This presentation summarizes key aspects of India's proposed Integrated Goods and Services Tax (IGST) and Compensation Draft Law. It introduces IGST as a new tax that will be levied on all inter-state supplies of goods and services at a rate equal to the sum of the CGST and SGST rates. It outlines provisions regarding the place of supply for determining whether a transaction is intra-state or inter-state. Input tax credit rules and the ability to claim a refund for zero-rated supplies are also summarized. The presentation provides an overview of the major components of India's proposed nationwide GST framework.

![INDEXTO PRESENTATION

• Introduction

• Integrated Goods and ServicesTax [IGST]

• Supply of goods and services

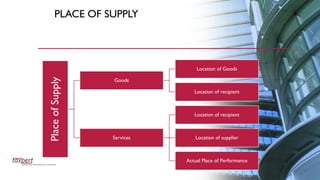

• Place of supply of Goods and services

• InputTax Credit

• Zero Rated Goods](https://image.slidesharecdn.com/presentationonigst-170127061803/85/Taxpert-Professionals-Presentation-on-IGST-2-320.jpg)

![INTEGRATED GOODS AND SERVICESTAX [IGST]

• A revised draft of Integrated Goods and Services tax (IGST) has been released by the

central government on 28 November 2016.

• The provisions of the Bill will apply to whole of India.

• The date of coming in will be notified by the Central Government by means of a

notification in the Official Gazette.

Charging Section : Section 5 :

“ There shall be levied a tax called Integrated Goods and Services Tax on all supplies of goods

and /or services made in the course of inter state trade or commence on the value determined

under section 15 of CGST Act, 2016 and at such rate as may be notified by the Central

Government”.](https://image.slidesharecdn.com/presentationonigst-170127061803/85/Taxpert-Professionals-Presentation-on-IGST-4-320.jpg)