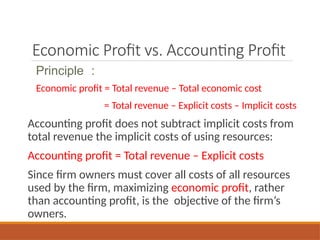

El primer capítulo de economía empresarial aborda las diferencias entre el beneficio económico y el contable, así como la importancia de entender las estructuras de mercado y la globalización en el contexto empresarial. Se discuten conceptos clave como el coste de oportunidad, el análisis marginal y los factores económicos que fomentan la rentabilidad a largo plazo. Los gerentes desempeñan un papel crucial al asignar recursos escasos y tomar decisiones estratégicas para maximizar los beneficios de la empresa.