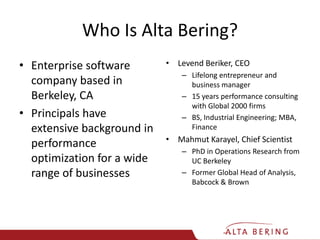

Alta Bering is an enterprise software company that provides a product called Enterprise Performance Optimization (EPO) to improve return on capital through more efficient allocation of resources. EPO analyzes performance data using optimization algorithms to identify how each business unit can maximize returns. This is done through an easy-to-use interface and aims to reduce planning time from months to days. EPO has proven successful across industries in applications like optimizing bank operations, pharmaceutical sales, and grocery store performance.