https://www.accountantadvocate.com/frs/27748764/cash-flow-secrets-every-upskilled-cpa-should-know

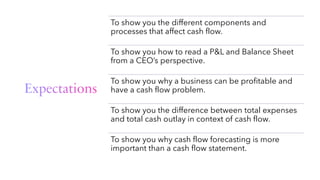

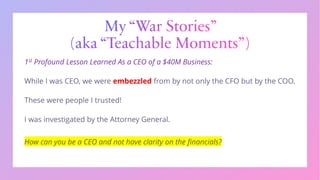

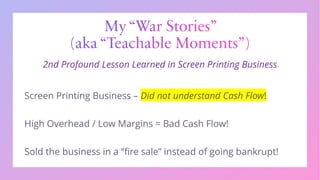

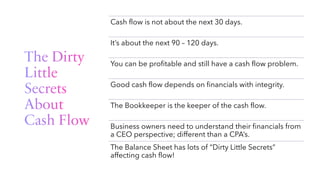

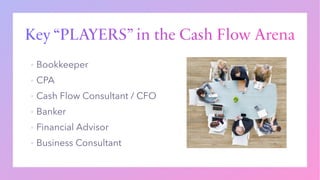

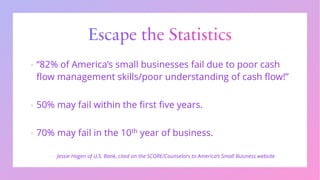

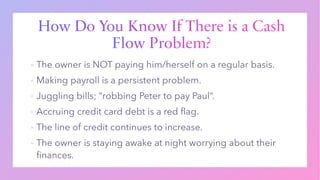

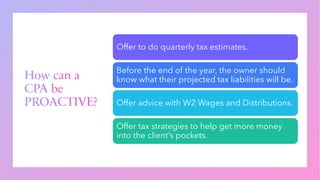

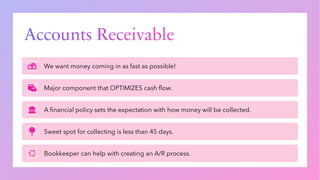

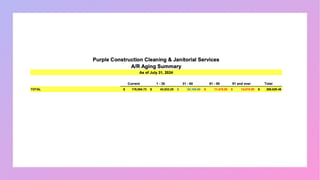

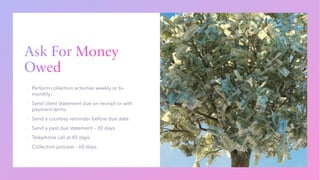

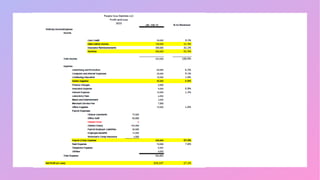

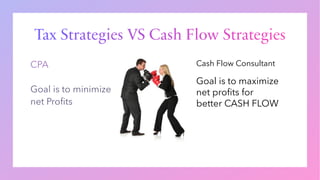

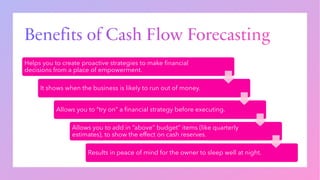

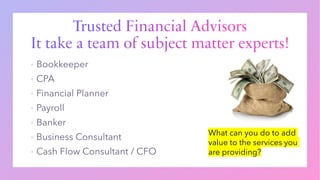

Upskill your cash flow expertise! Discover the strategies CPAs need to shift from reactive to proactive financial management, build resilience, and deliver greater value.