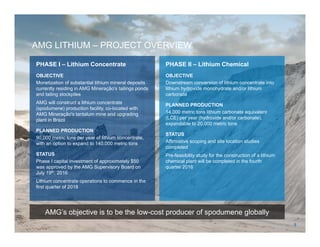

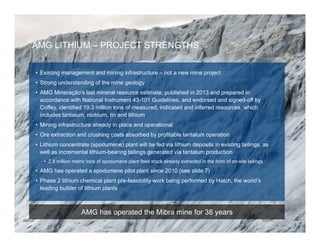

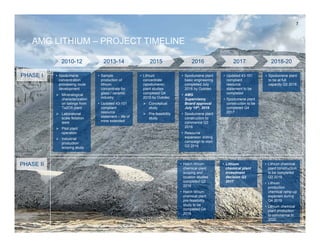

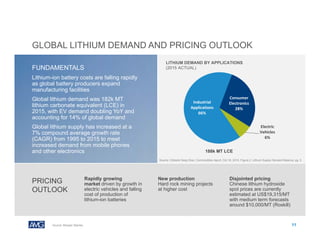

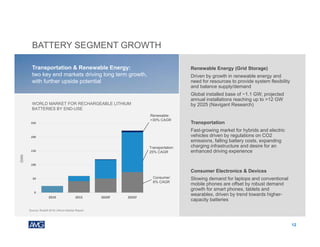

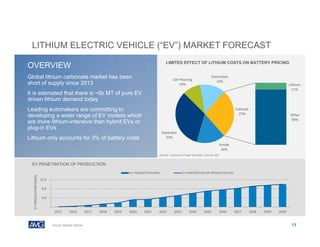

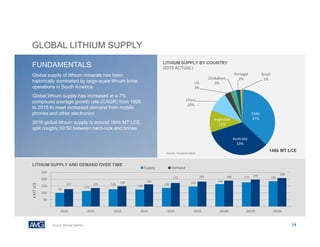

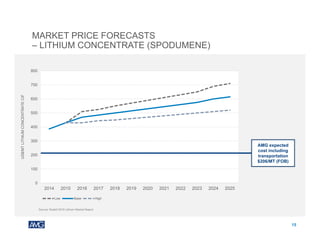

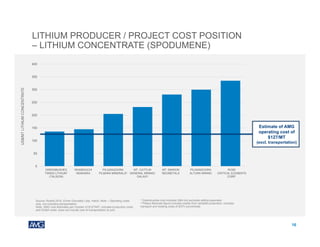

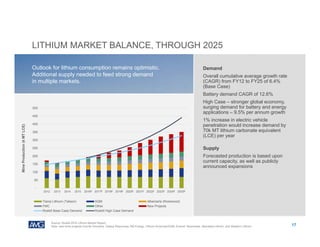

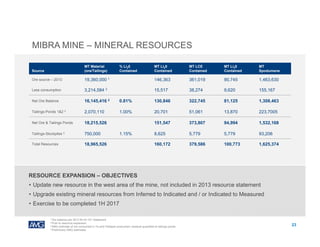

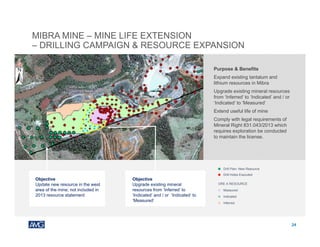

AMG is developing a lithium project at its existing Mibra mine in Brazil, which has operated for 38 years producing tantalum. Phase I will produce 90,000 metric tons per year of lithium concentrate from tailings at the mine. Phase II will further process the concentrate into 14,000 metric tons per year of lithium chemical products. AMG sees the project as leveraging its existing mining infrastructure and experience to become a low-cost lithium producer. Rapidly growing demand for lithium from electric vehicles and energy storage is expected to support increased lithium prices in the coming years.