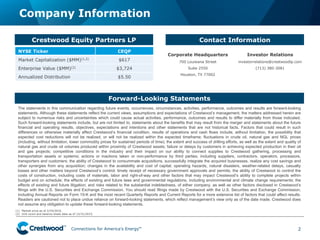

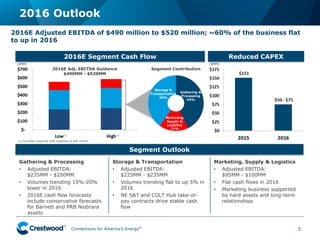

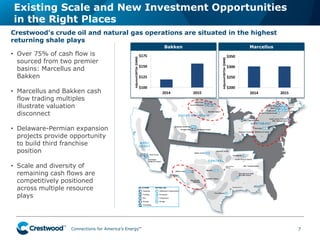

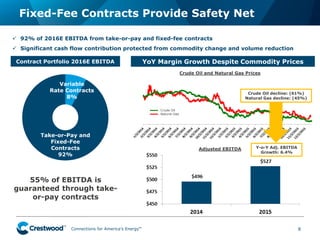

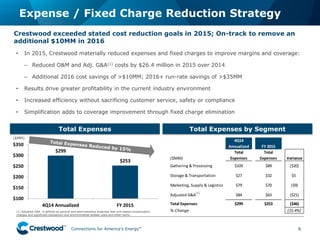

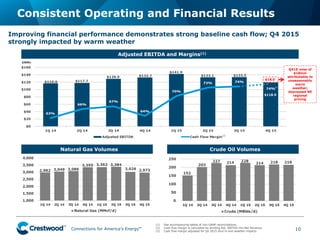

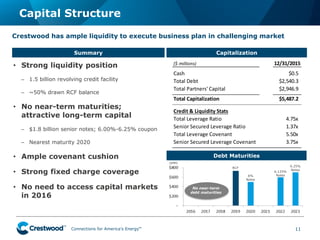

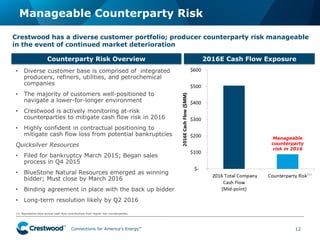

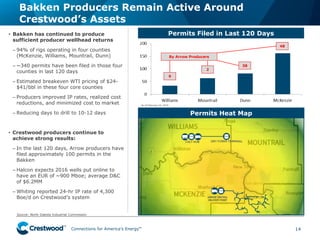

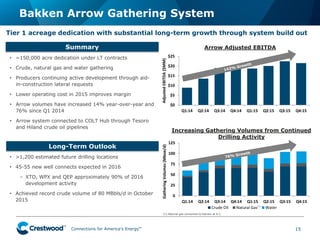

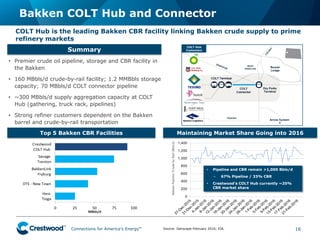

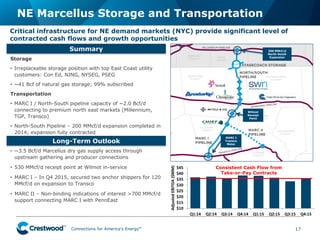

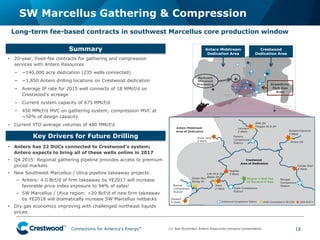

This document provides an overview of Crestwood Midstream Partners LP and Crestwood Equity Partners LP. It discusses the company's 2016 outlook, key investor highlights, cost cutting measures, capital structure, core operations in the Bakken shale play, and its COLT Hub facility. The presentation aims to position Crestwood favorably in the current challenging energy market environment through stable cash flow, high contract coverage, expense reductions, and operations in top producing regions.