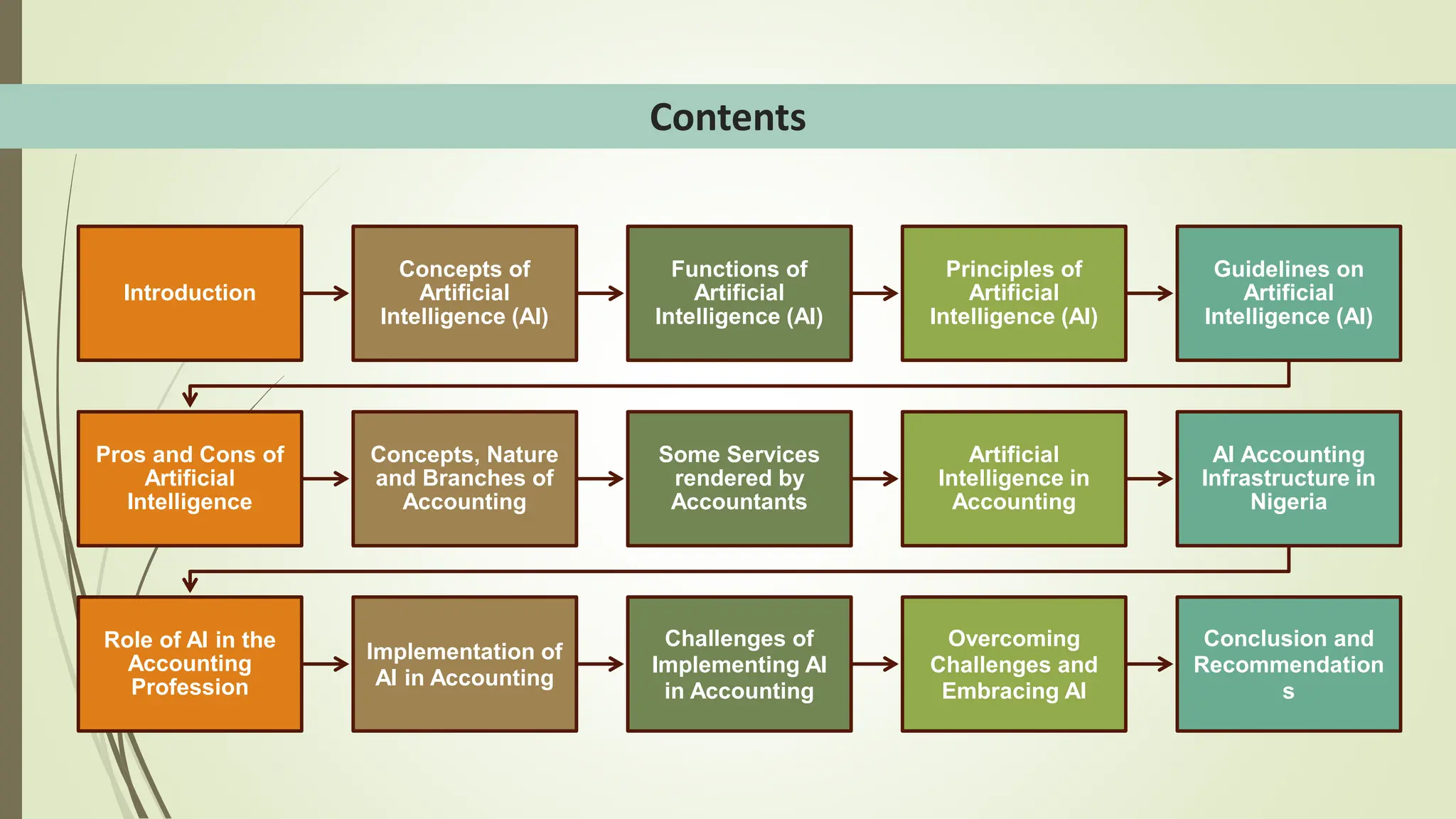

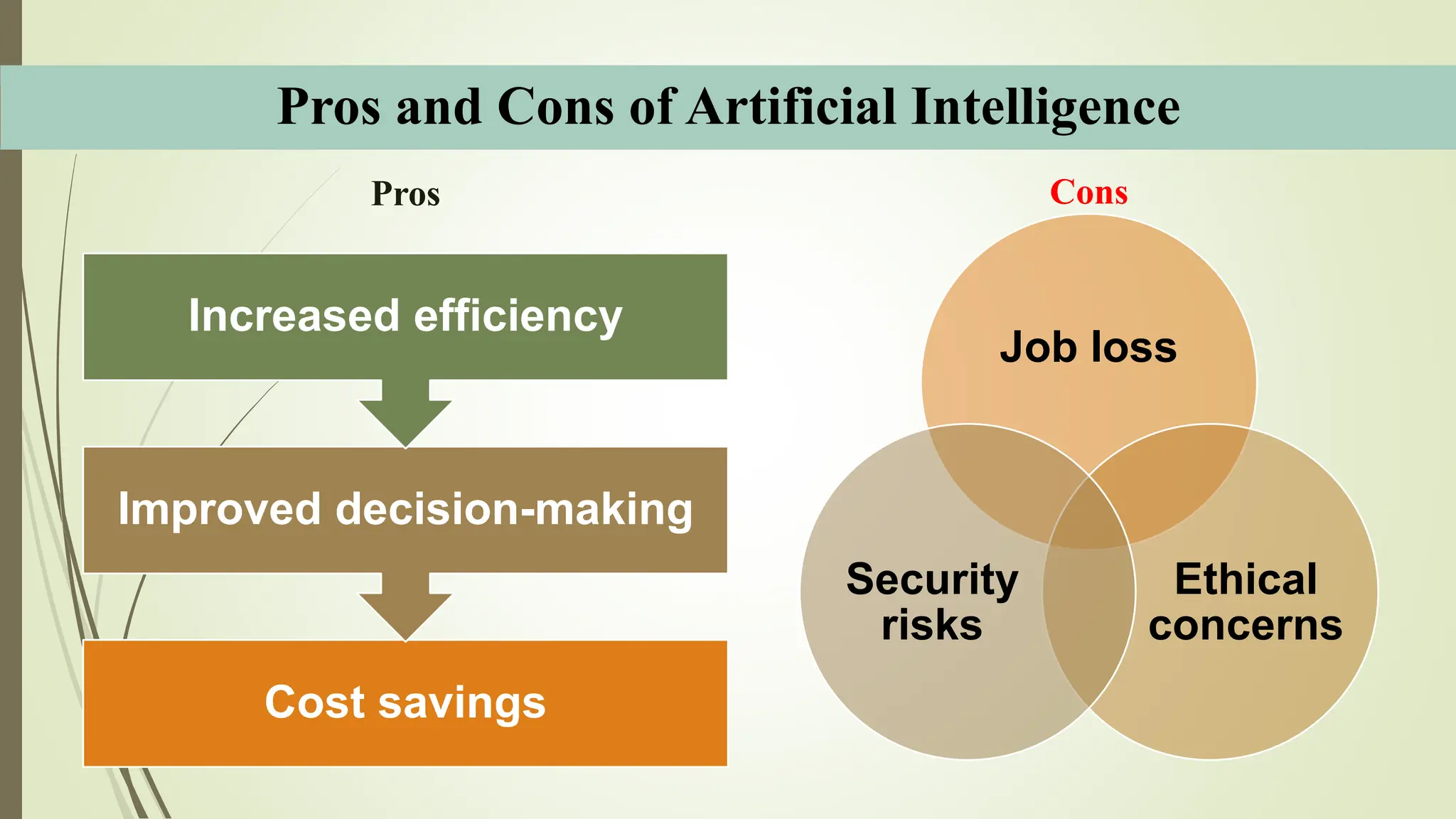

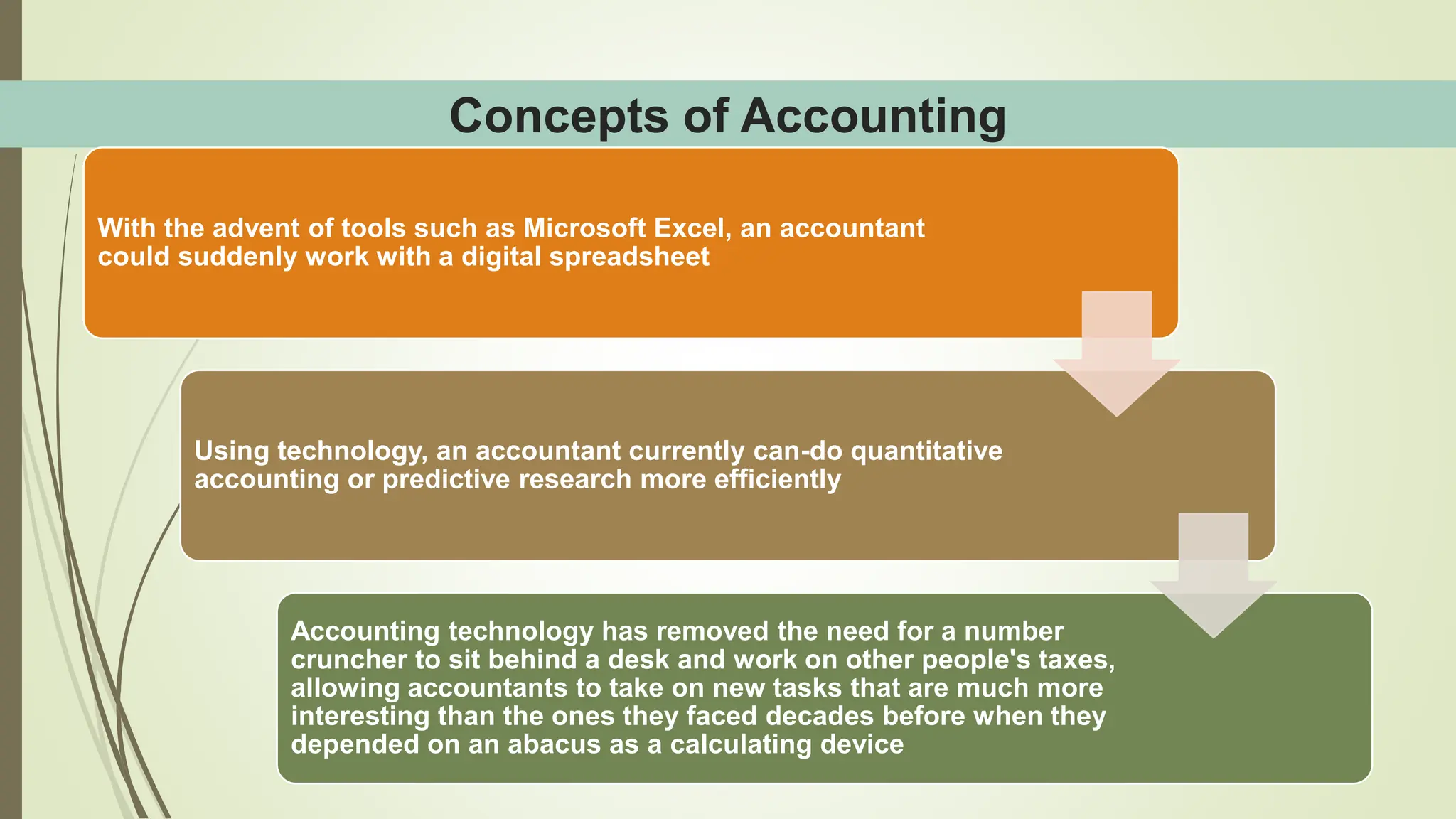

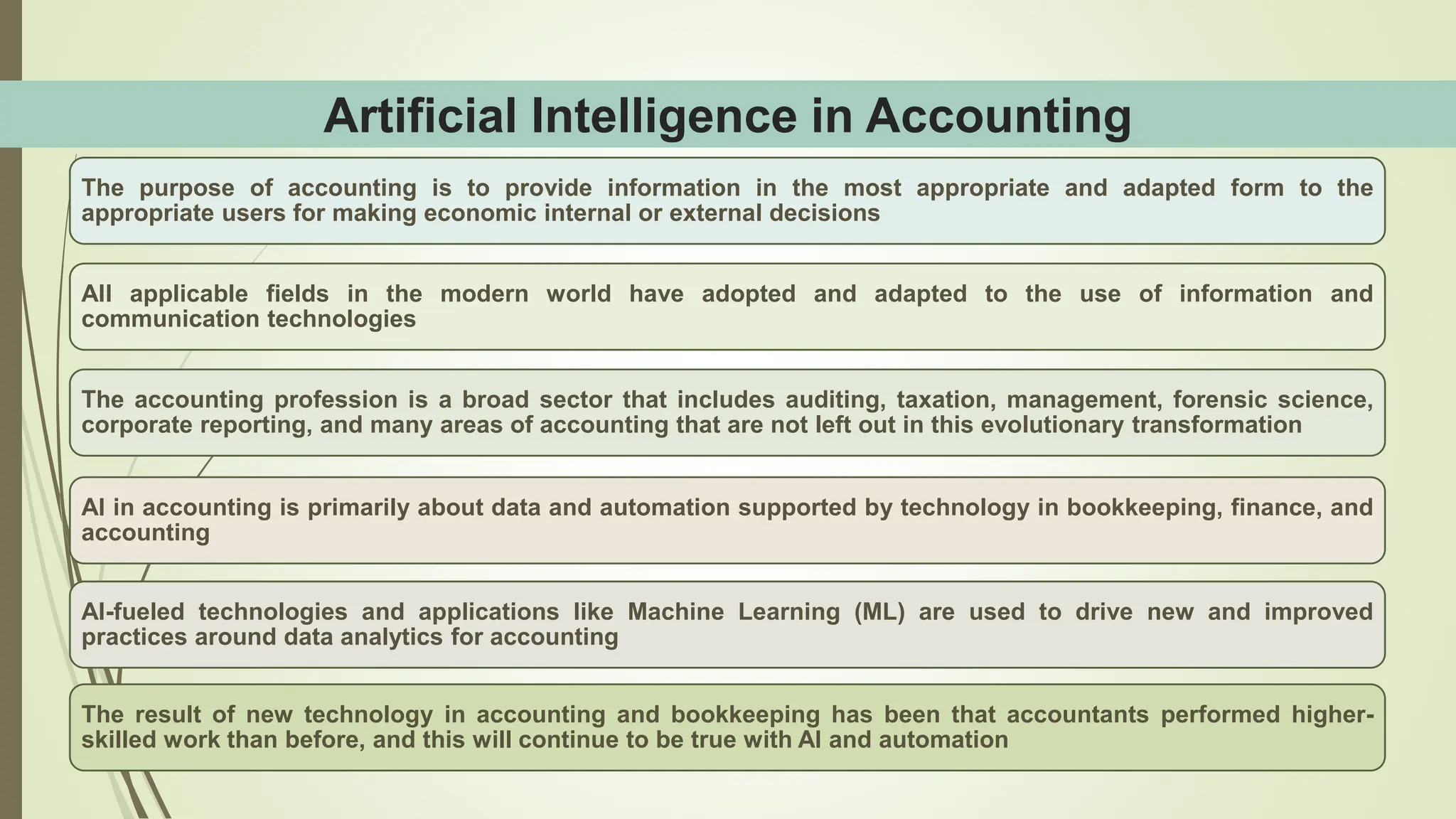

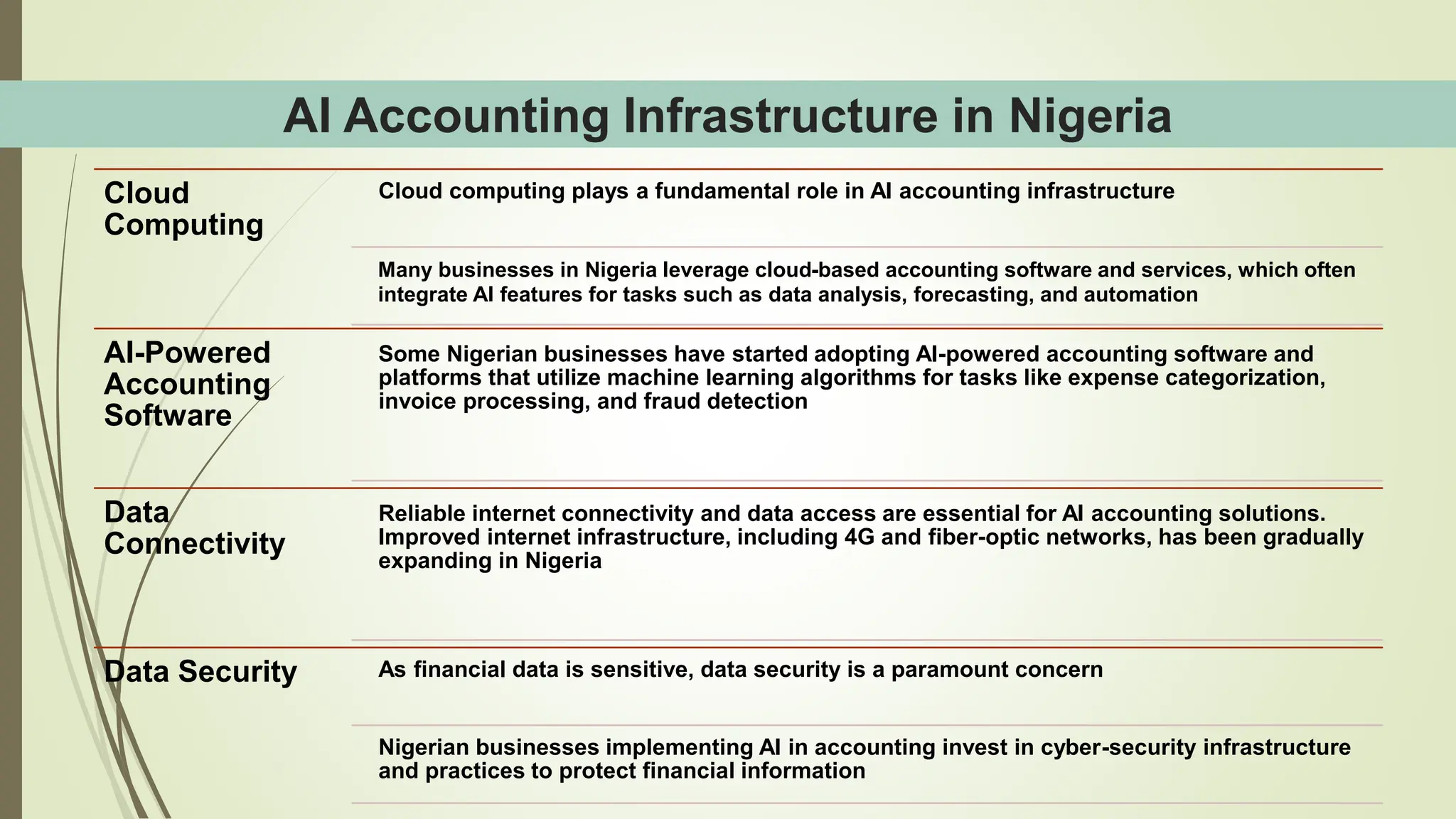

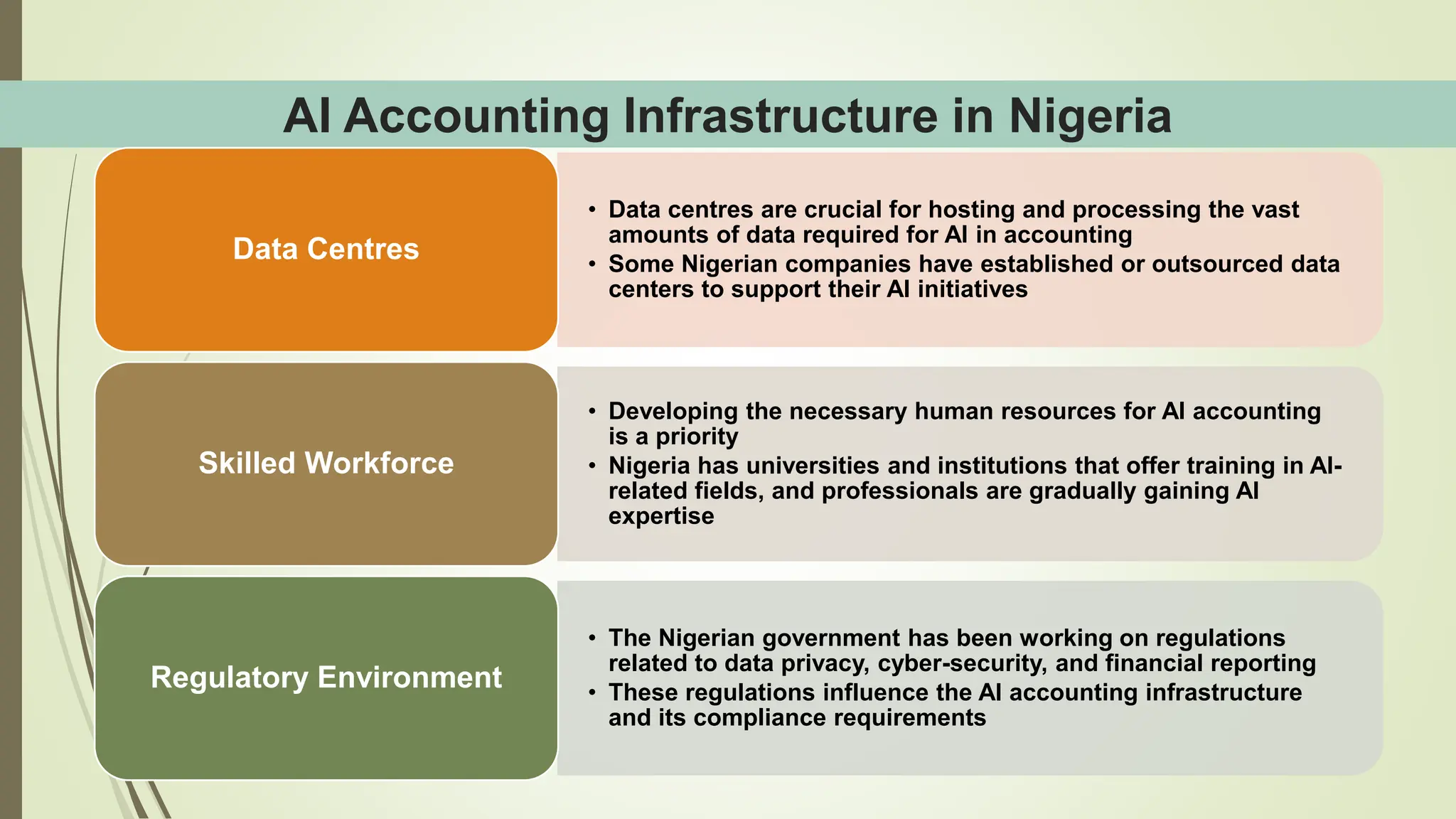

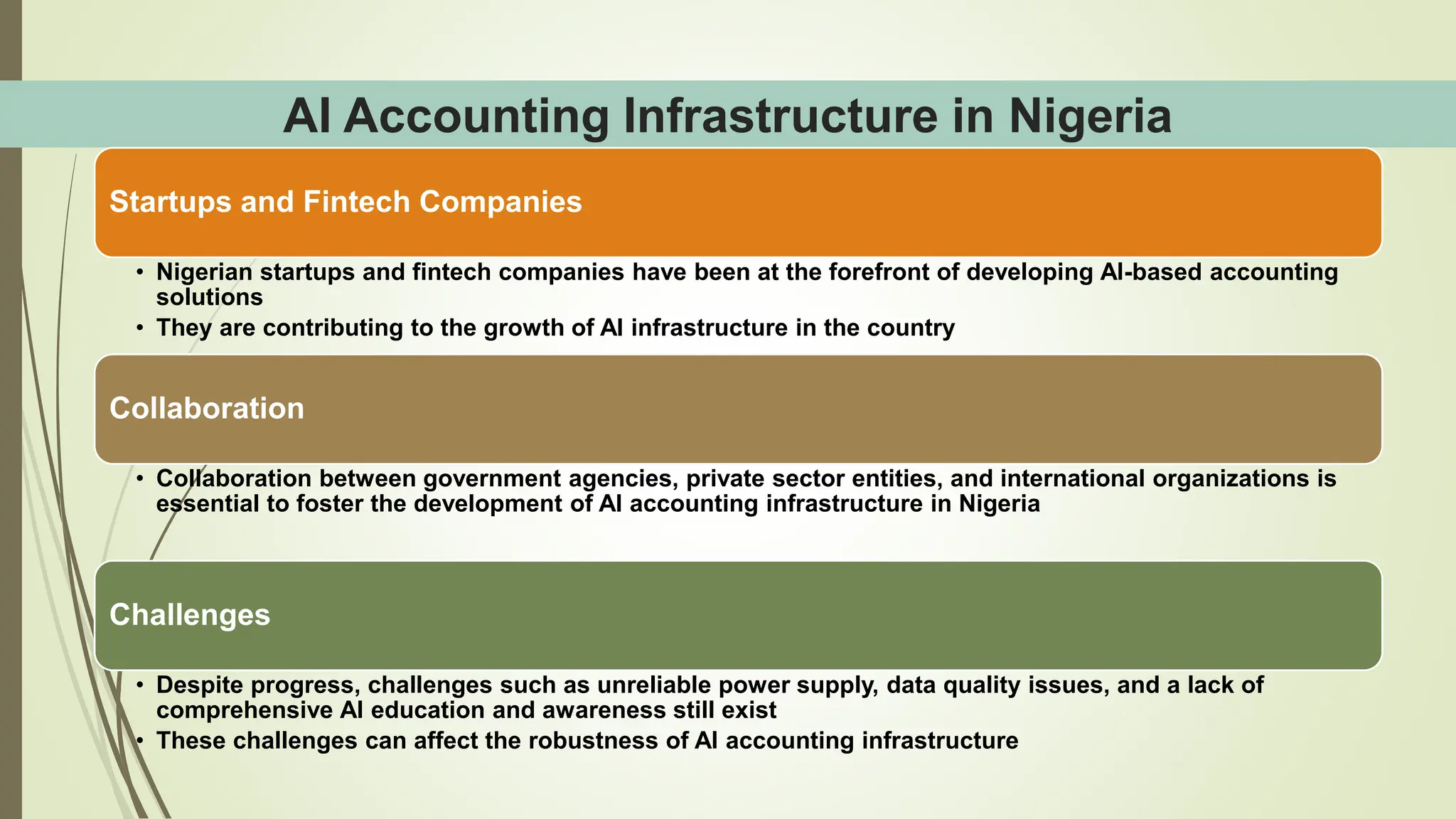

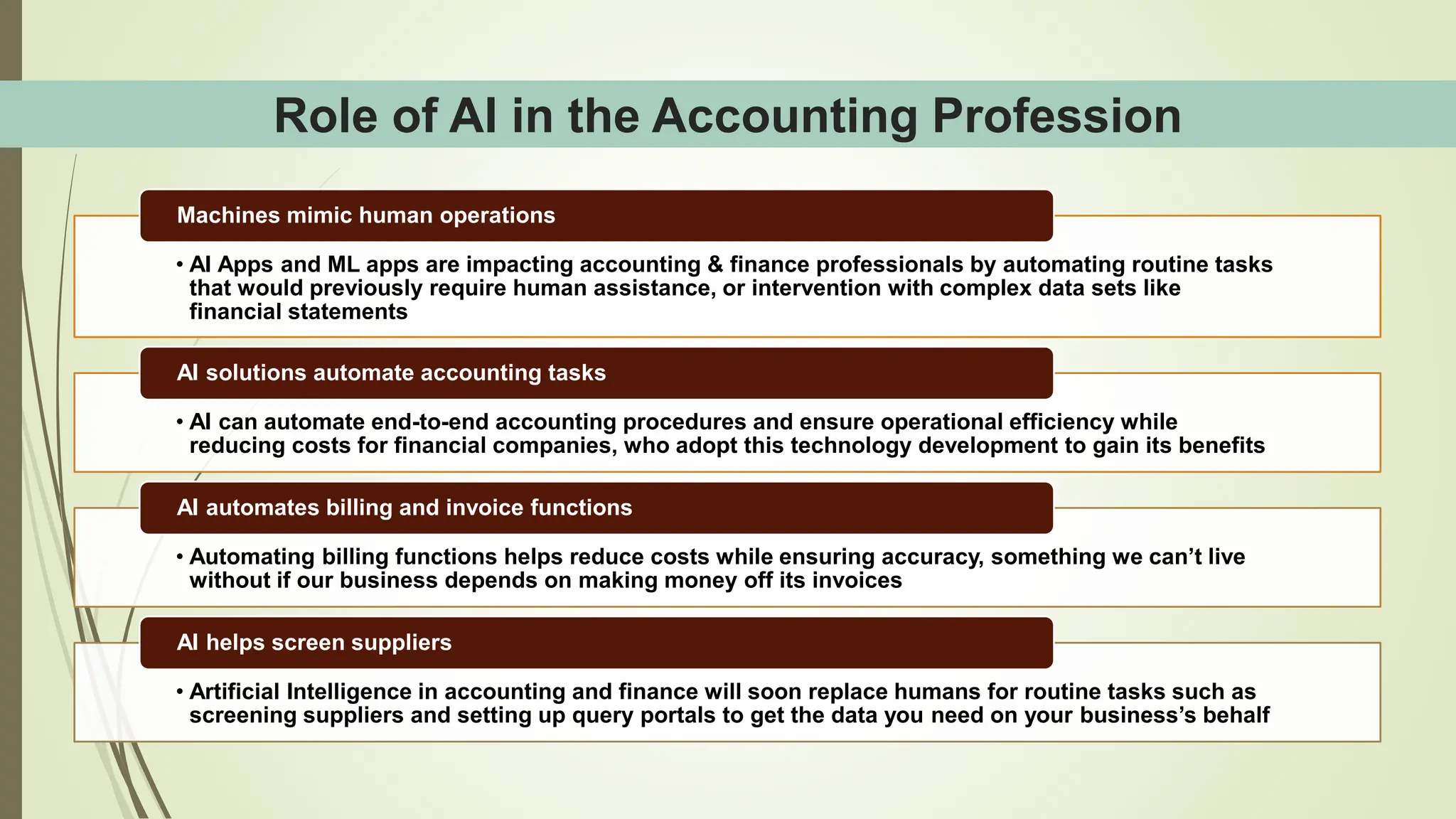

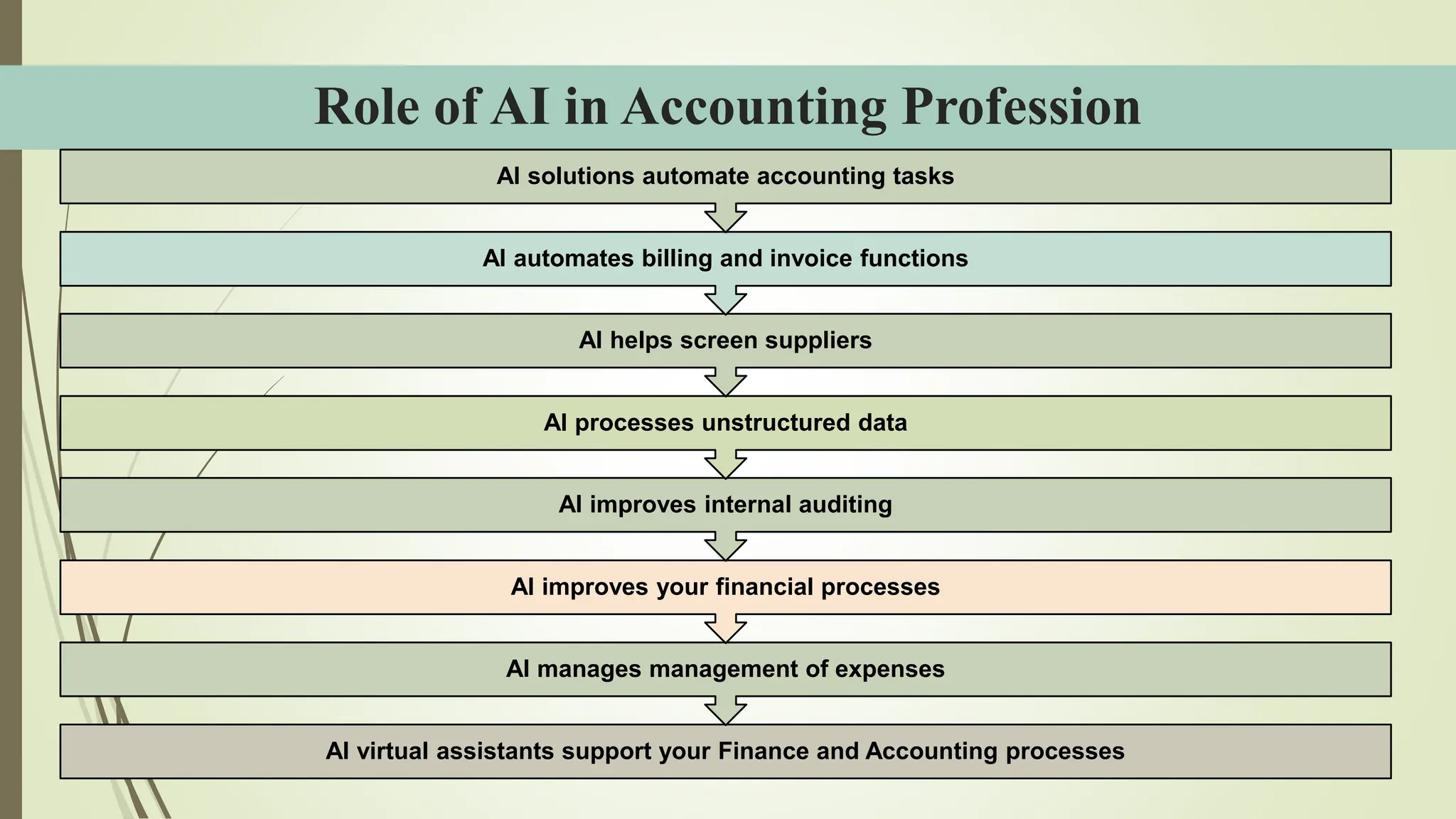

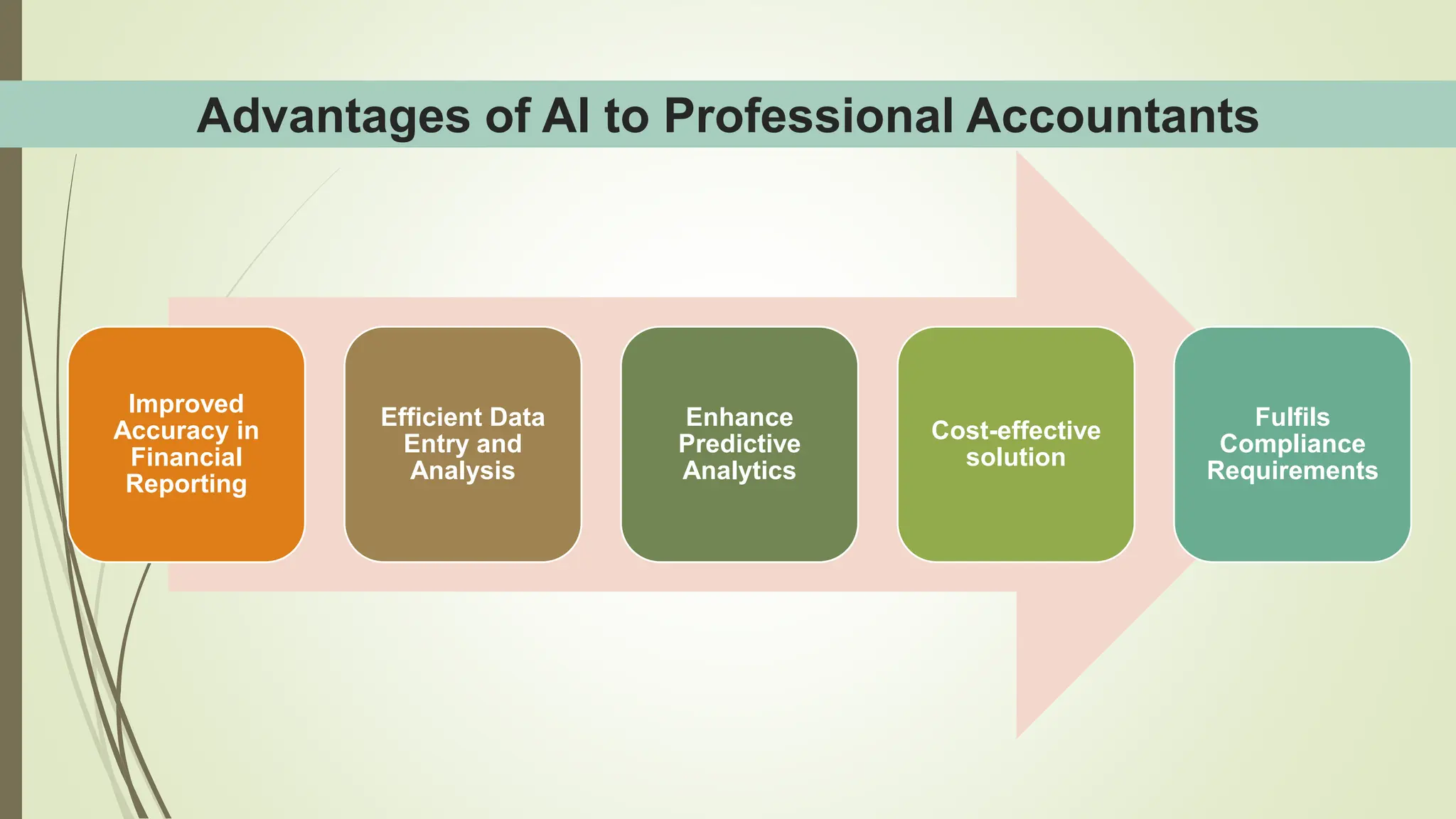

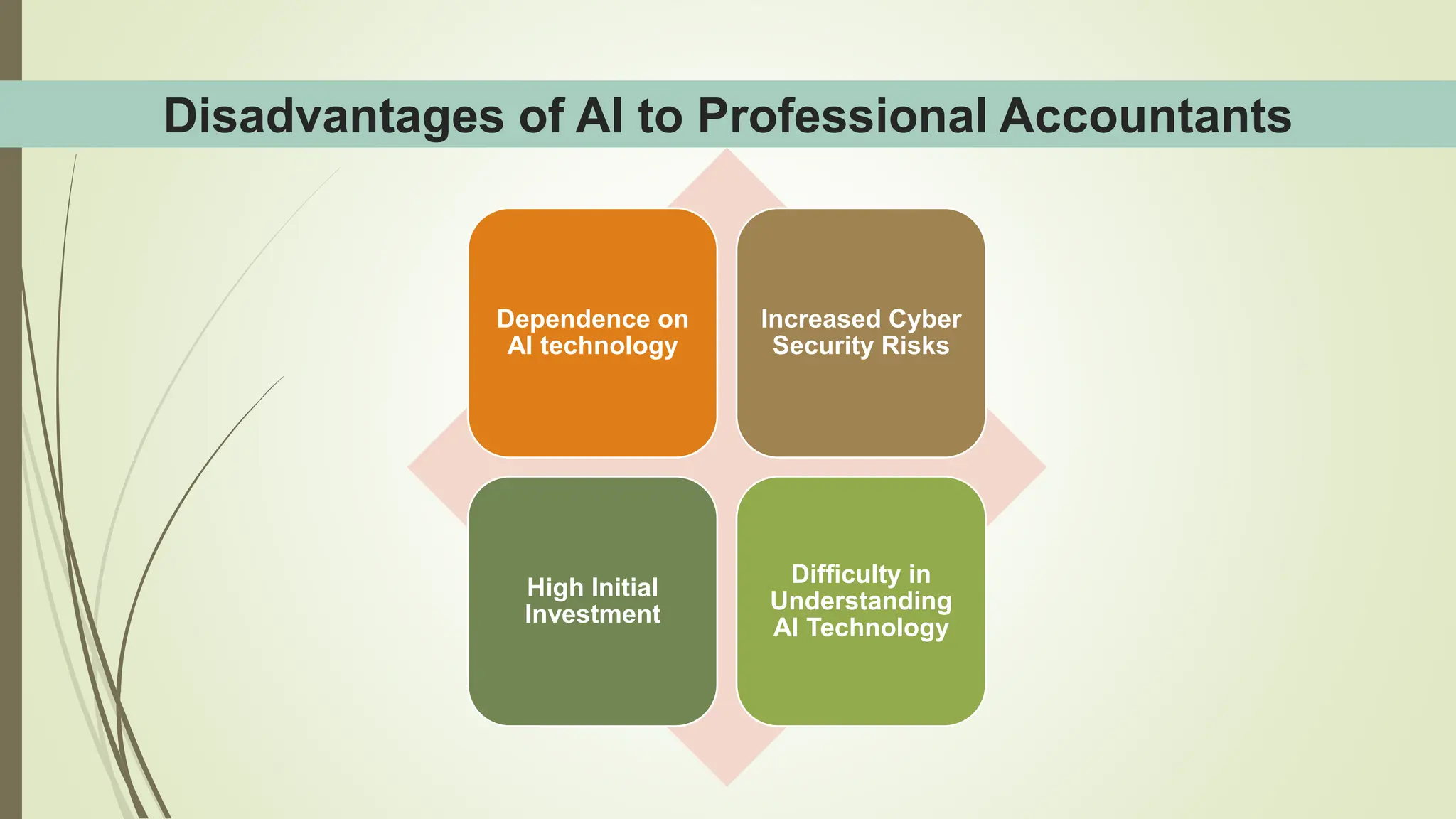

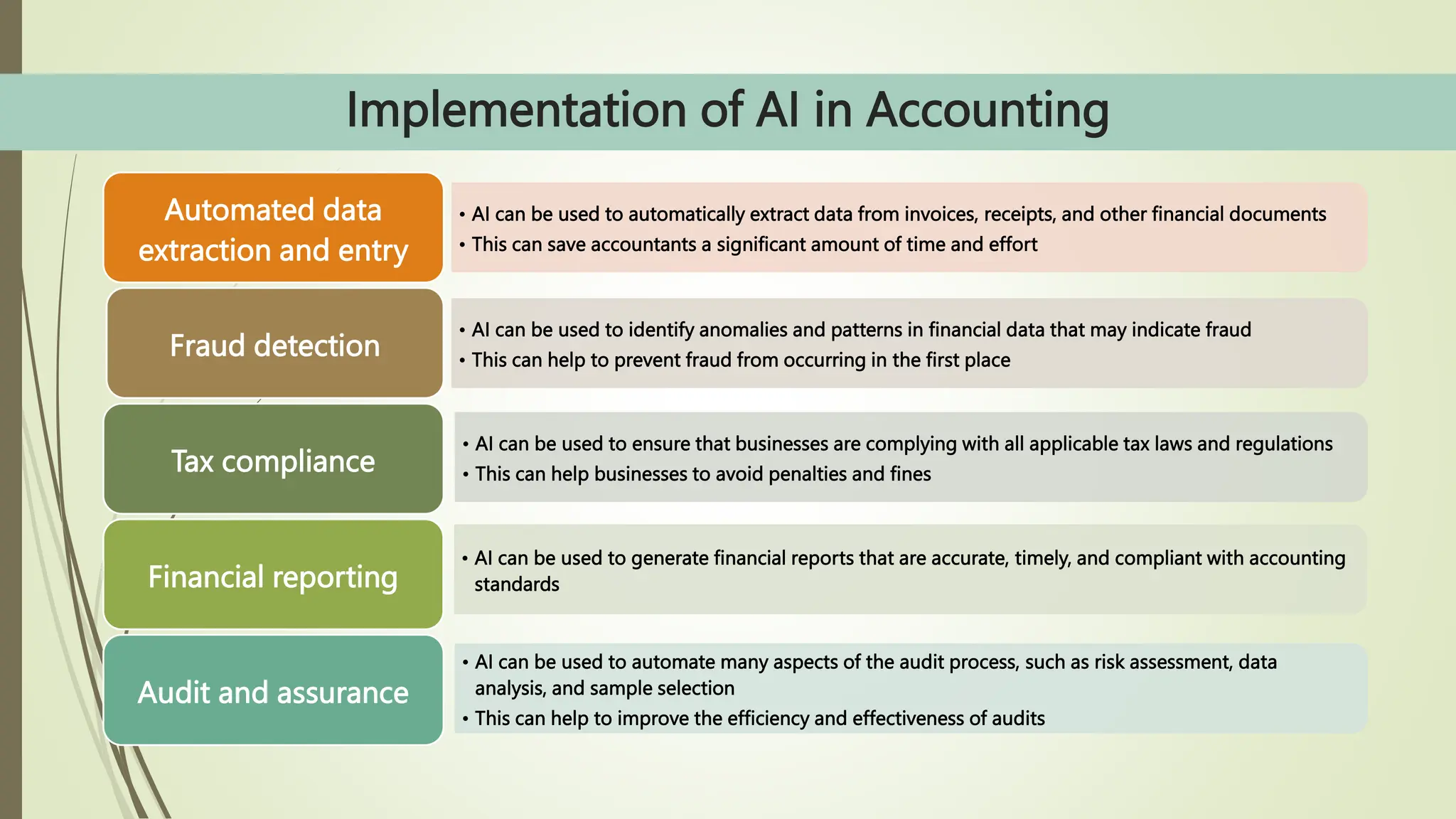

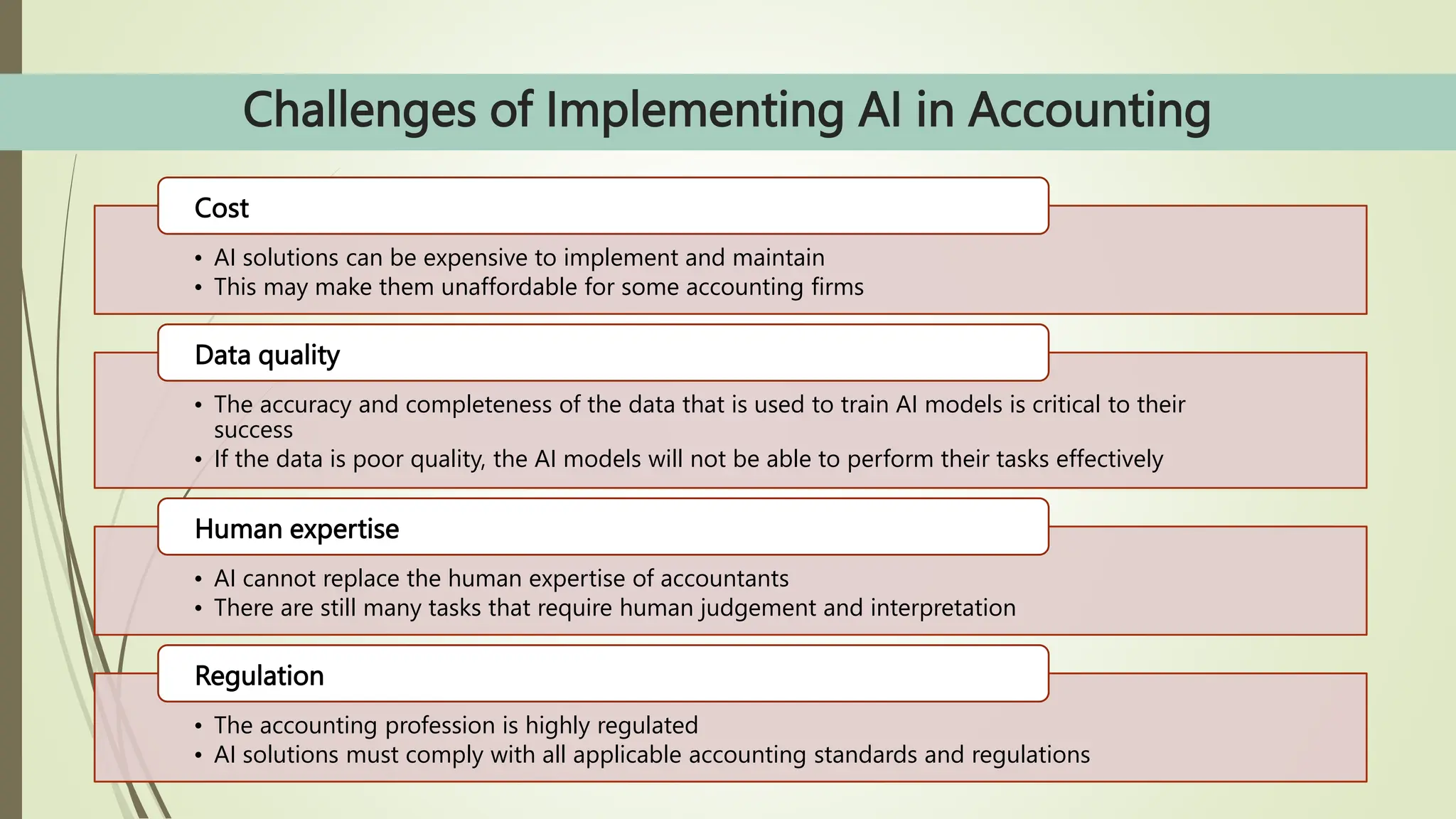

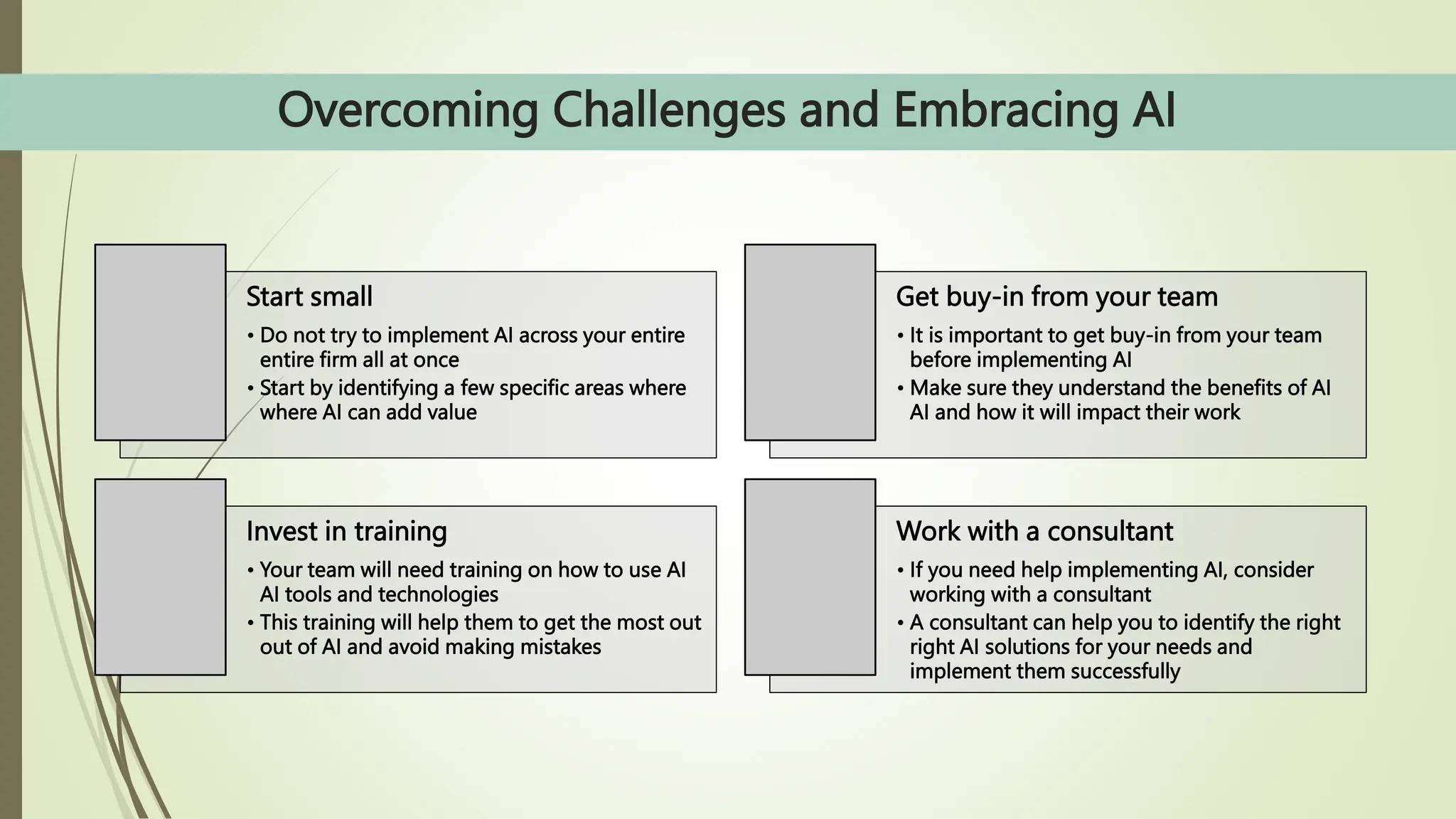

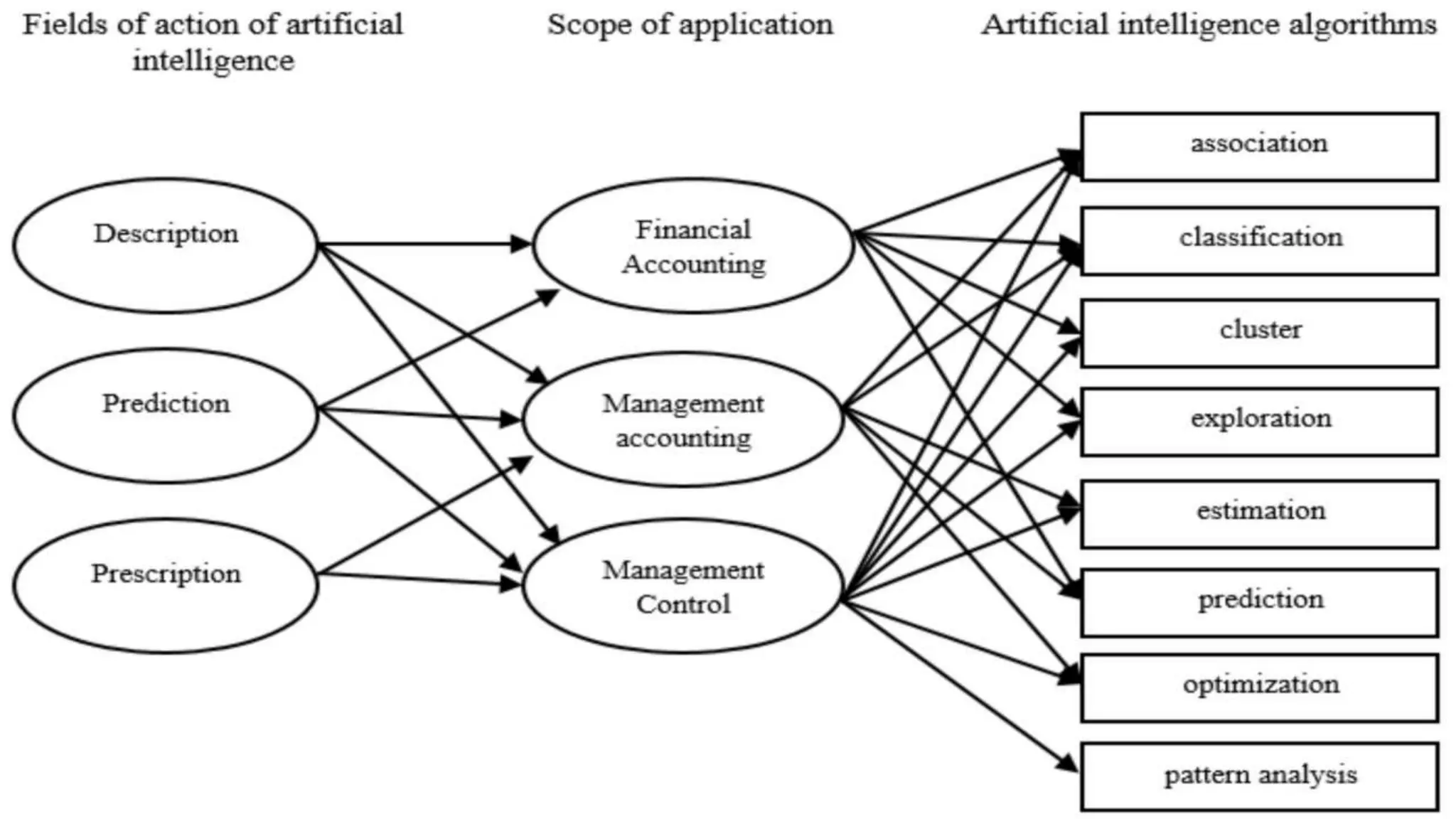

The paper presented at the International Accounting Day discusses the transformative impact of artificial intelligence (AI) on the accounting profession, highlighting its potential to enhance efficiency, accuracy, and decision-making in Nigeria. Despite its advantages, the implementation of AI faces challenges, such as infrastructural issues and the need for skilled labor, while also raising ethical concerns and the importance of compliance with regulatory standards. To effectively adopt AI, the paper suggests starting small, securing team buy-in, and investing in training to navigate this technological shift.