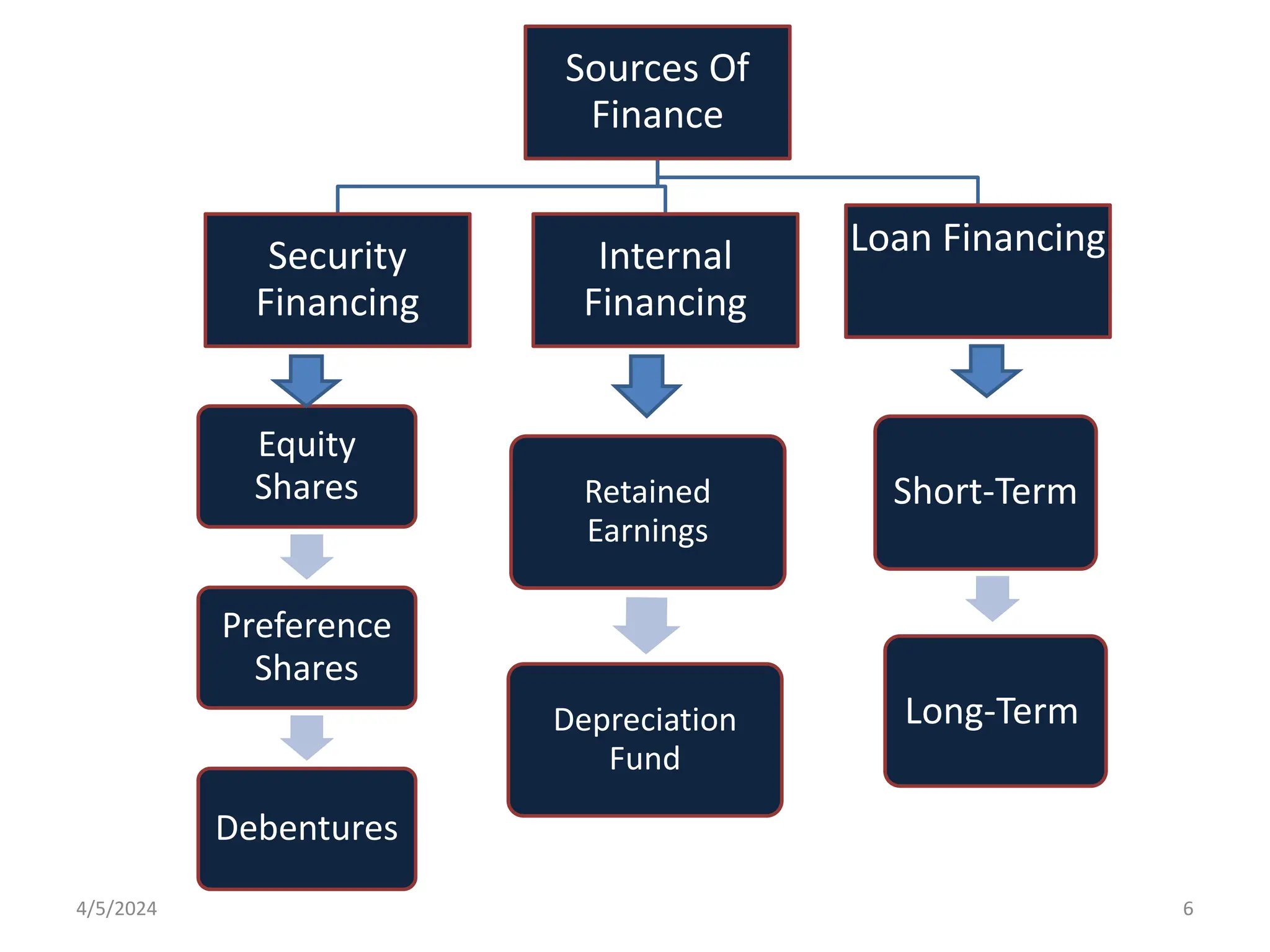

This document discusses different sources of finance available to businesses, including equity shares, preference shares, debentures/bonds, term loans, and internal accruals. It explains the advantages and disadvantages of each source and the factors to consider when choosing a source of finance, such as cost, risk level, and term of funding needed. The chapter provides an overview of financing options for businesses needing capital for starting up, expanding, or other purposes.