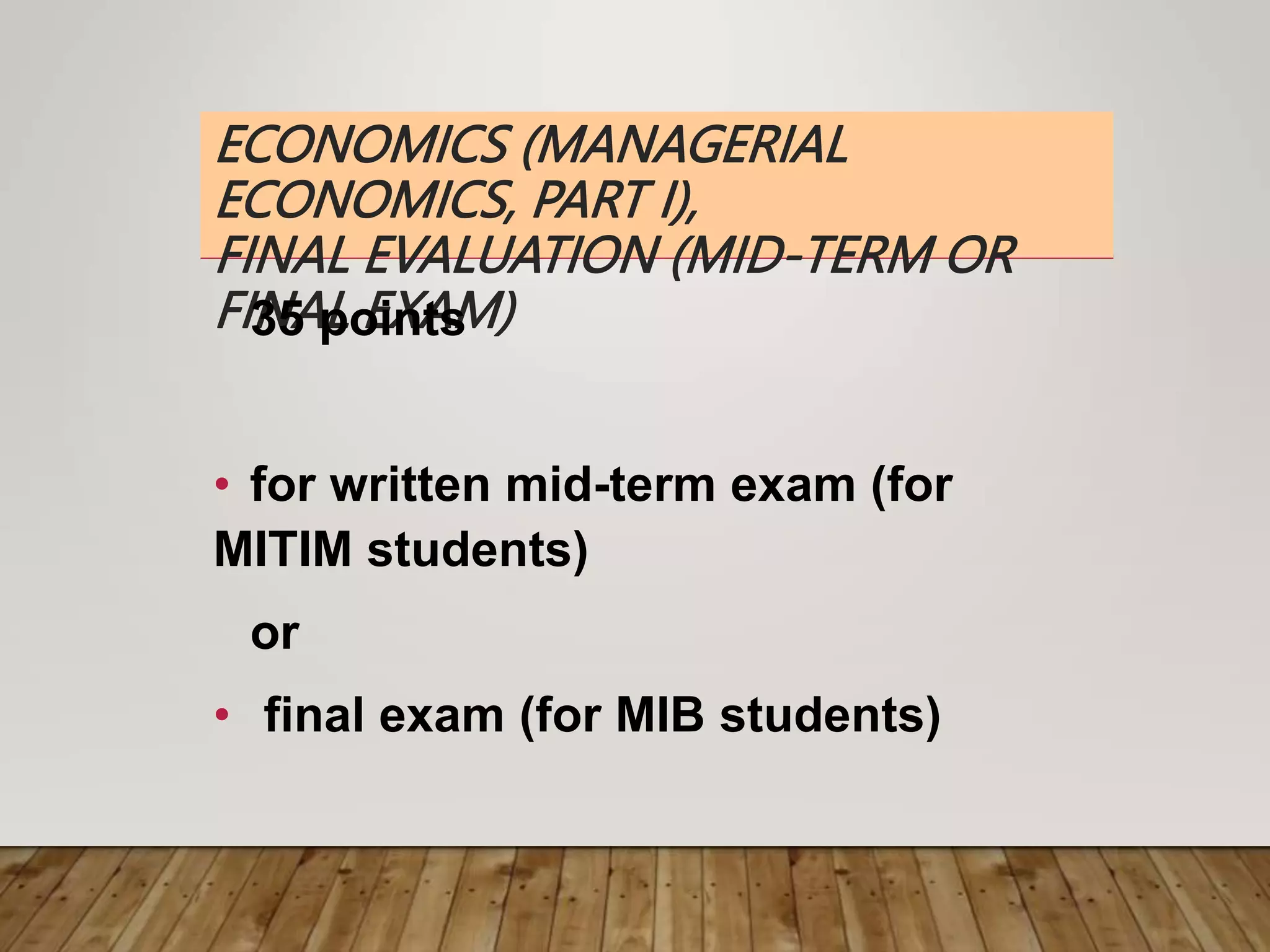

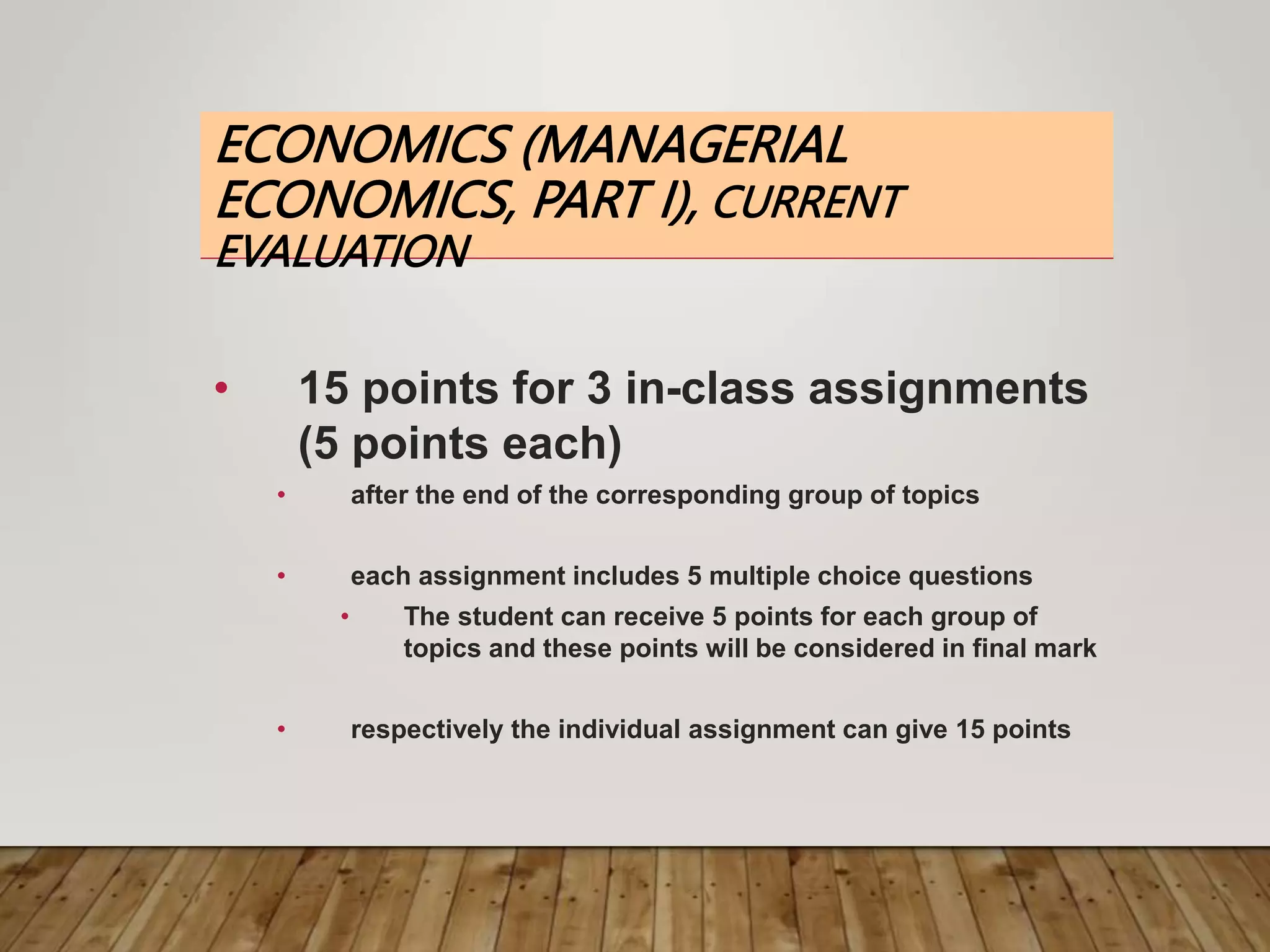

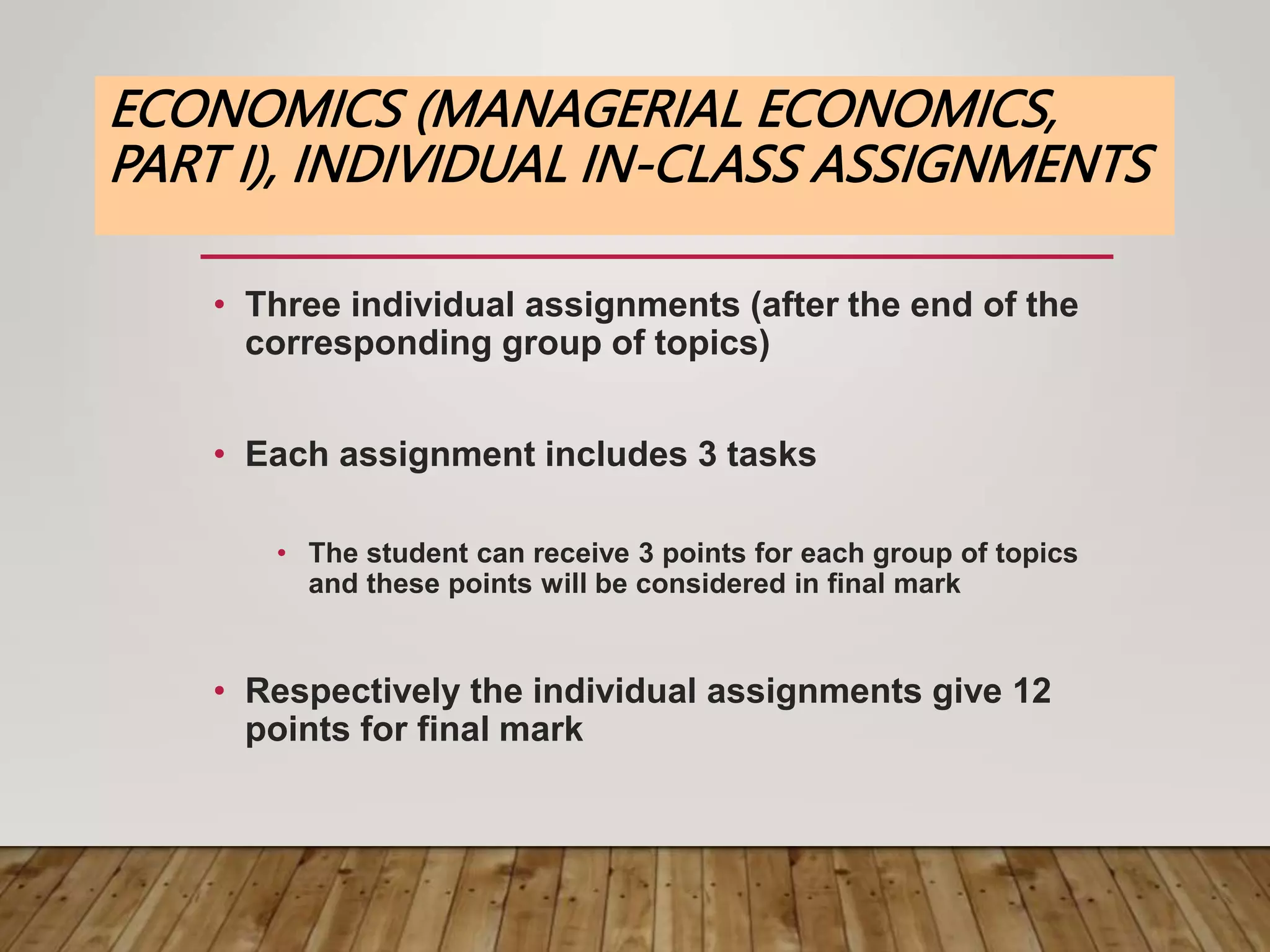

This document outlines the course structure and grading policy for a Managerial Economics course. It will cover topics such as economic analysis, demand and supply, production analysis, and market structure. Students will be evaluated based on mid-term exams, final exams, and individual in-class assignments. The course will use economic concepts like opportunity cost, profit maximization, and marginal analysis to teach students how to make optimal business decisions under constraints.

![LITERATURE

• Microeconomics: Optimization, Experiments,

and Behaviour. Burkett, John P. 2006. Oxford

Univ. Press., Source: http://site.ebrary.com/

• Microeconomics Demystified. Depken,

Craig. 2005. The McGraw-Hill Companies.,

Source: http://site.ebrary.com/

• Baye M. Managerial Economics and Business

Strategy [Text] / M. Baye. – McGraw-Hill, 2006.

– 620 p.](https://image.slidesharecdn.com/arunkumarmba-230308095157-addf65fb/75/Arunkumar-MBA-ppt-8-2048.jpg)