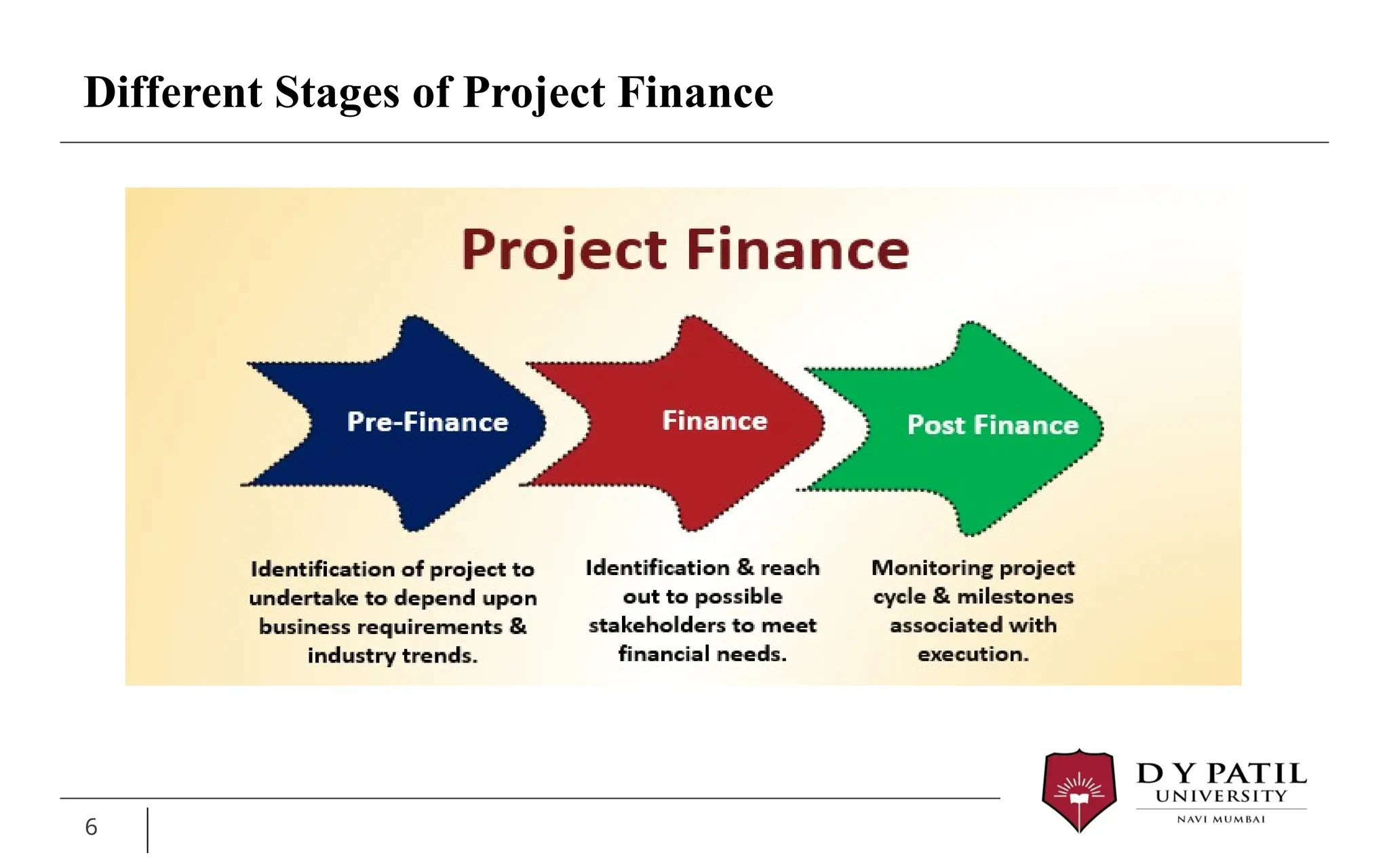

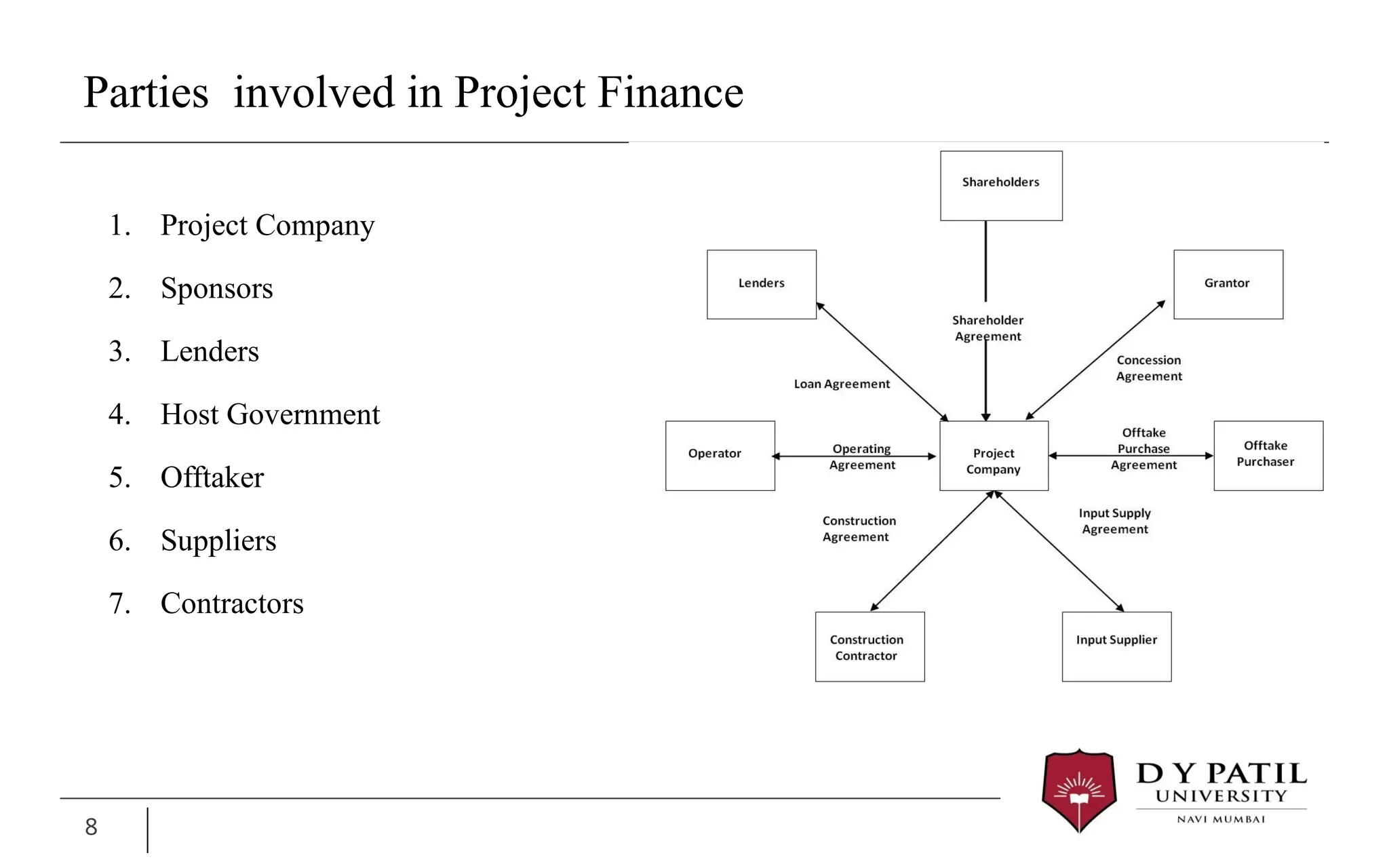

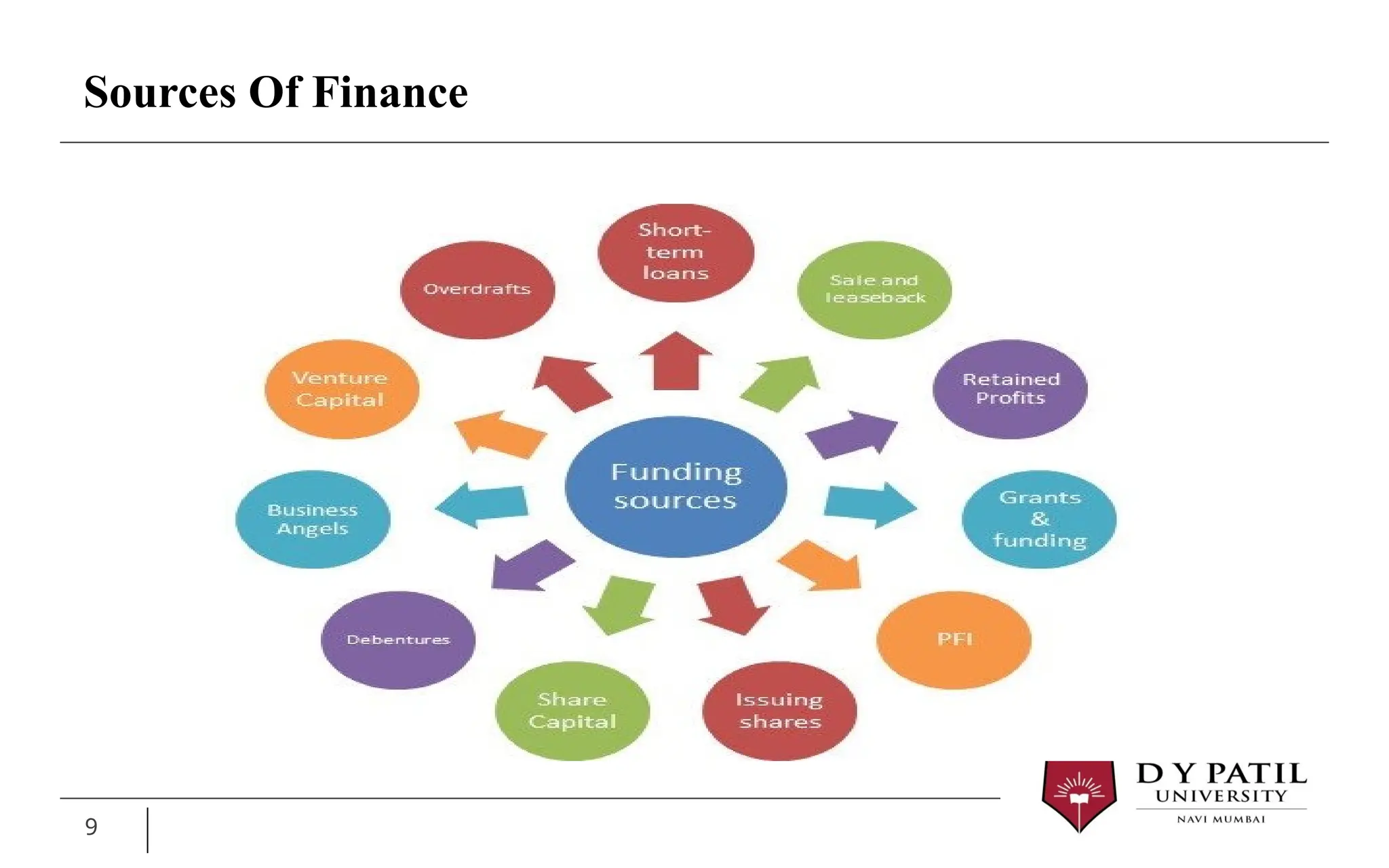

The document discusses the concept of a project, defining it as a temporary and unique endeavor aimed at achieving specific results, and elaborates on project finance, which focuses on financing related to such projects by assessing feasibility and funding needs. It highlights both advantages, such as reduced lender recourse and off-balance sheet financing, and disadvantages, like longer structuring times and higher transaction costs. Additionally, it outlines various sources of finance, including overdrafts, loans, and equity through shares and venture capital.