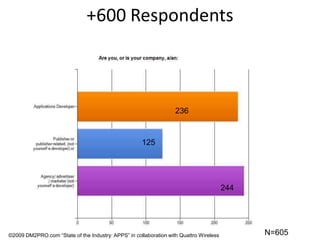

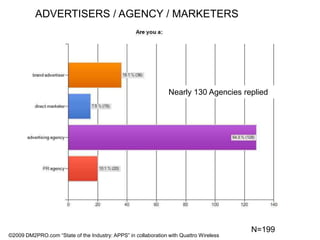

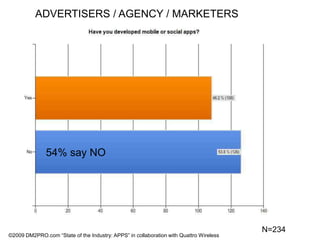

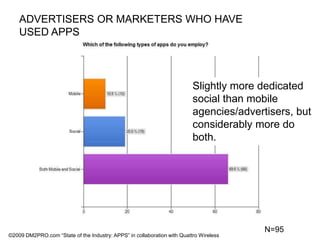

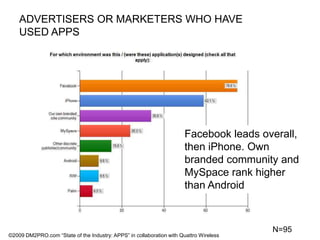

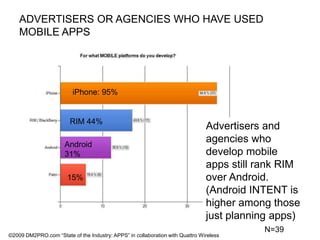

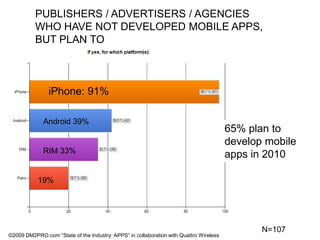

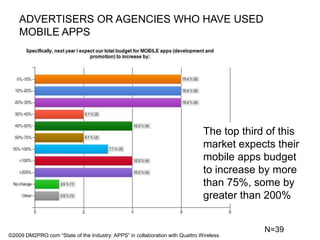

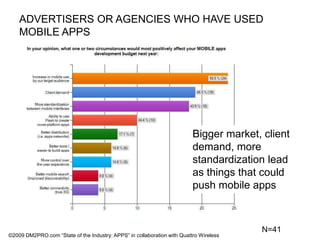

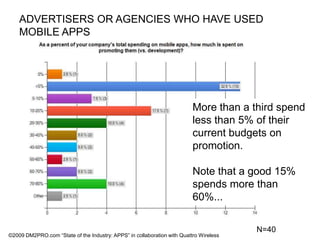

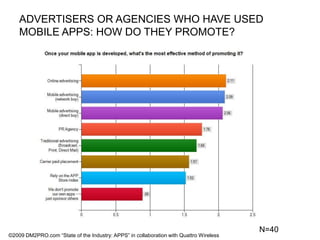

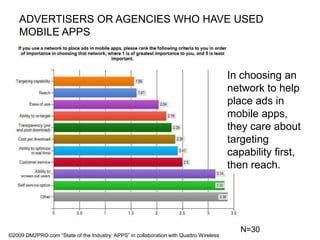

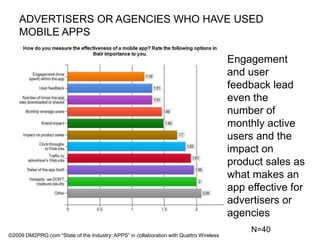

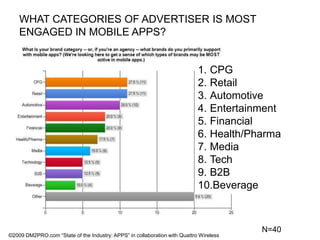

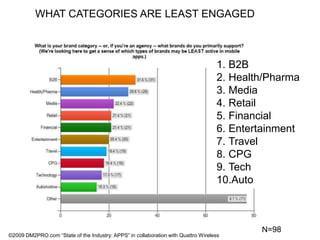

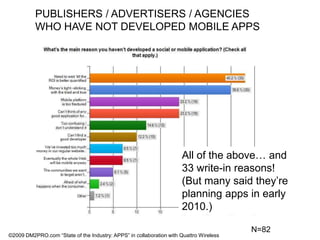

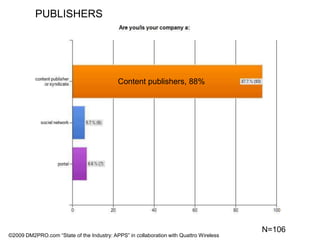

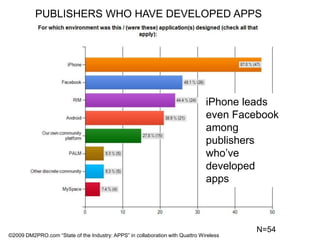

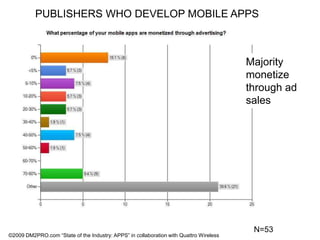

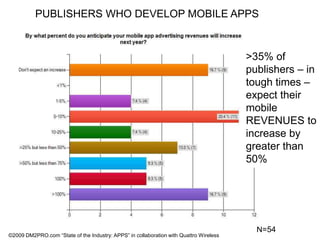

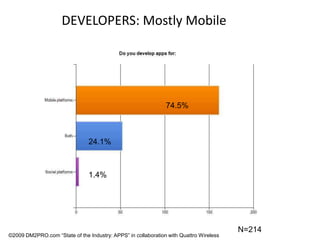

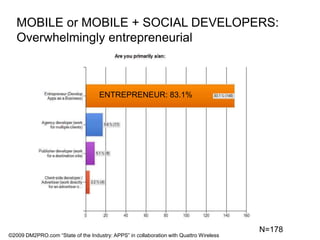

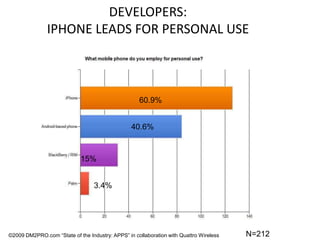

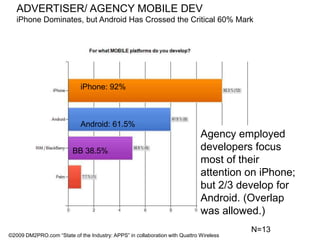

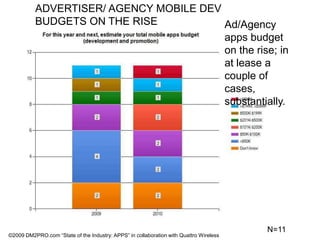

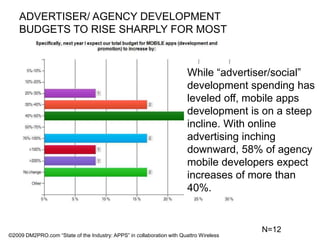

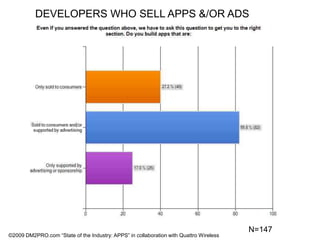

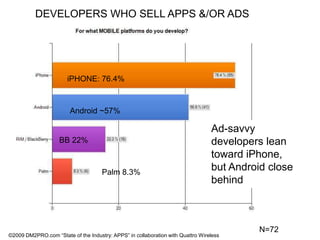

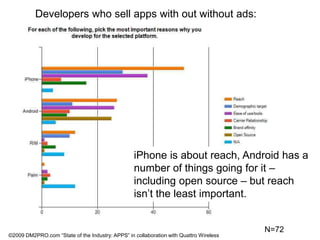

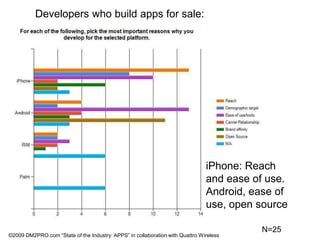

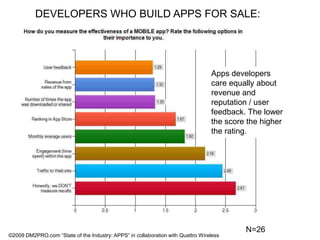

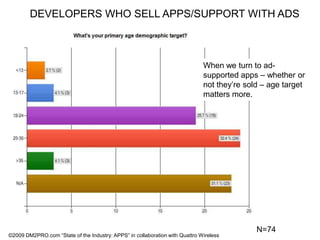

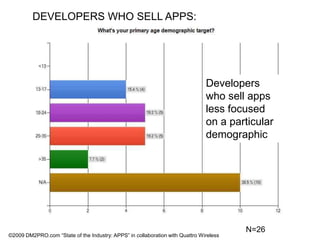

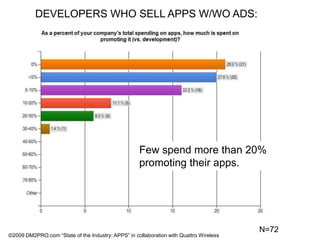

The document summarizes the findings of a survey on mobile app developers, advertisers, agencies, and publishers. It found that iPhone was the dominant platform but Android adoption was growing. Mobile app budgets were expected to increase significantly. Developers focused on iPhone for its reach but saw opportunities in Android's open source approach. Advertisers valued engagement and user feedback from apps over metrics like monthly users. Publishers expected mobile revenues to increase over 50% on average.