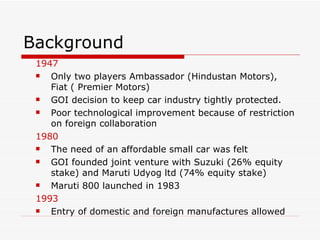

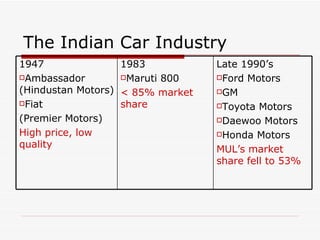

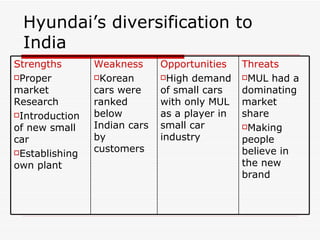

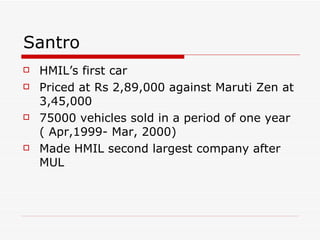

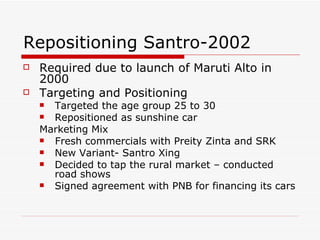

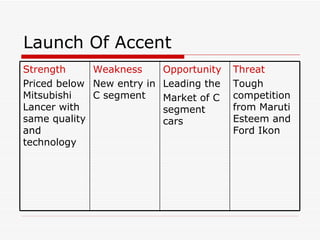

Hyundai entered the Indian car market in 1996 by establishing a manufacturing plant in Chennai and launching its first car, the Santro, a small B segment car. The Santro was priced lower than its competitors and sold over 75,000 units in its first year, making Hyundai the second largest carmaker in India behind Maruti Suzuki. Hyundai further diversified its lineup with the launch of the Accent sedan in the C segment. Through focused market research, competitive pricing, and celebrity endorsements in advertising, Hyundai was able to successfully position itself in the Indian market and differentiate its vehicles from other brands. Hyundai has continued expanding its presence in India with newer models across different