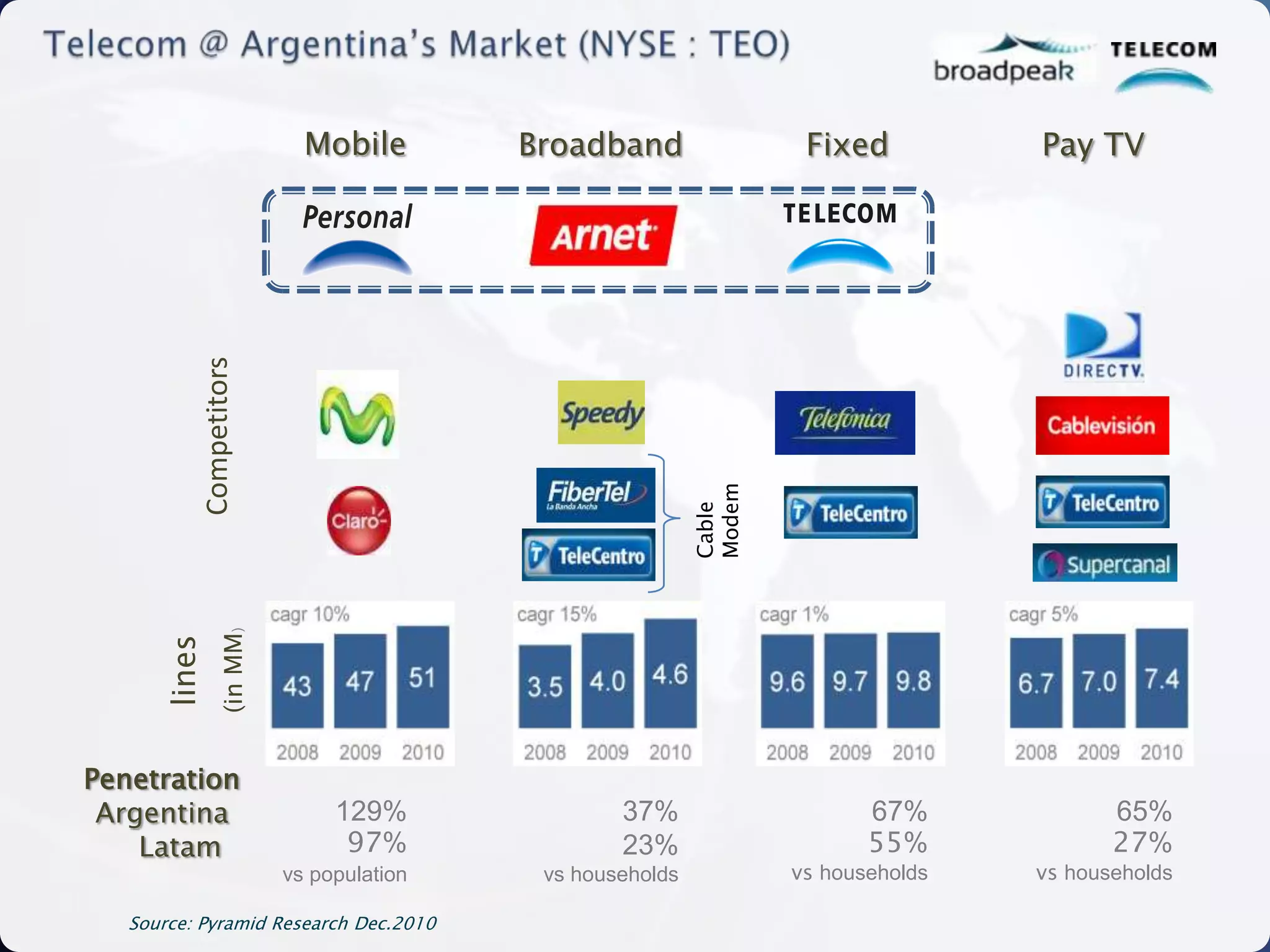

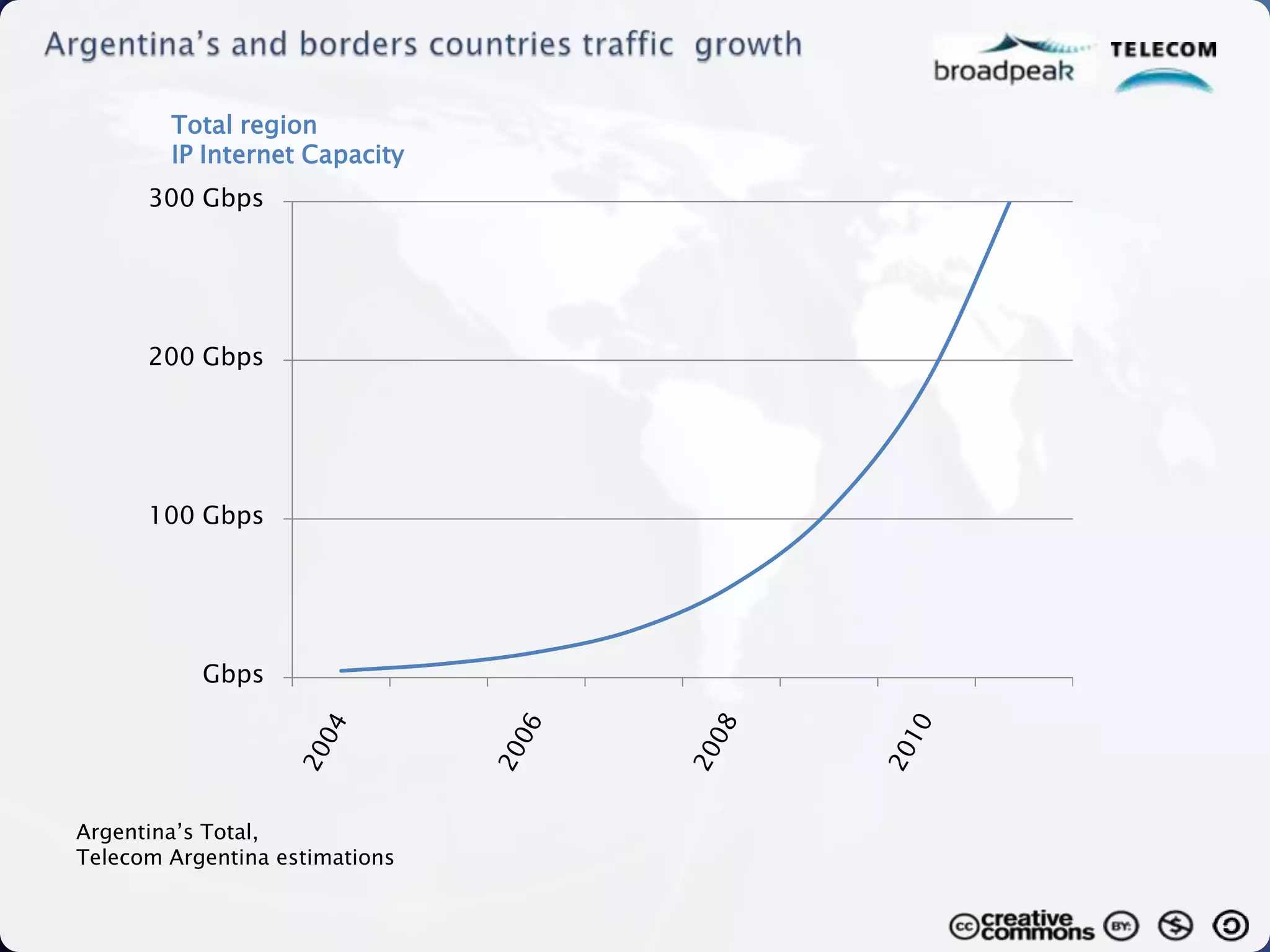

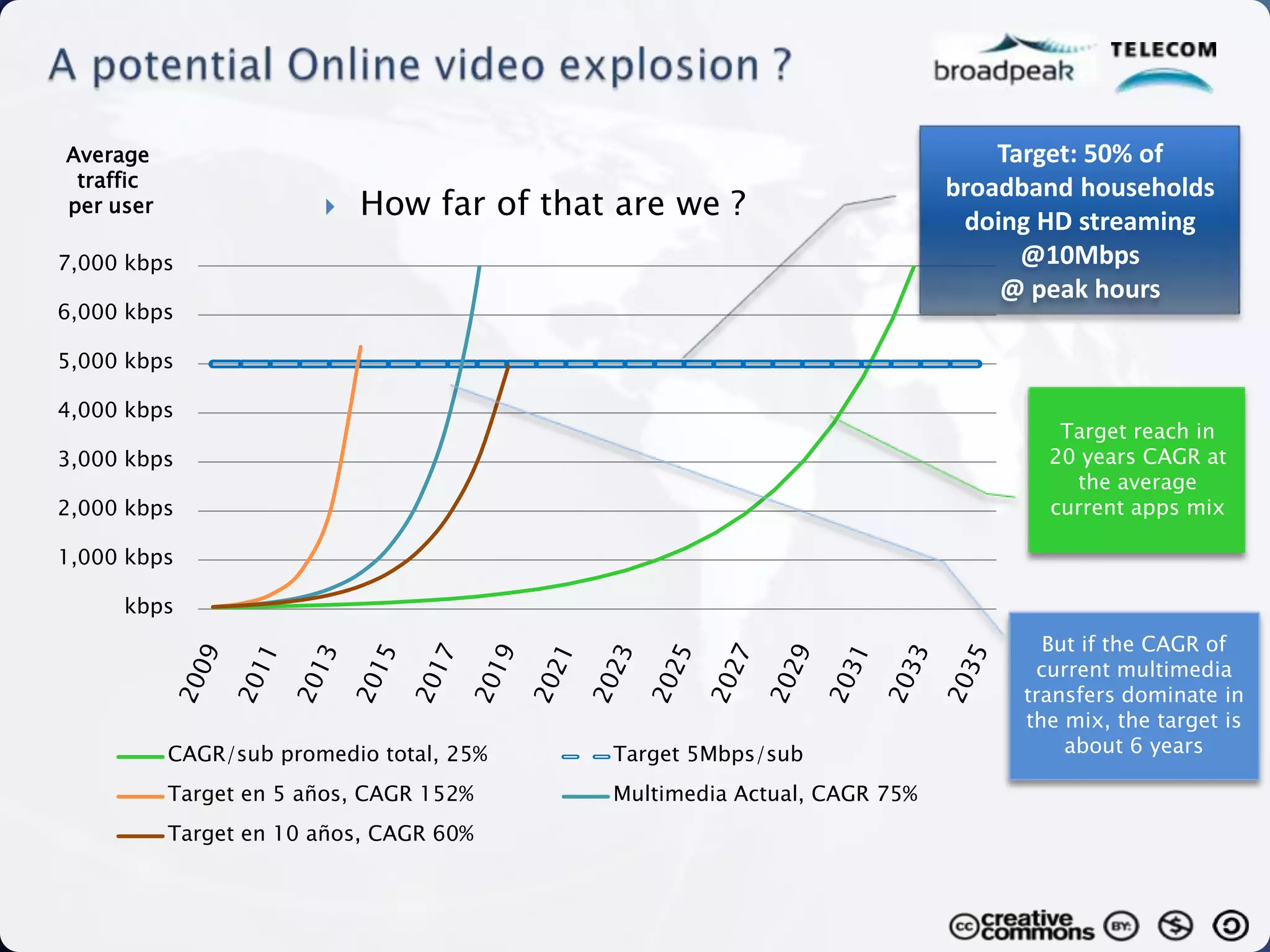

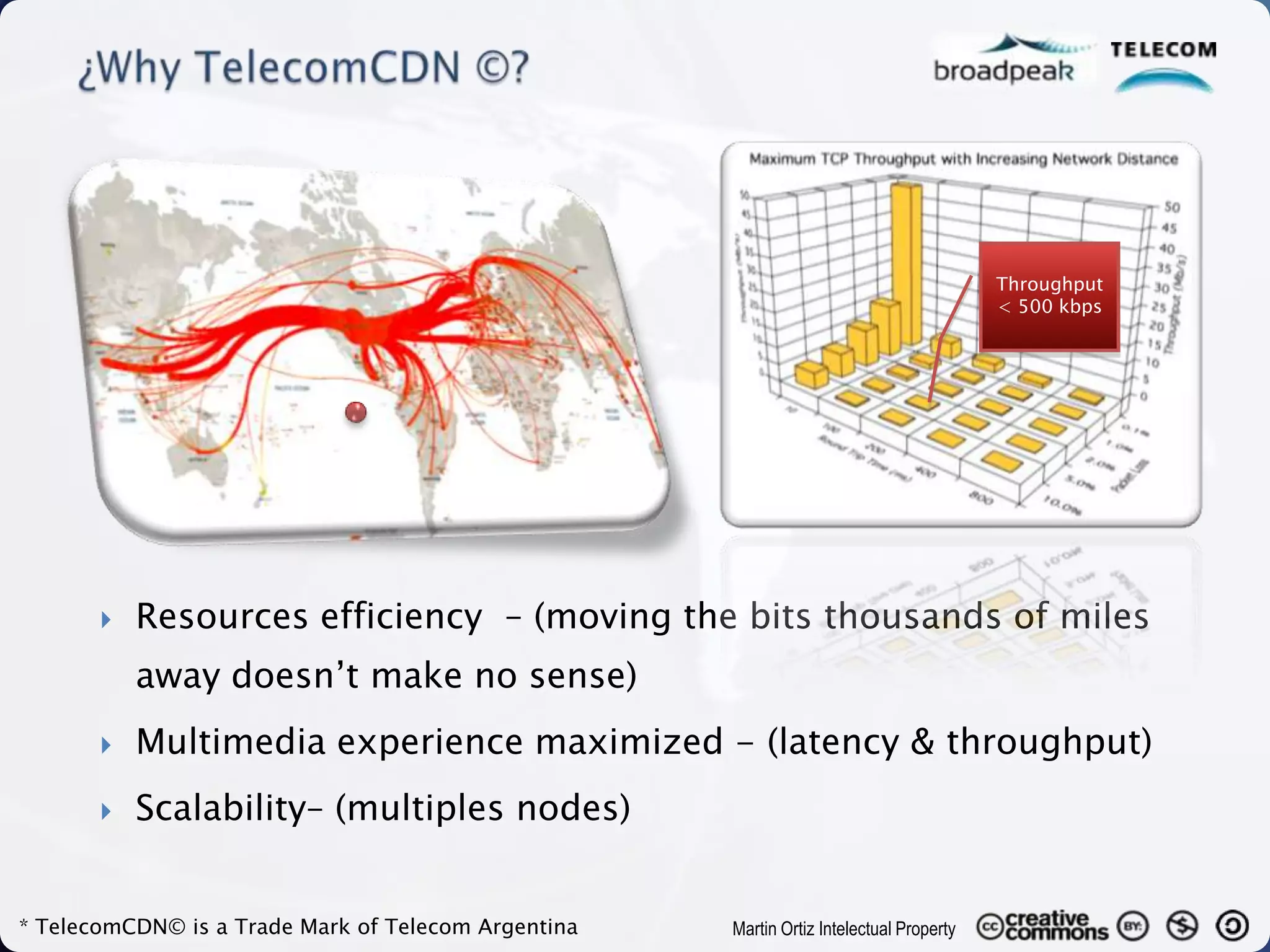

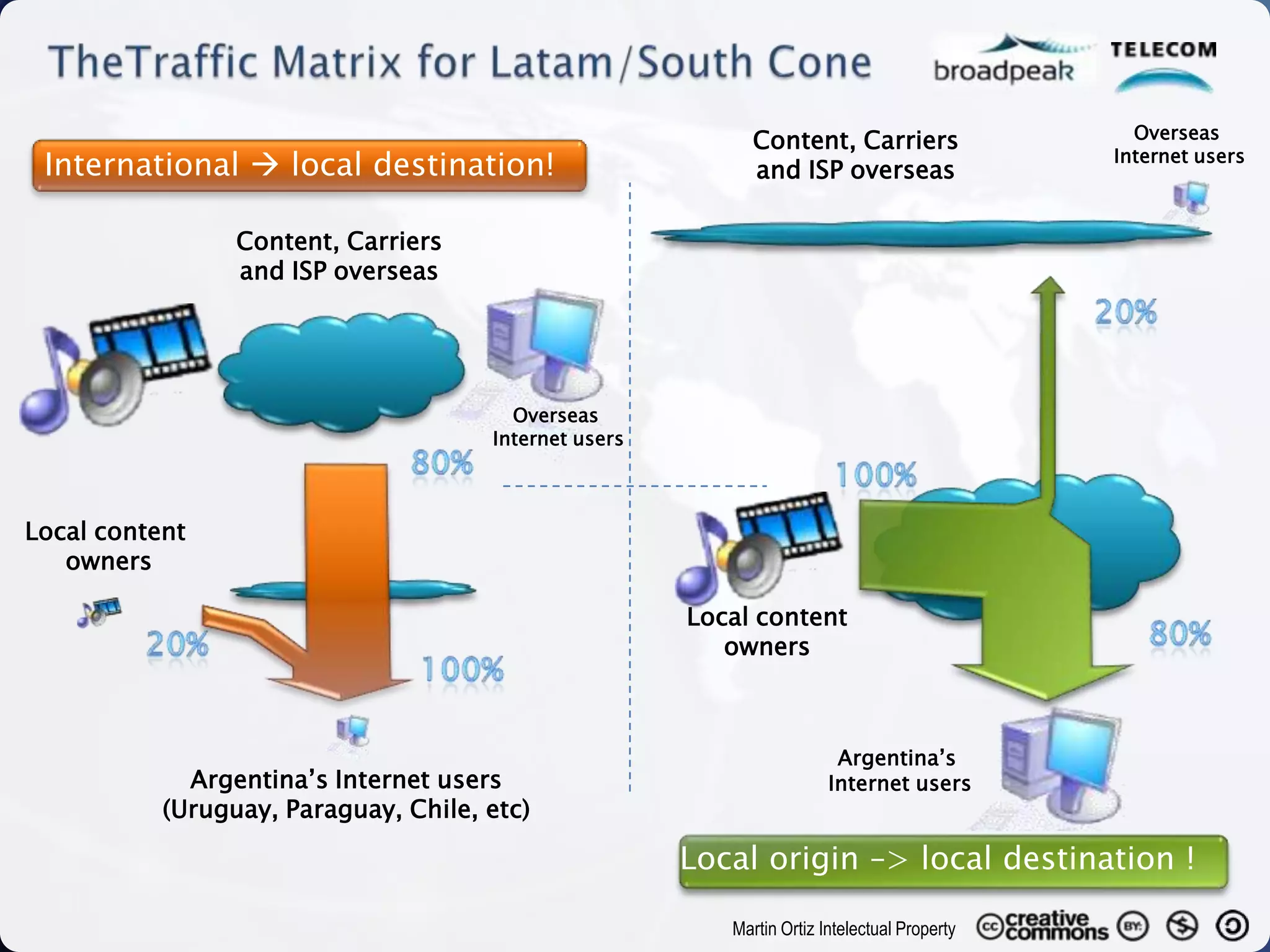

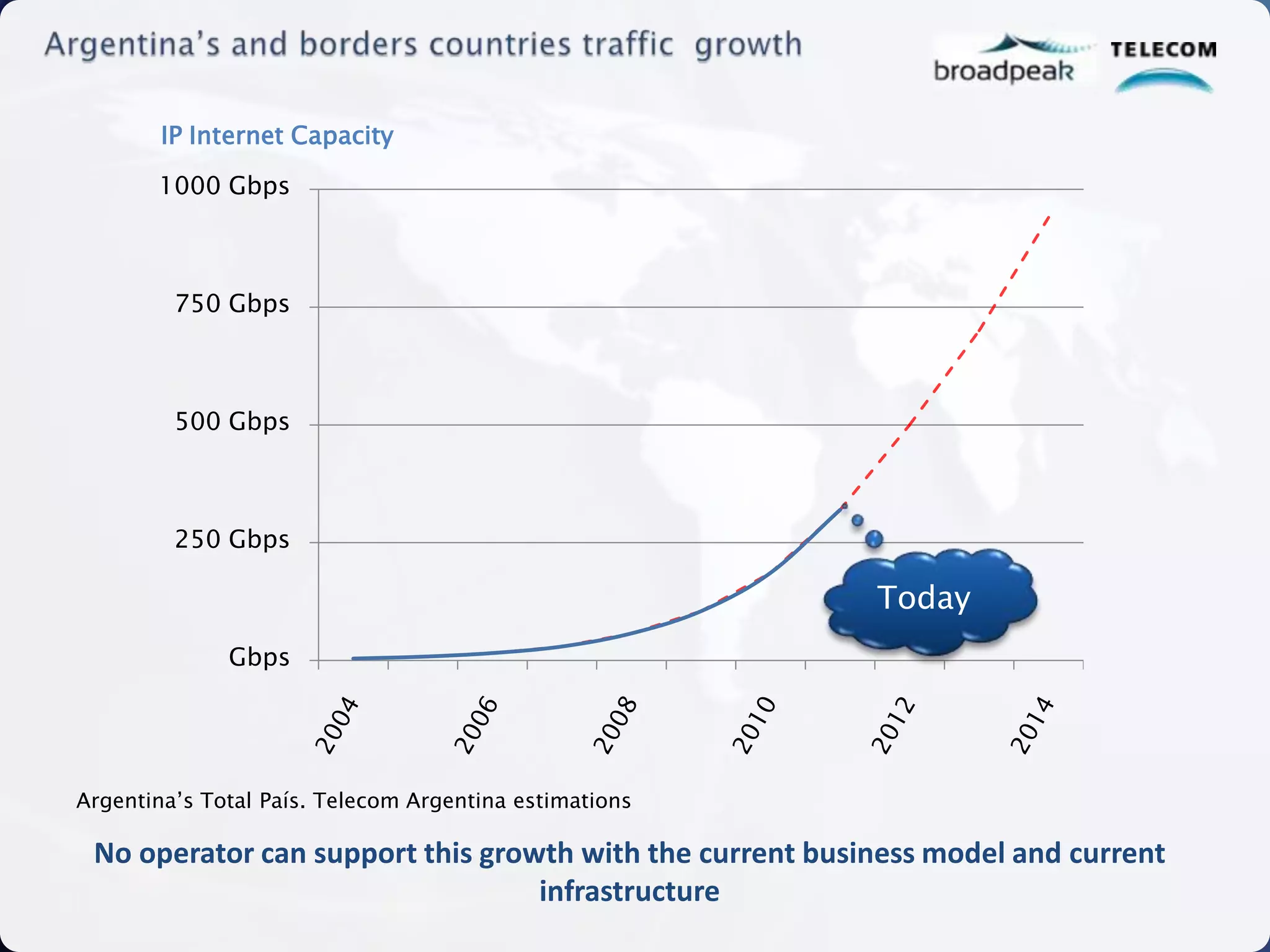

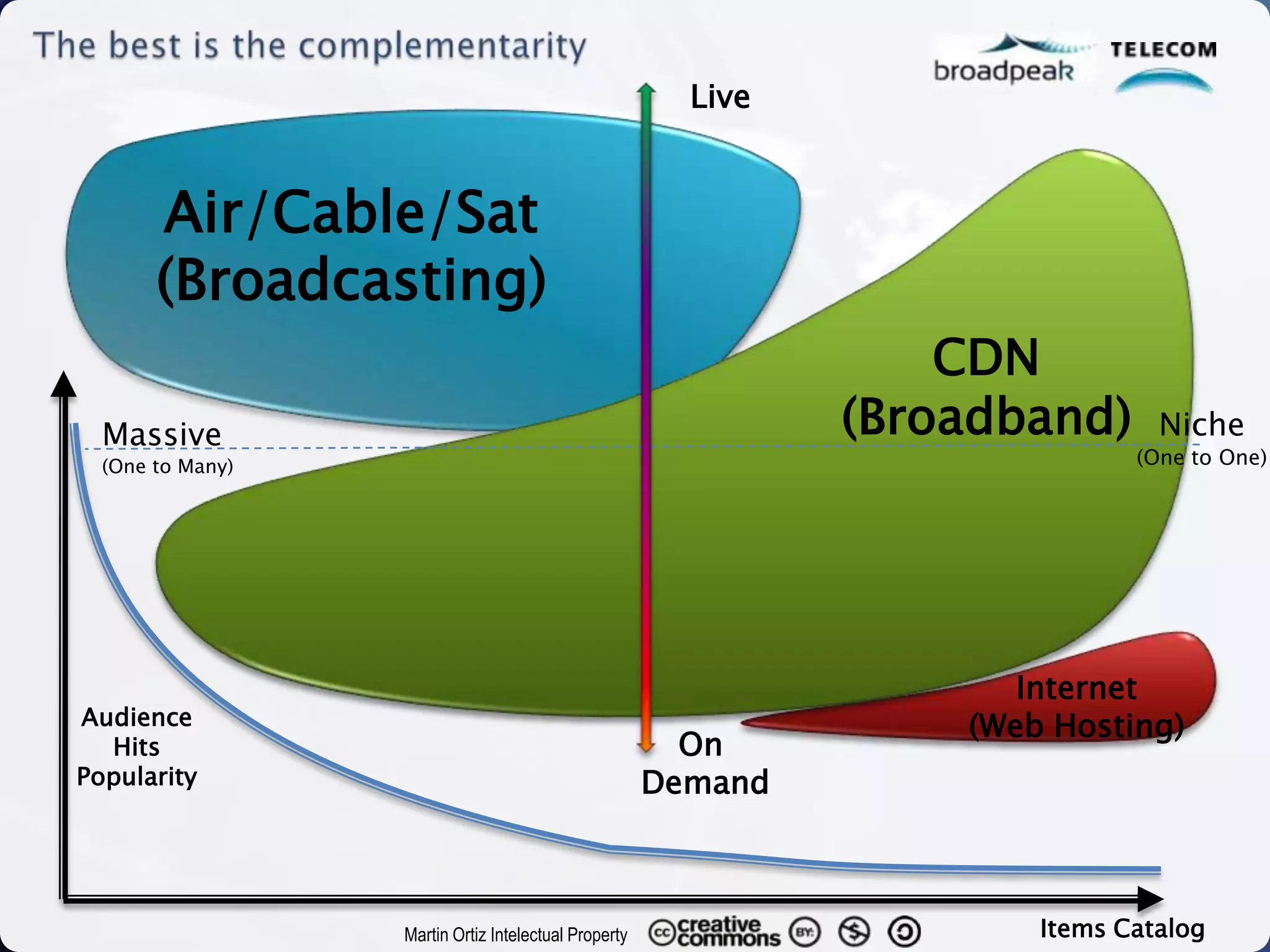

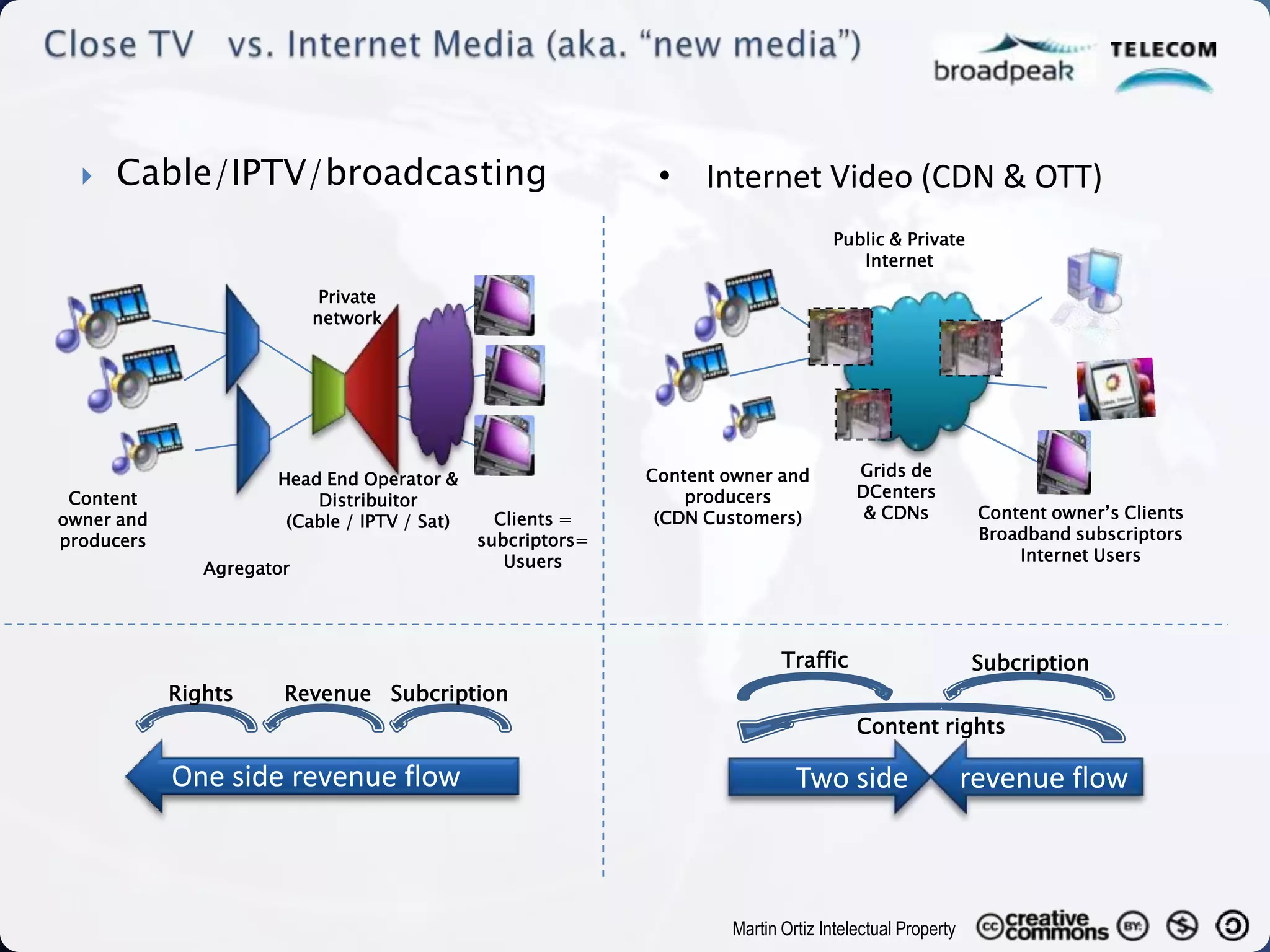

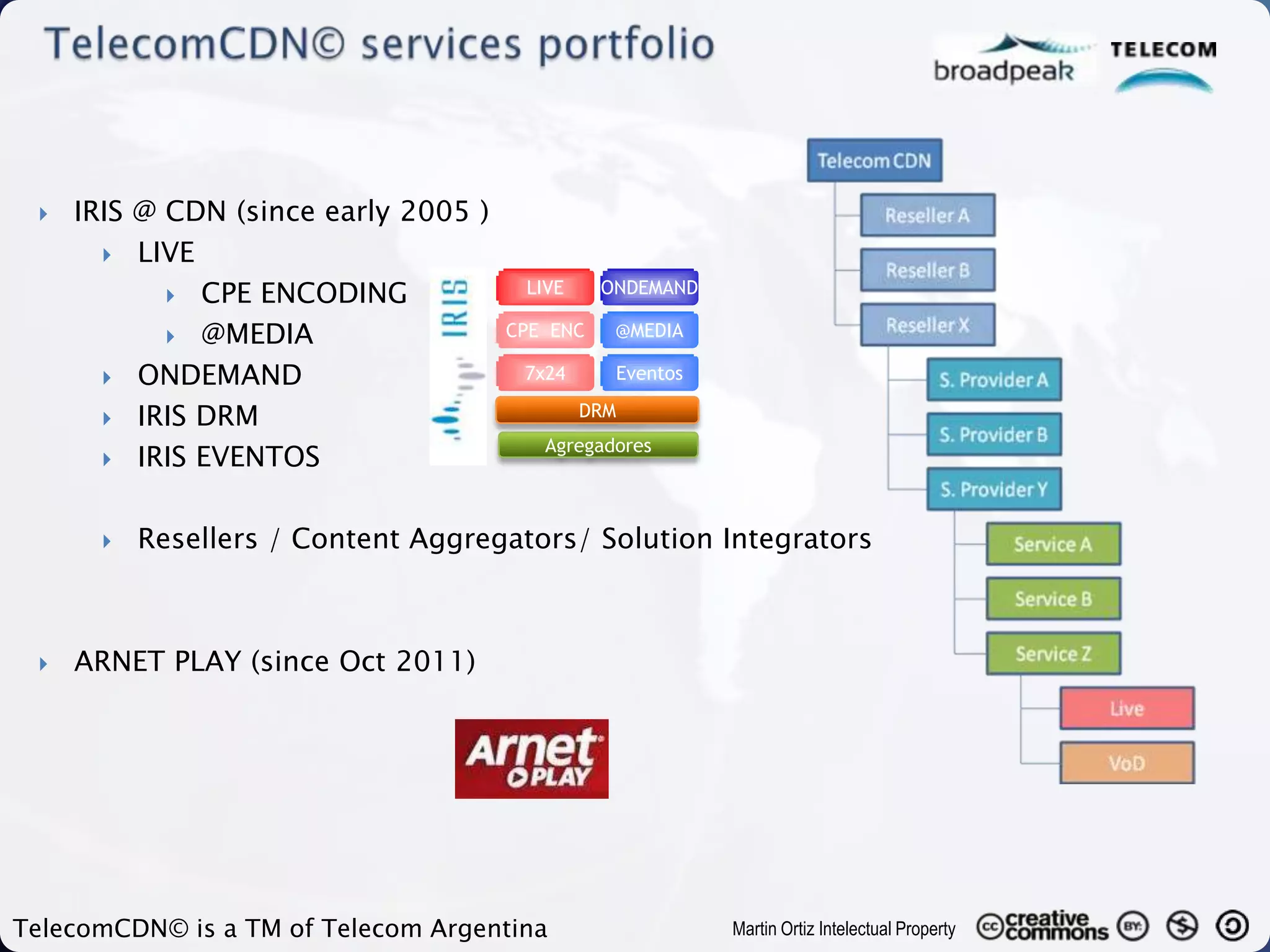

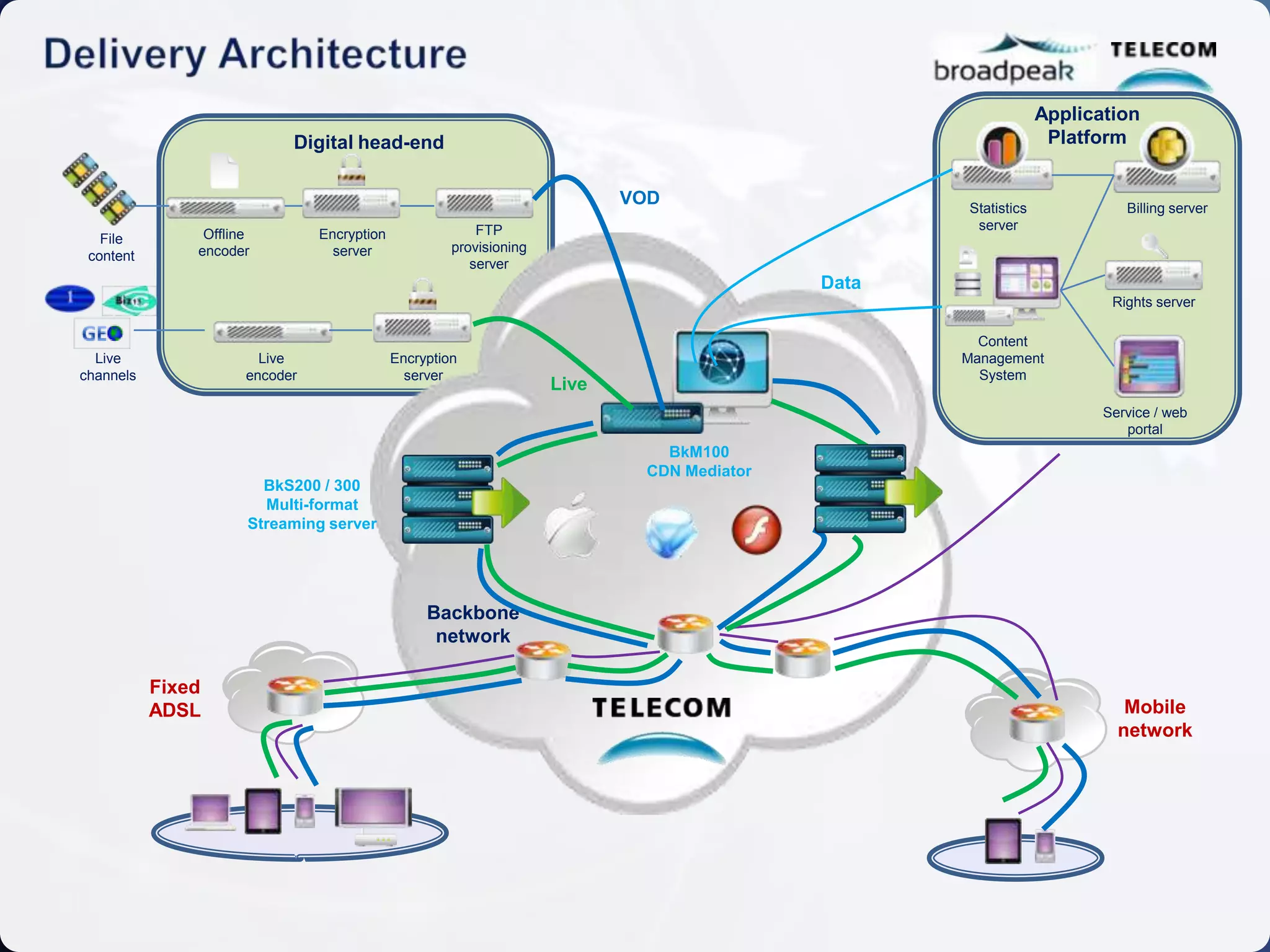

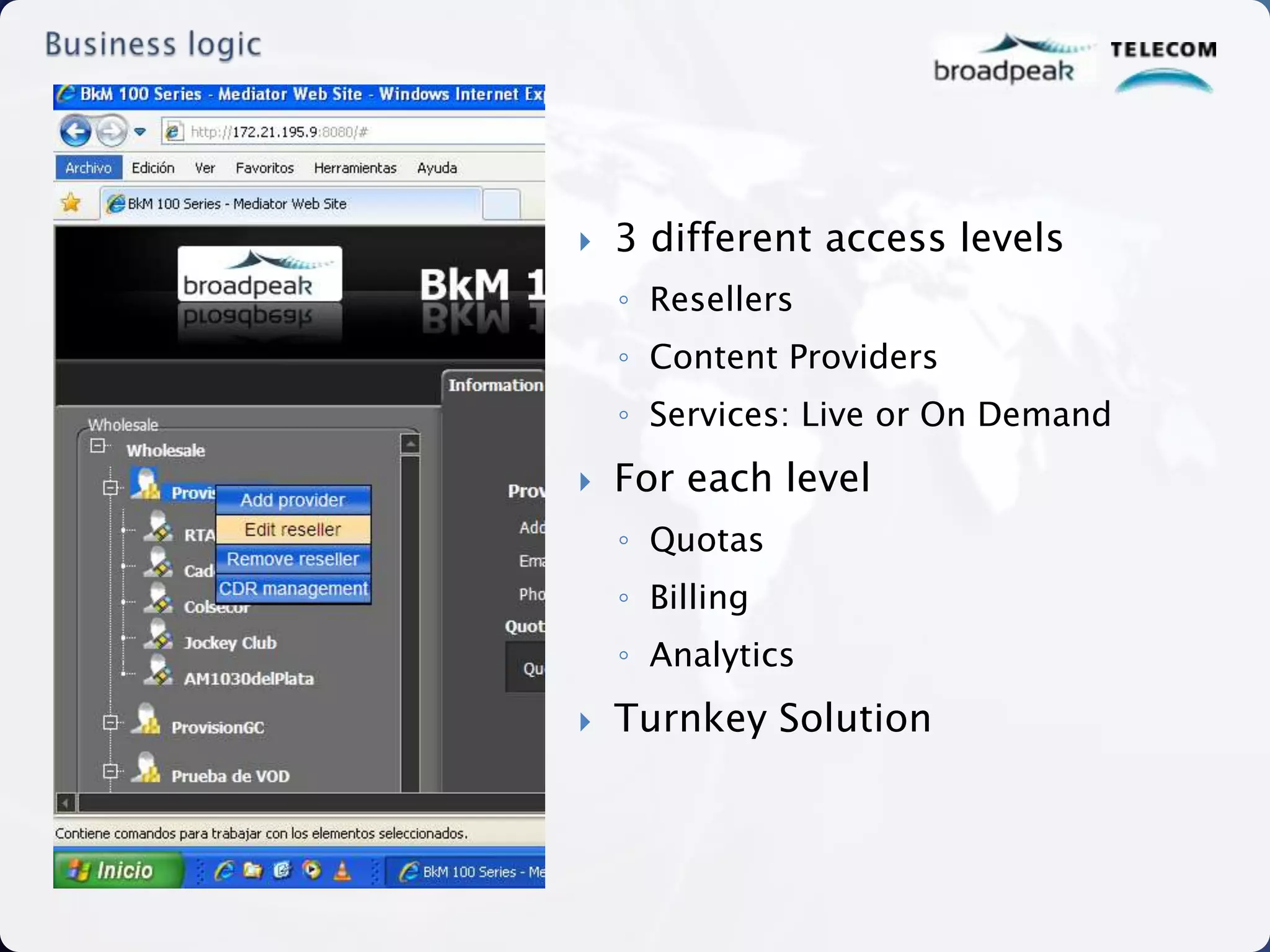

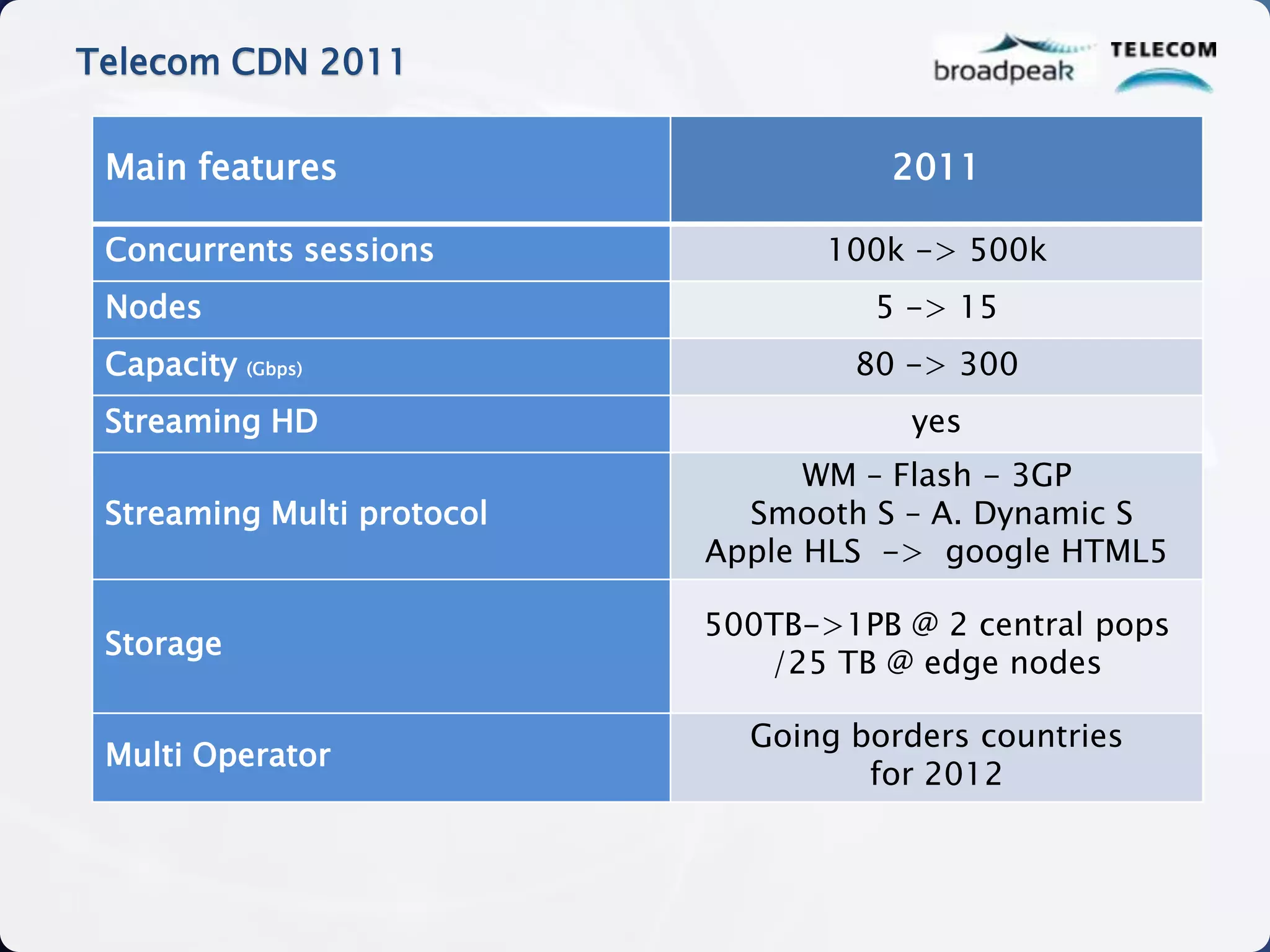

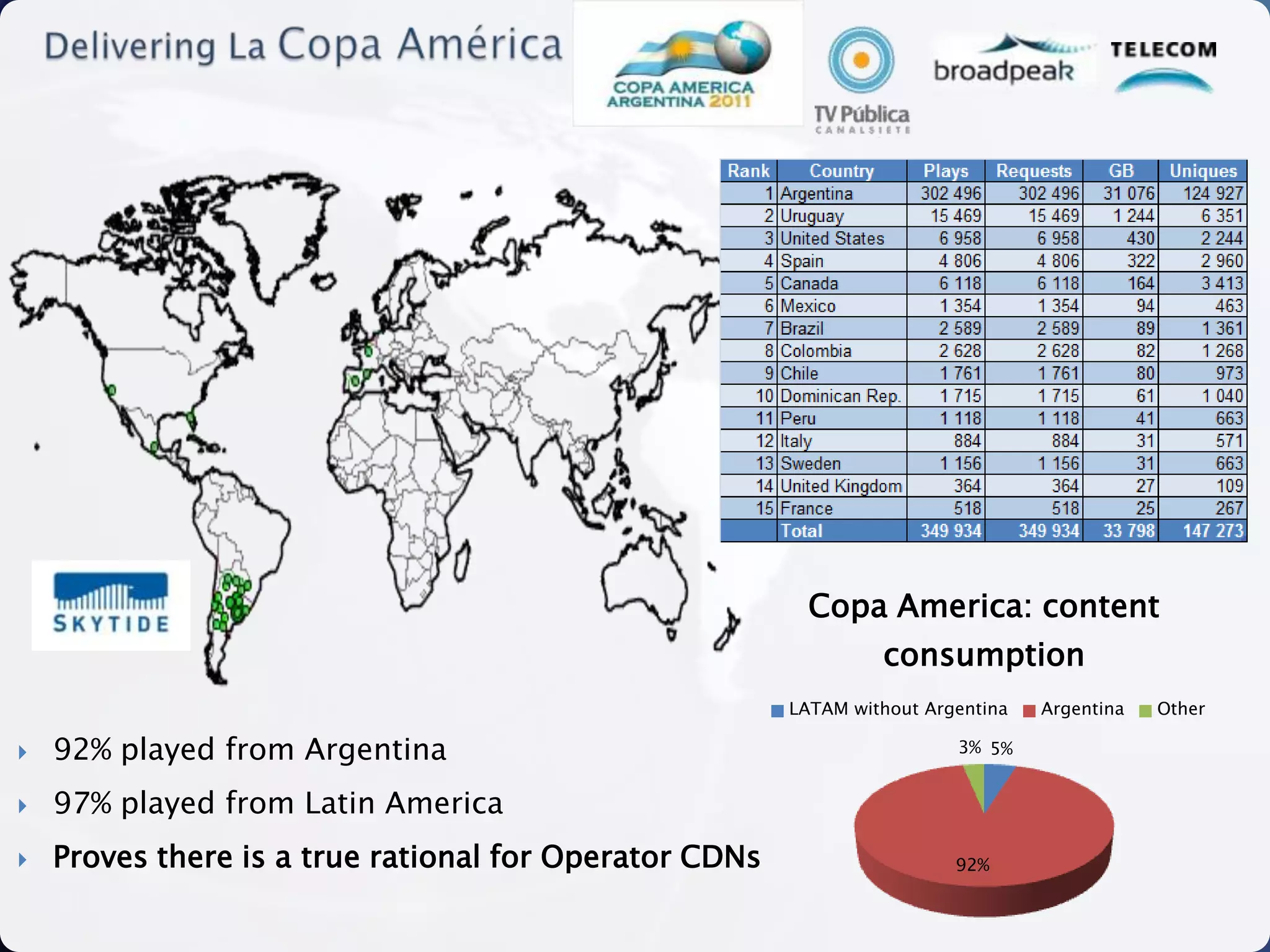

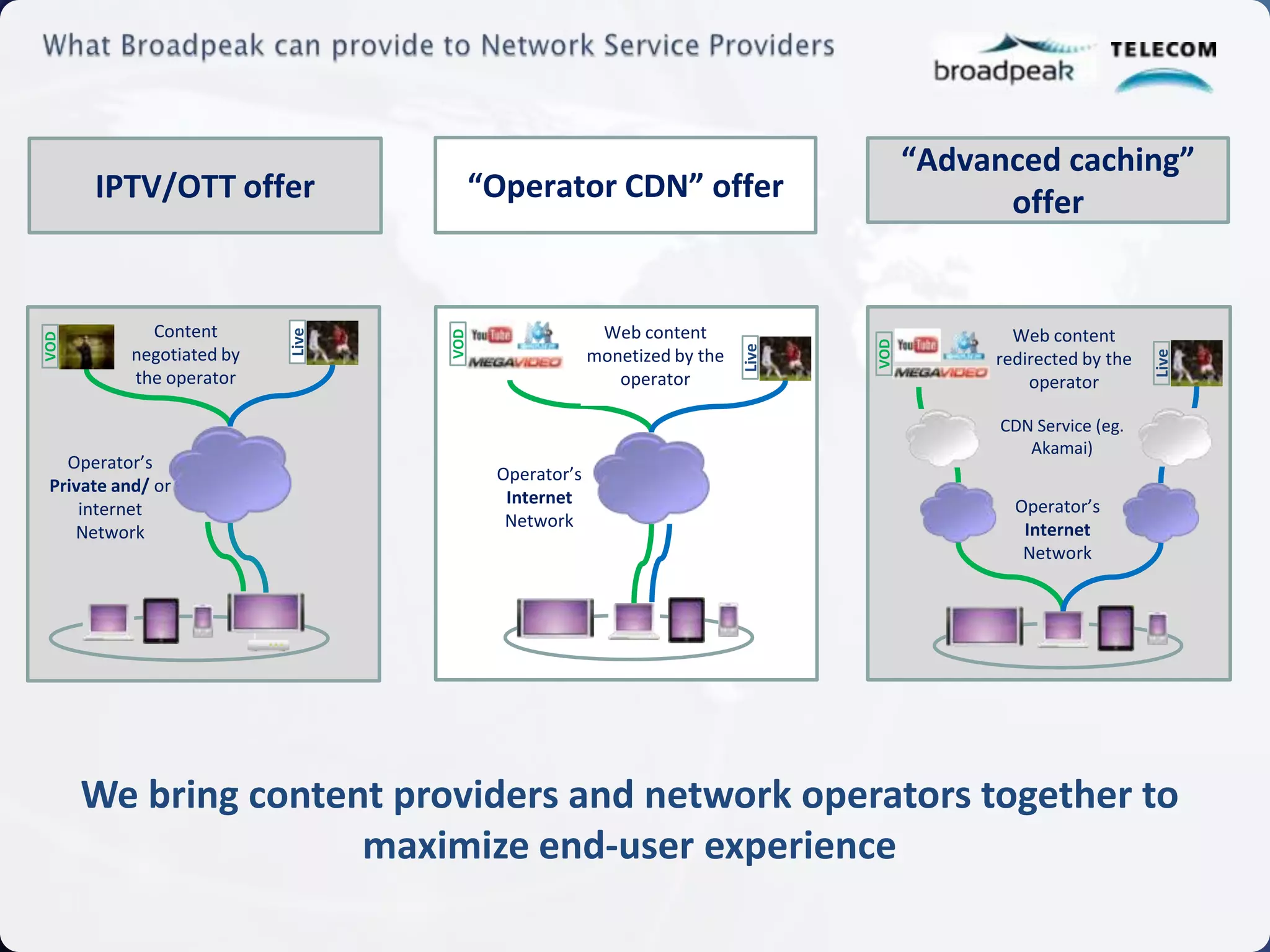

The document discusses the competitive landscape and infrastructure challenges in the broadband and content delivery network (CDN) sectors in Argentina and Latin America. It highlights growth targets for internet capacity, multimedia usage, and scalability, emphasizing the need for improved resources and business models. The importance of collaboration between content providers and network operators to enhance the end-user experience is also noted.