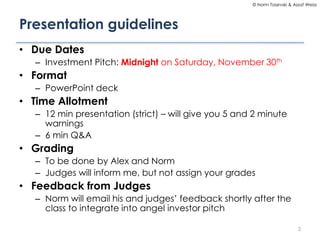

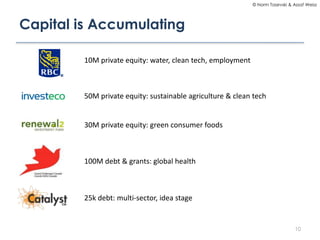

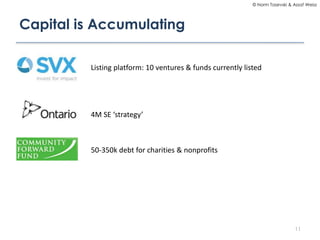

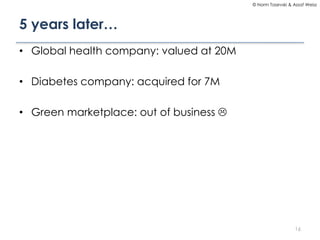

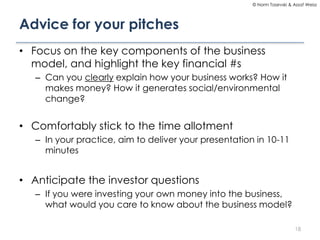

The document outlines the agenda for a social entrepreneurship class, detailing presentation guidelines, emerging issues, and evaluation methods. It discusses trends in social entrepreneurship and the challenges faced in deal flow and measurement systems. Additionally, it emphasizes the importance of a strong business model and preparation for investor pitches.