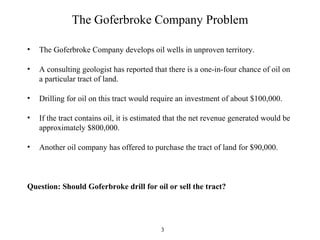

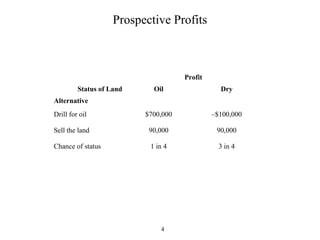

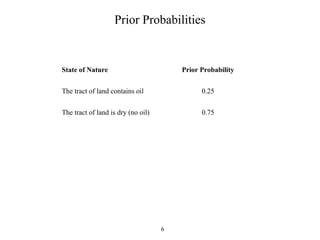

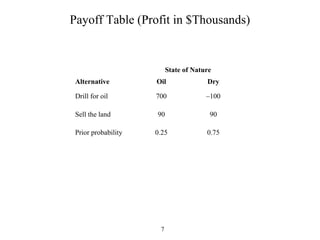

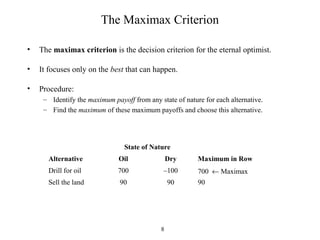

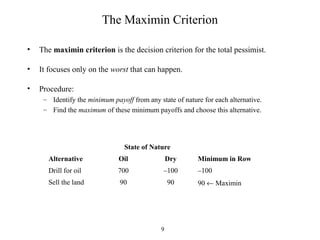

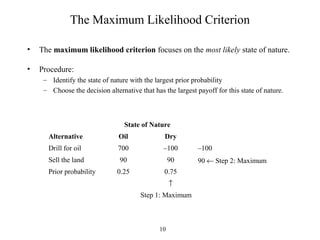

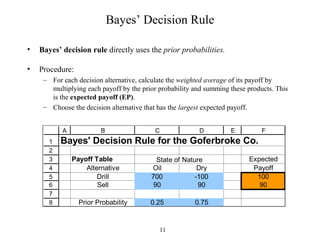

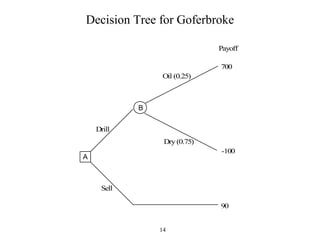

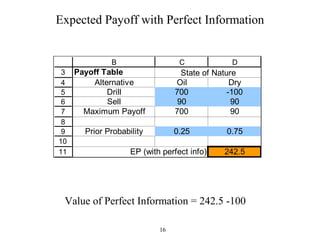

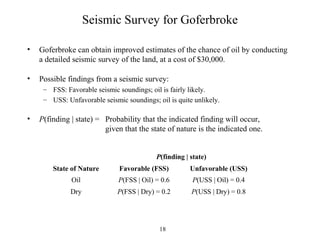

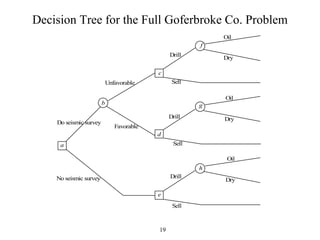

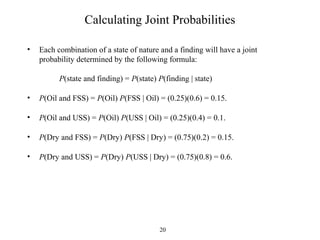

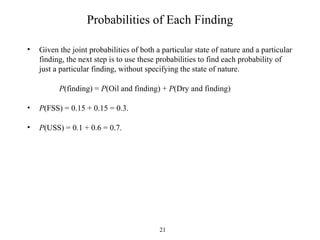

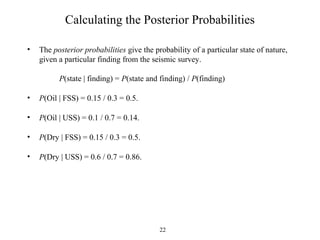

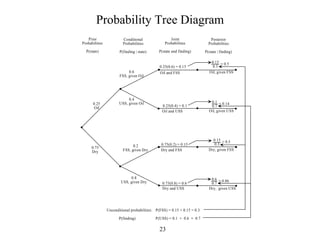

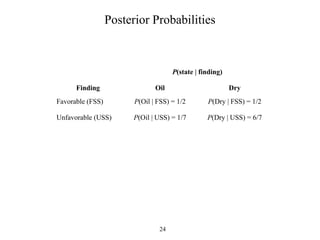

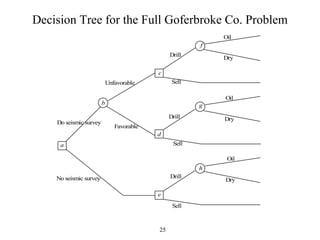

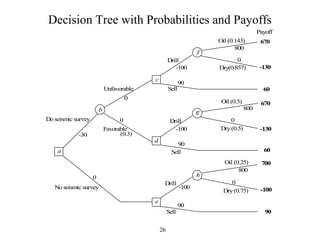

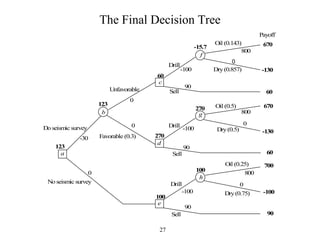

The document discusses decision analysis and presents a case study on the Goferbroke Company. Goferbroke must decide whether to drill for oil or sell land with a 25% chance of containing oil. Drilling costs $100,000 but may yield $800,000 profit if successful. Selling now offers $90,000. Additional seismic analysis could update probabilities at a $30,000 cost. The final decision tree weighs expected payoffs of drilling versus selling under both scenarios of conducting or not conducting the seismic analysis.