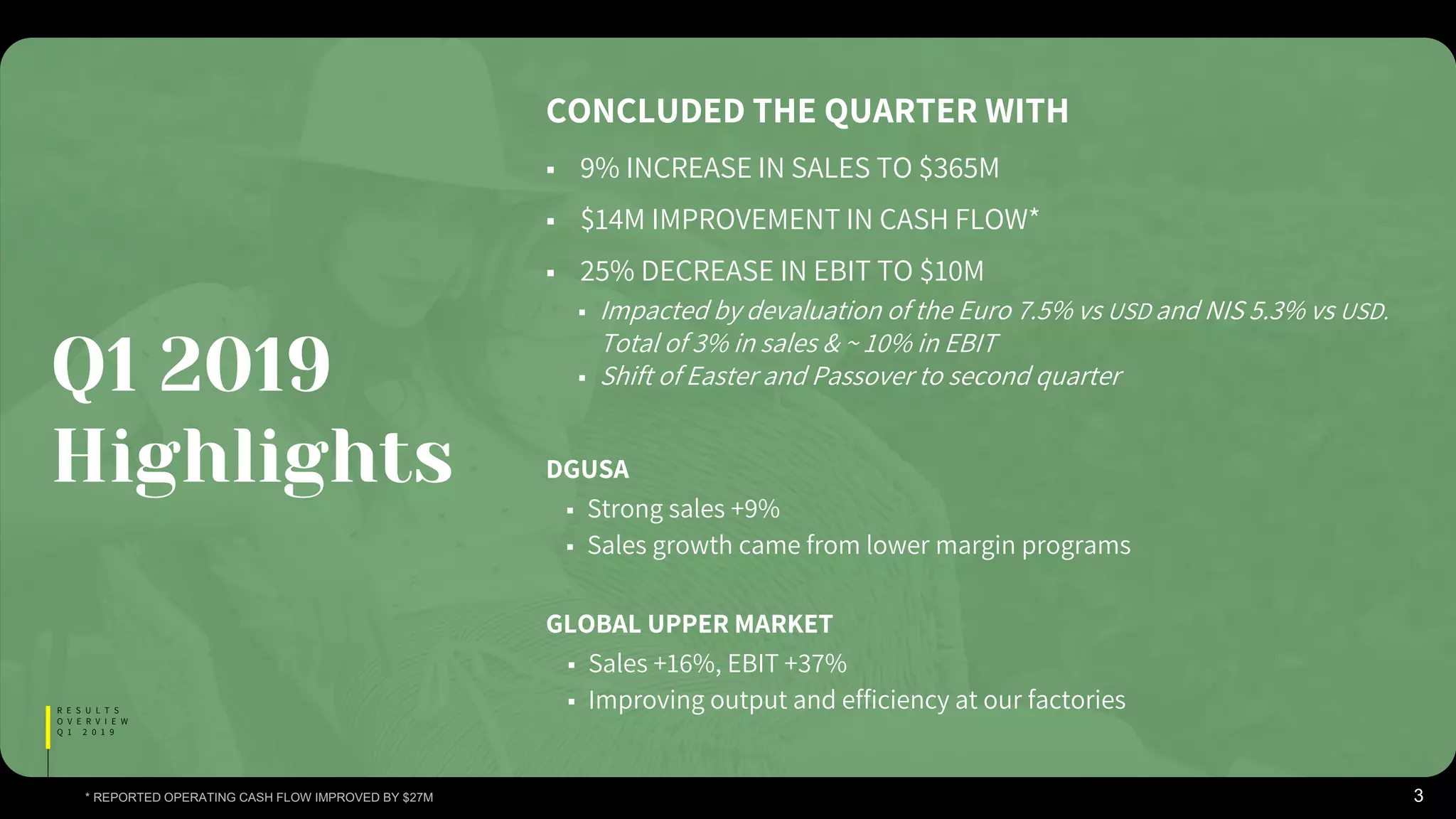

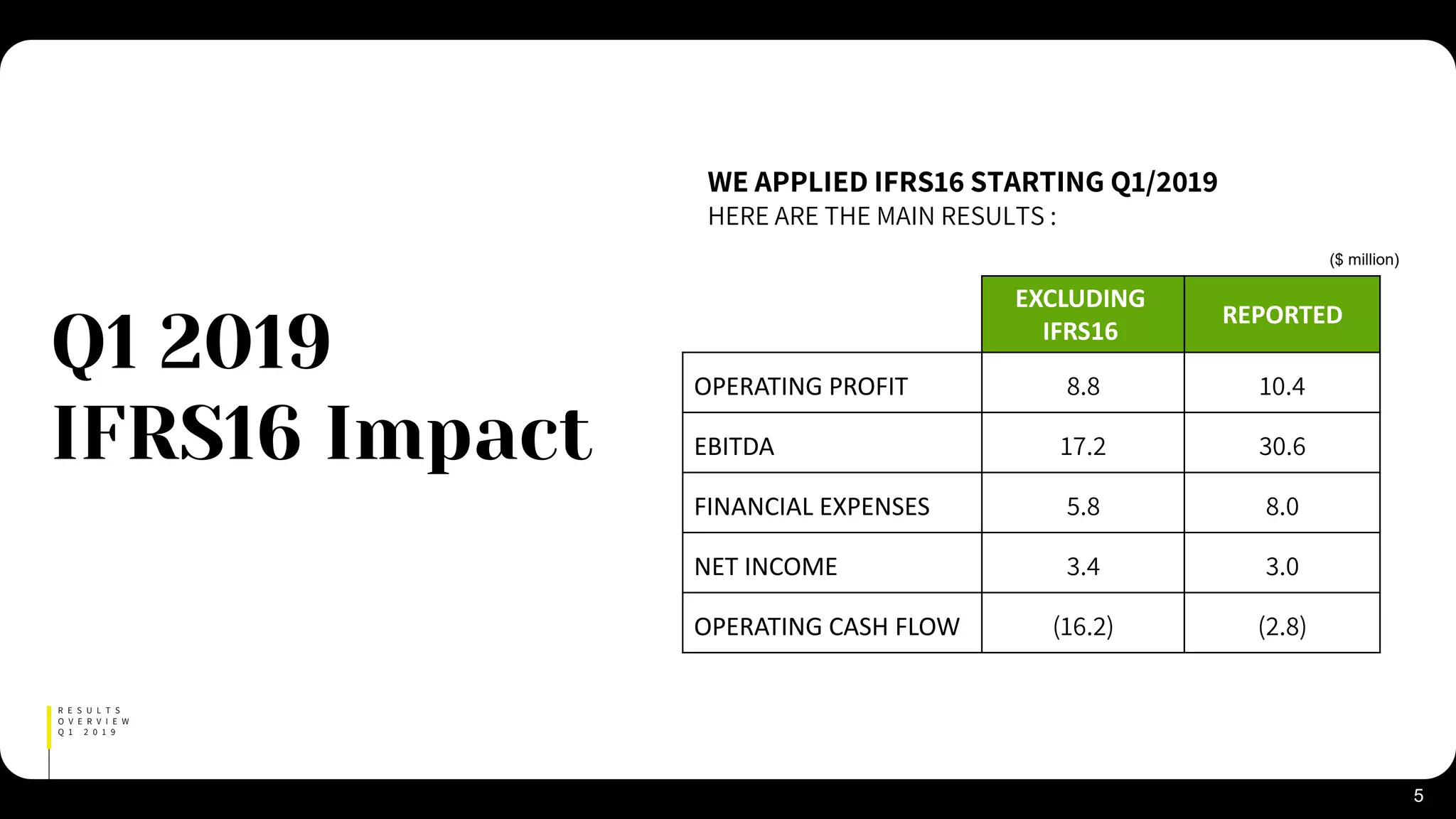

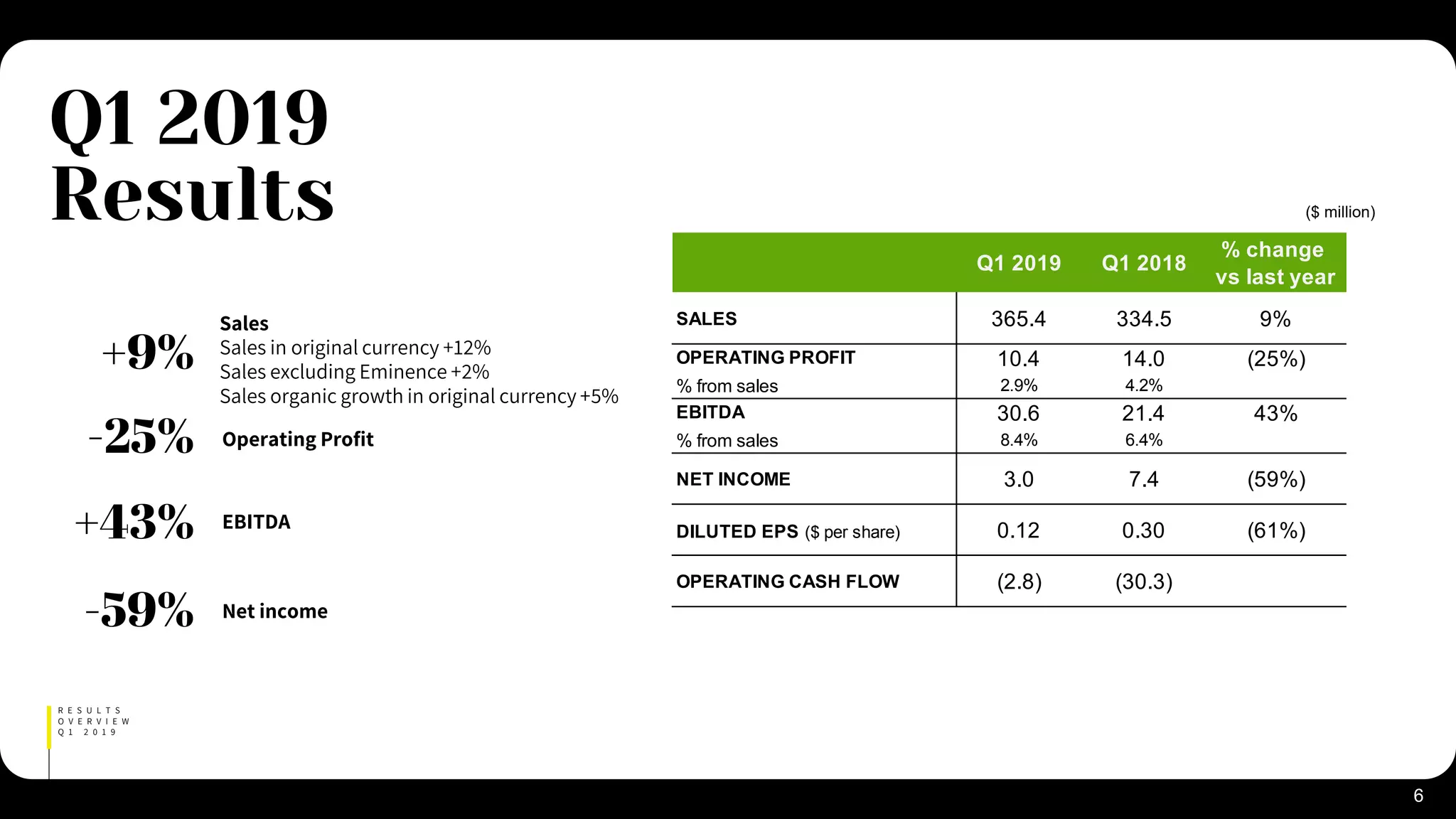

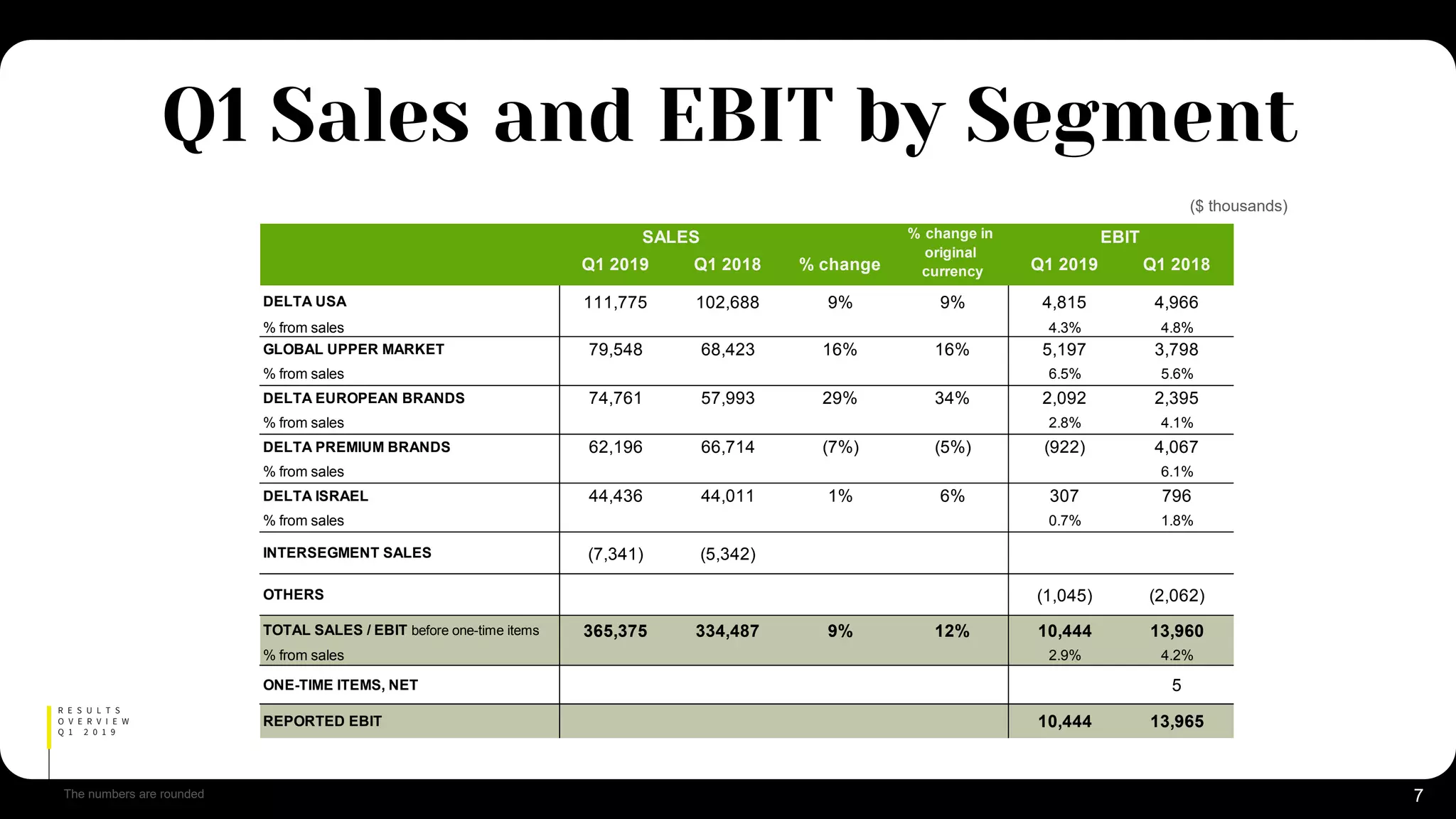

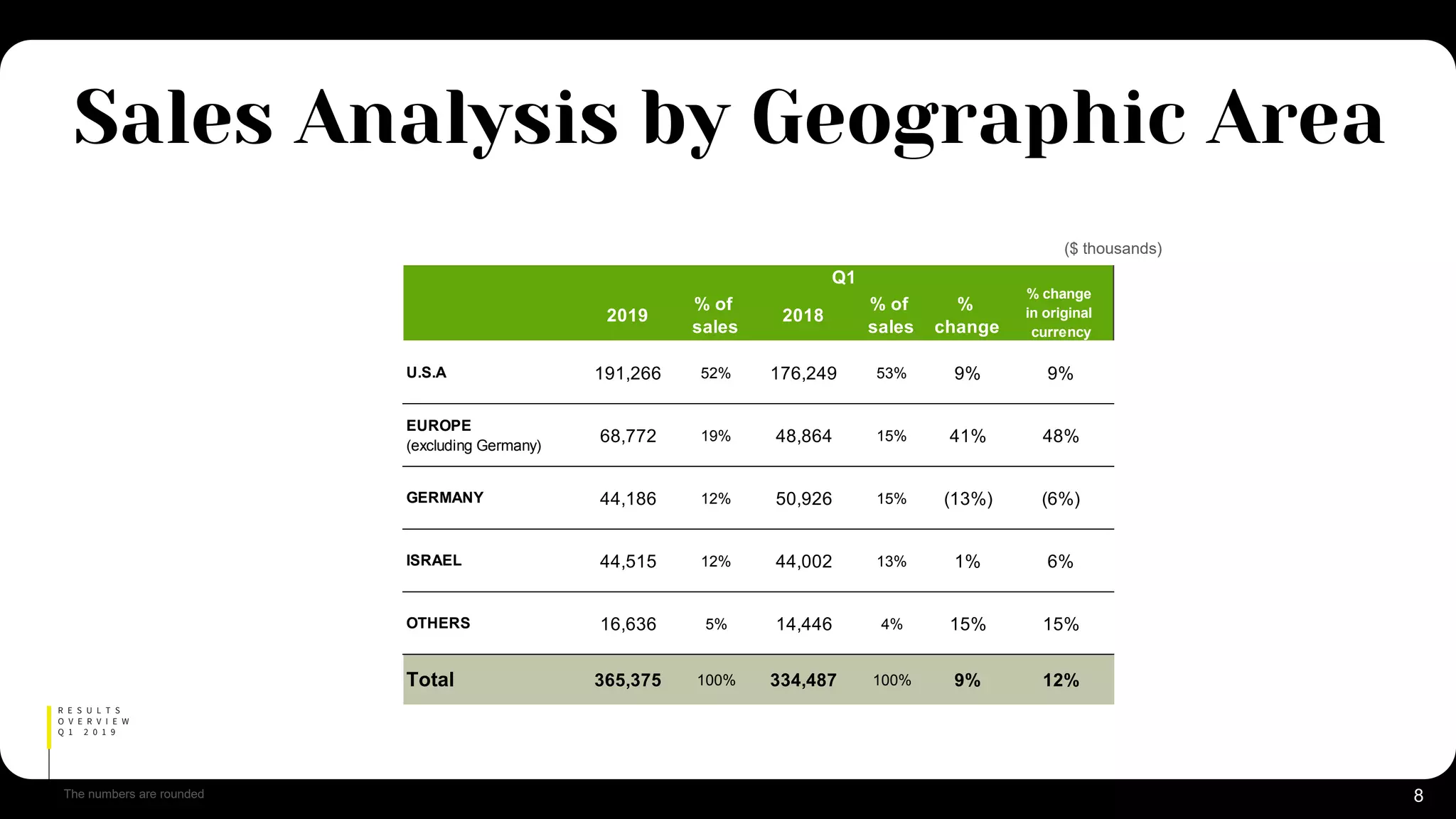

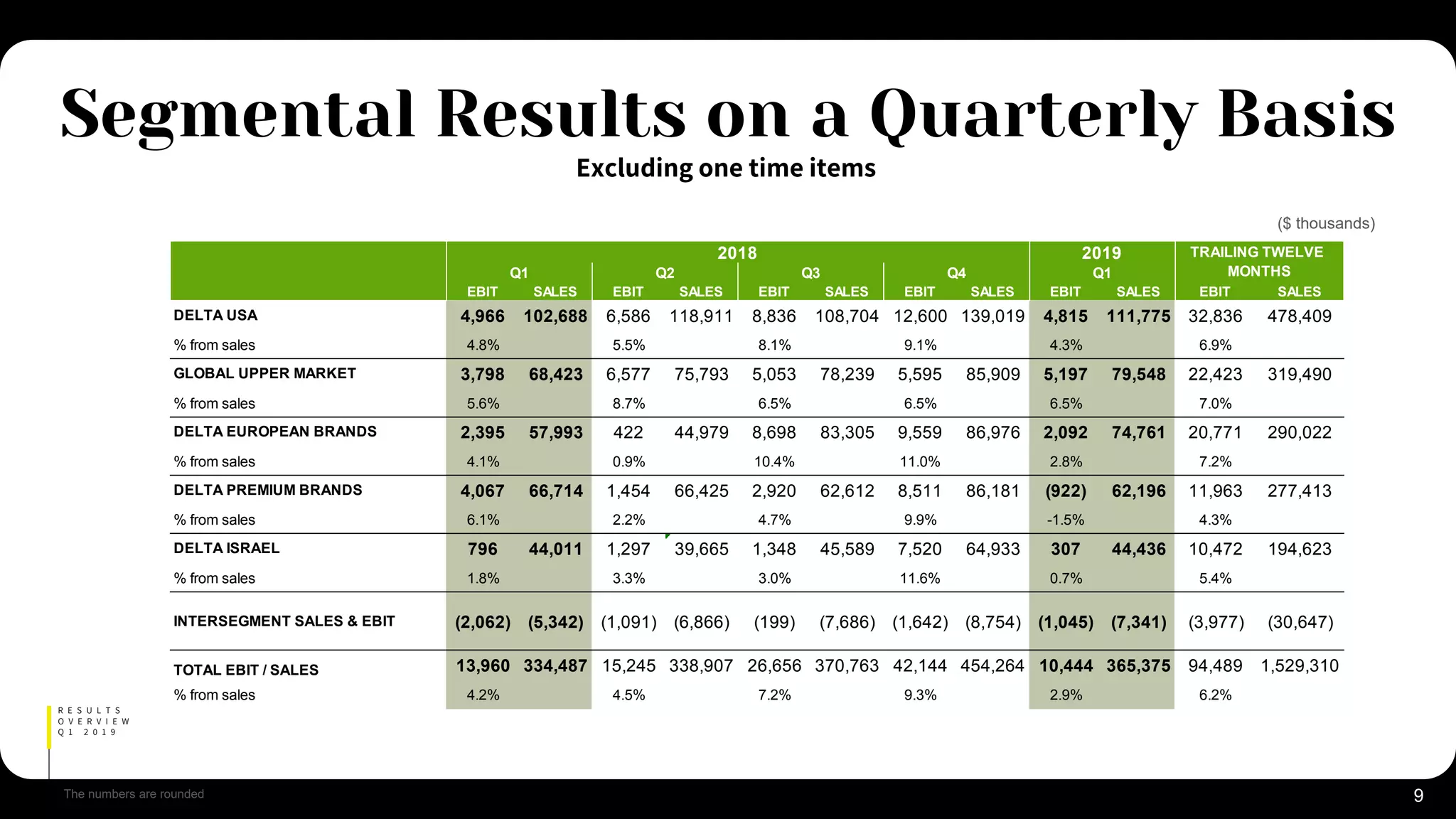

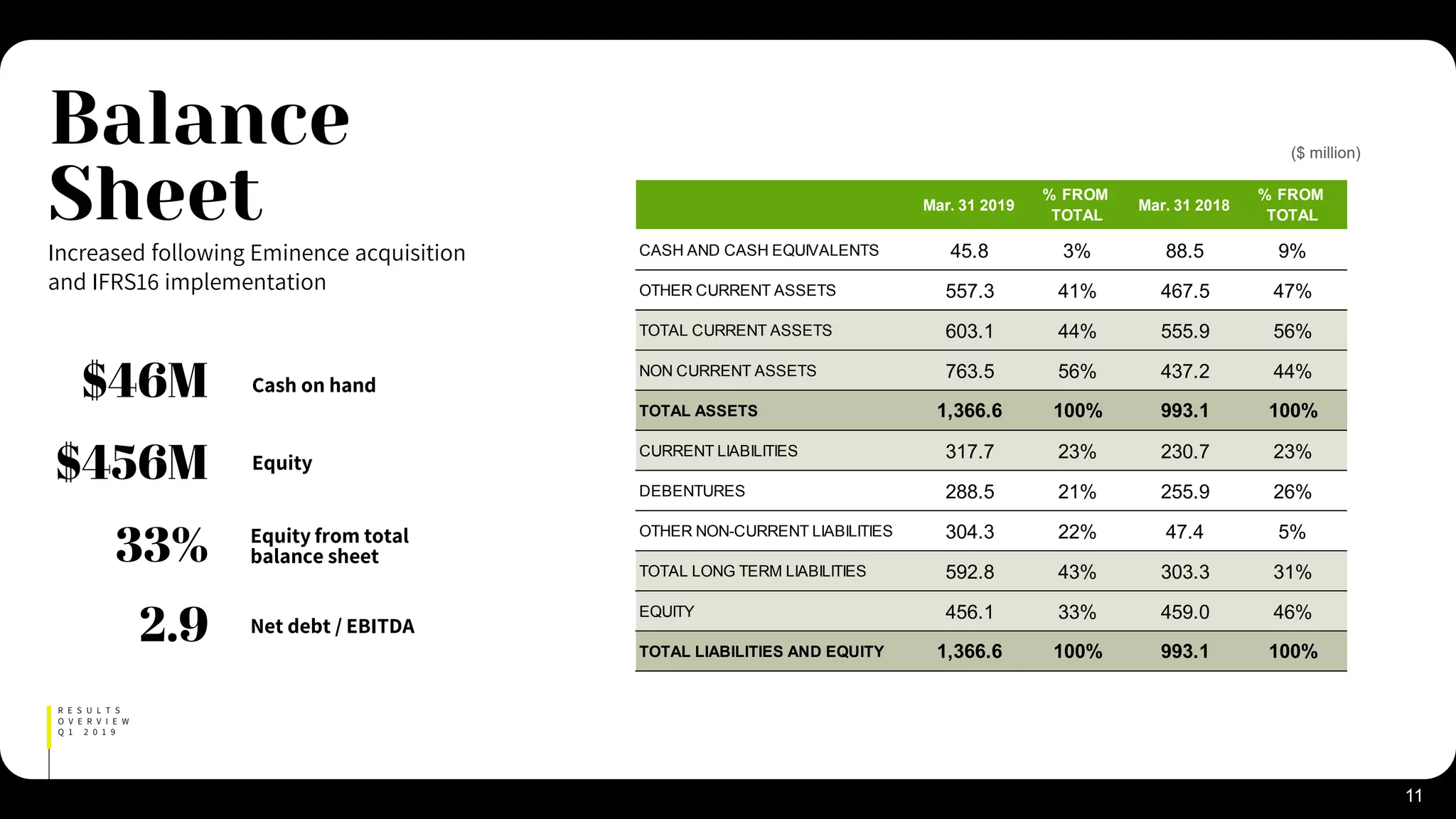

Q1 2019 sales increased 9% to $365 million compared to Q1 2018. However, operating profit decreased 25% to $10.4 million due to factors such as currency devaluations against the US dollar and shifts in holiday timing. Cash flow improved by $27 million compared to Q1 2018. The results were impacted by IFRS 16 accounting standard changes applied starting in Q1 2019.