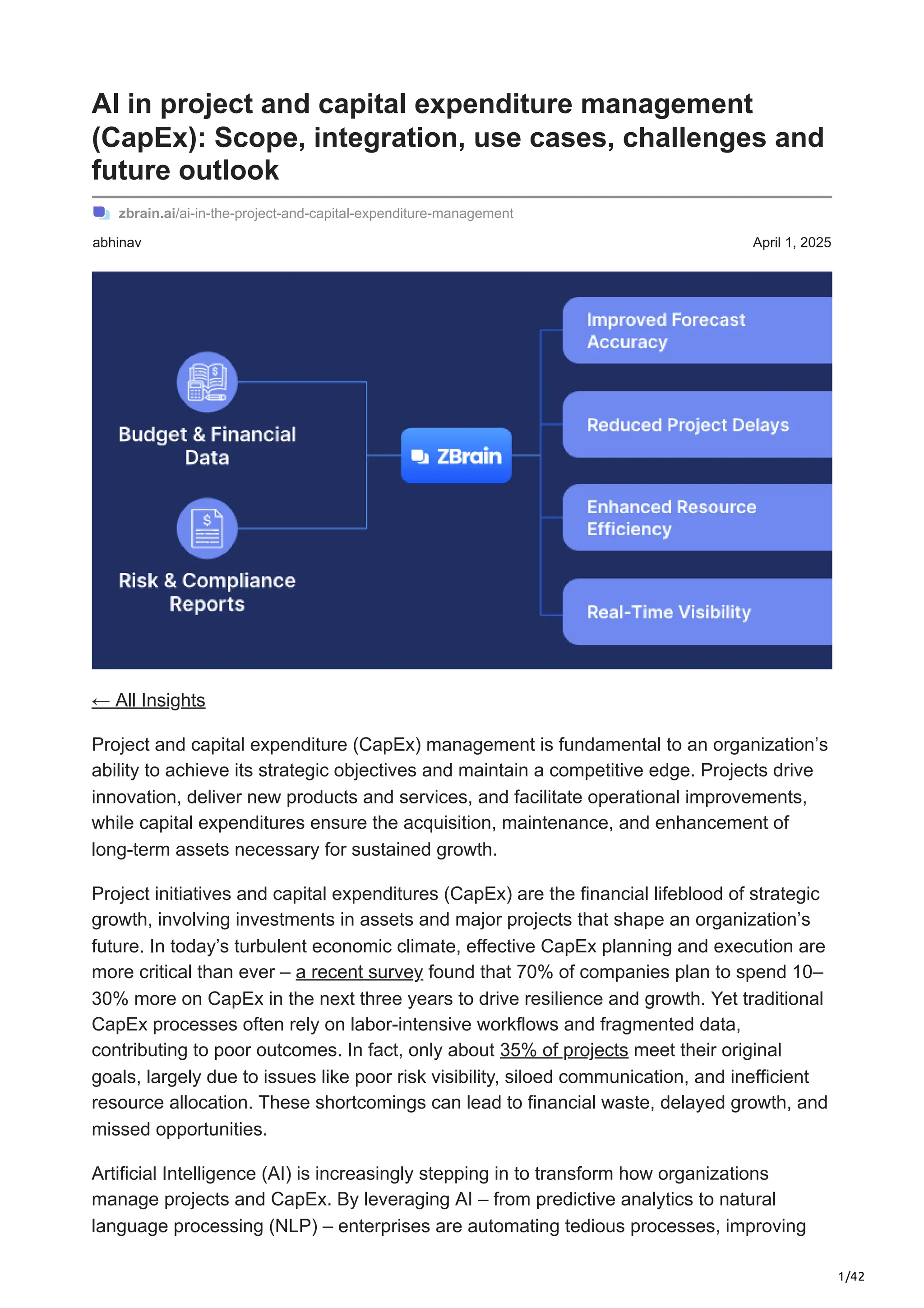

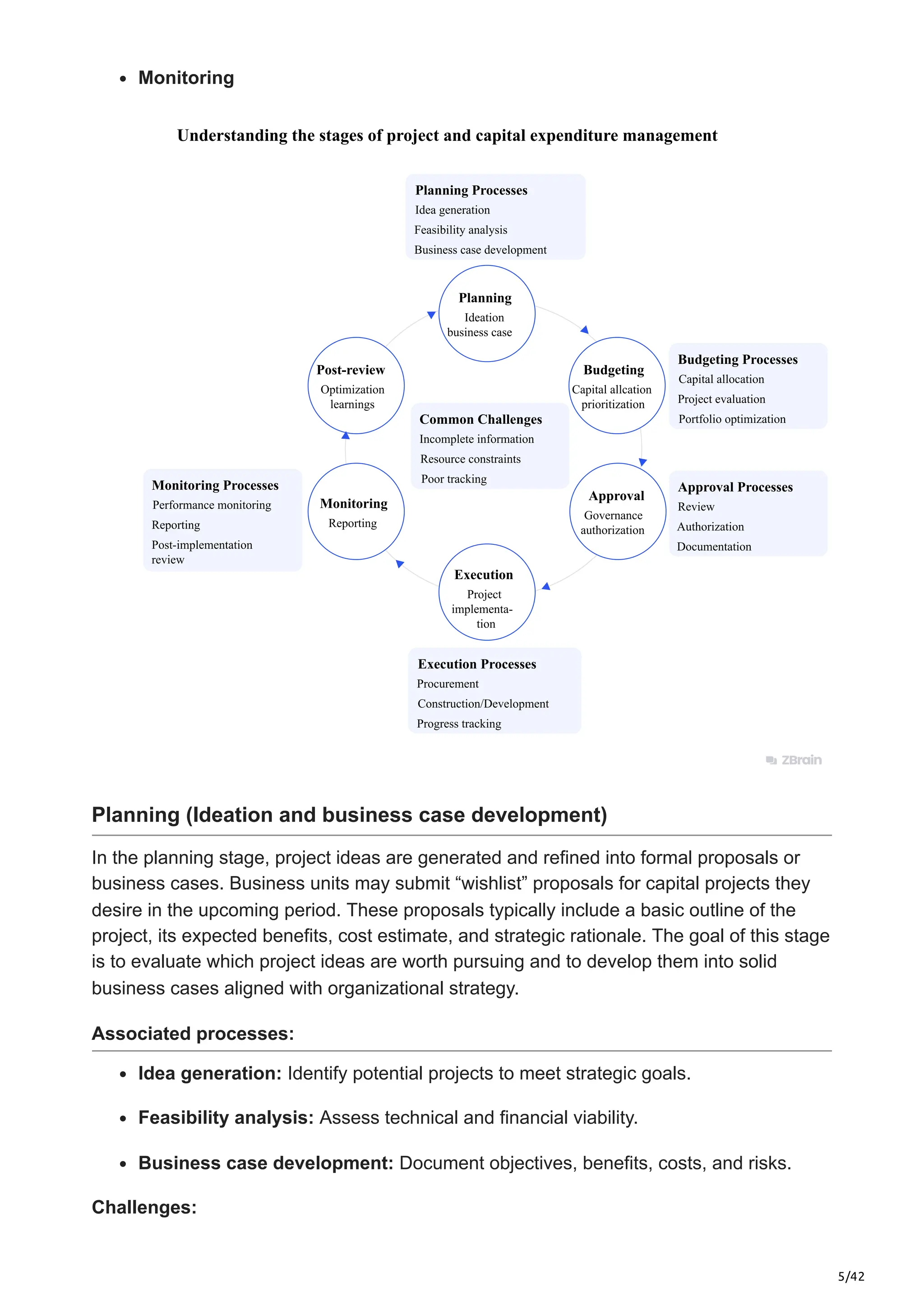

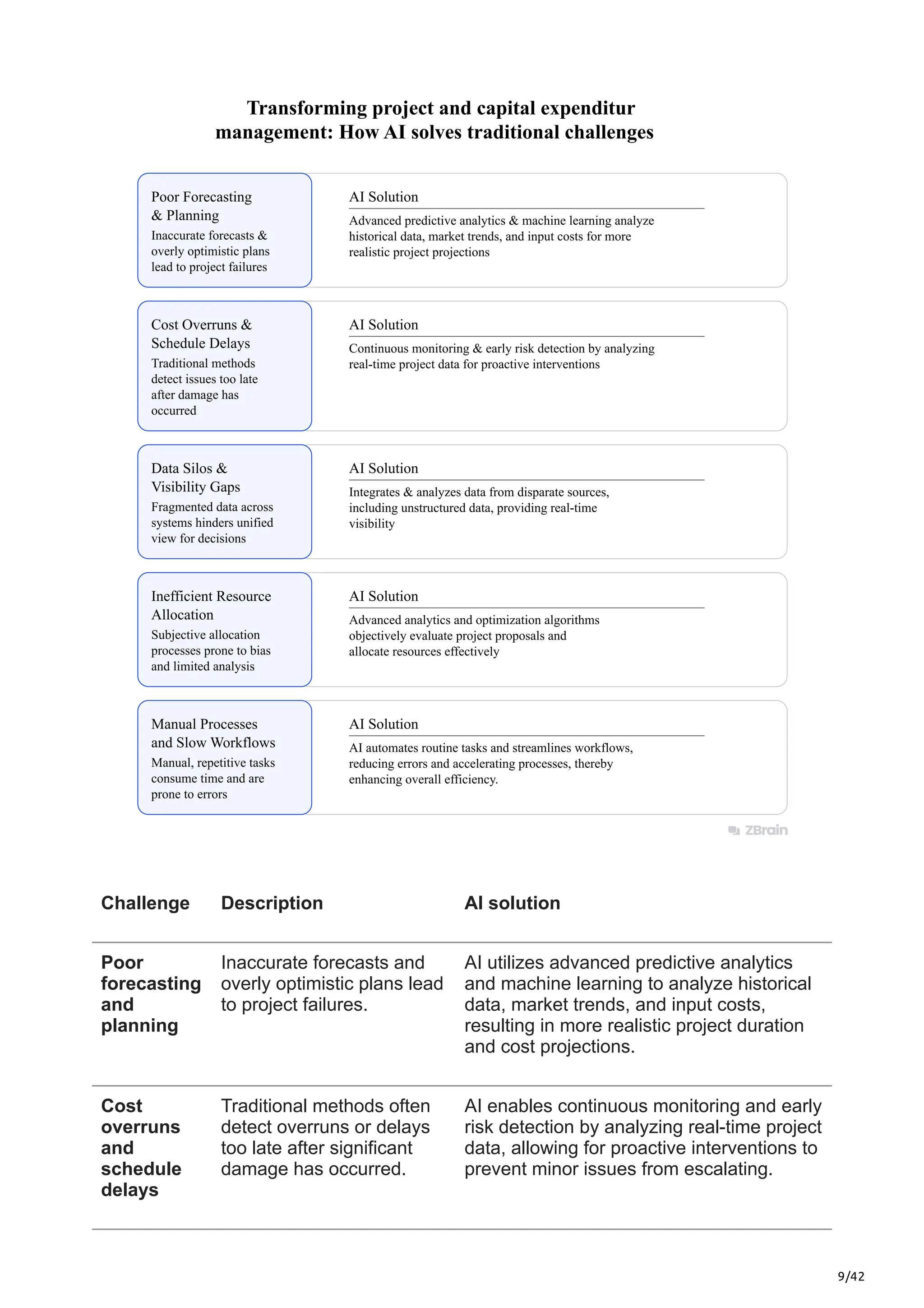

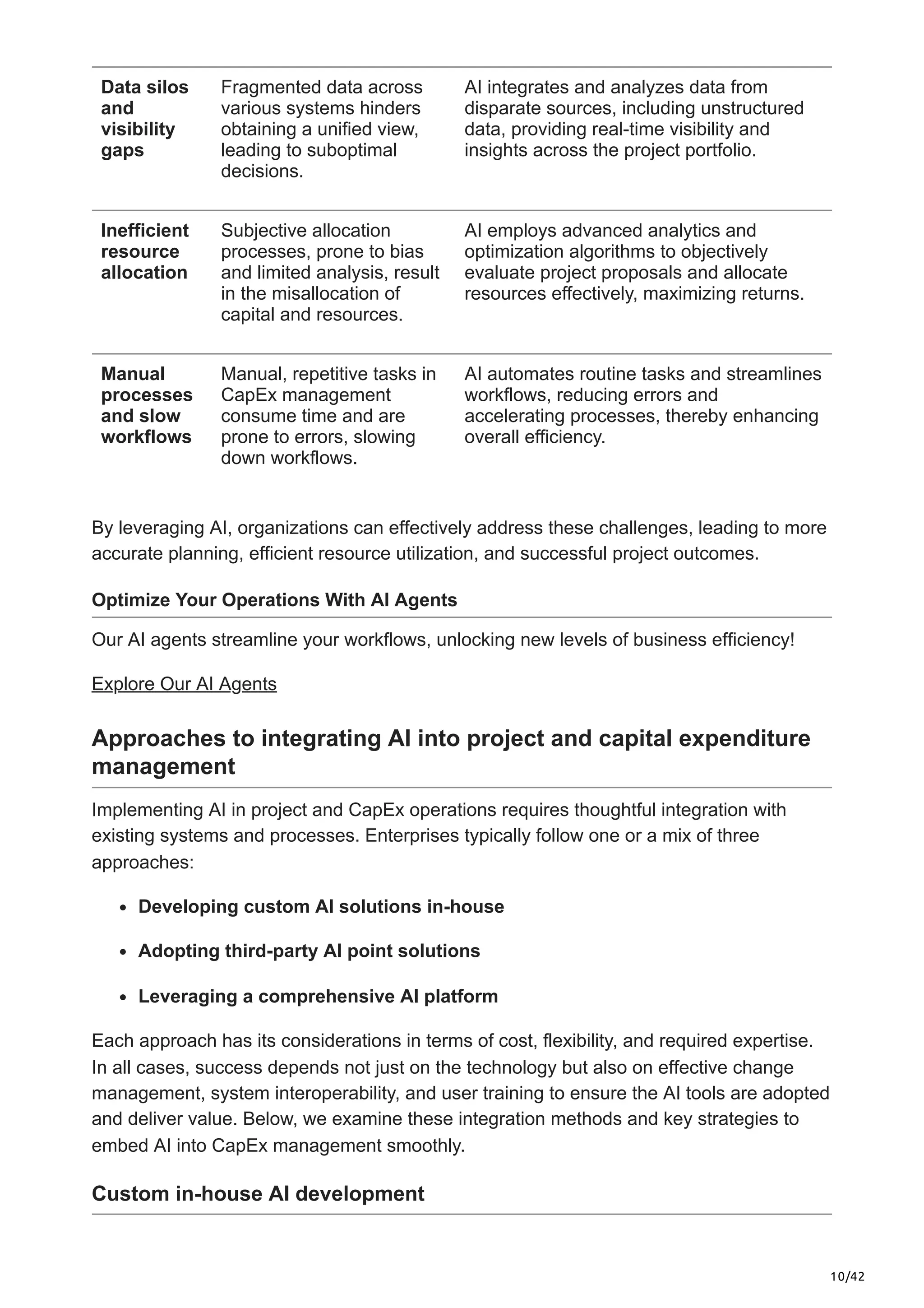

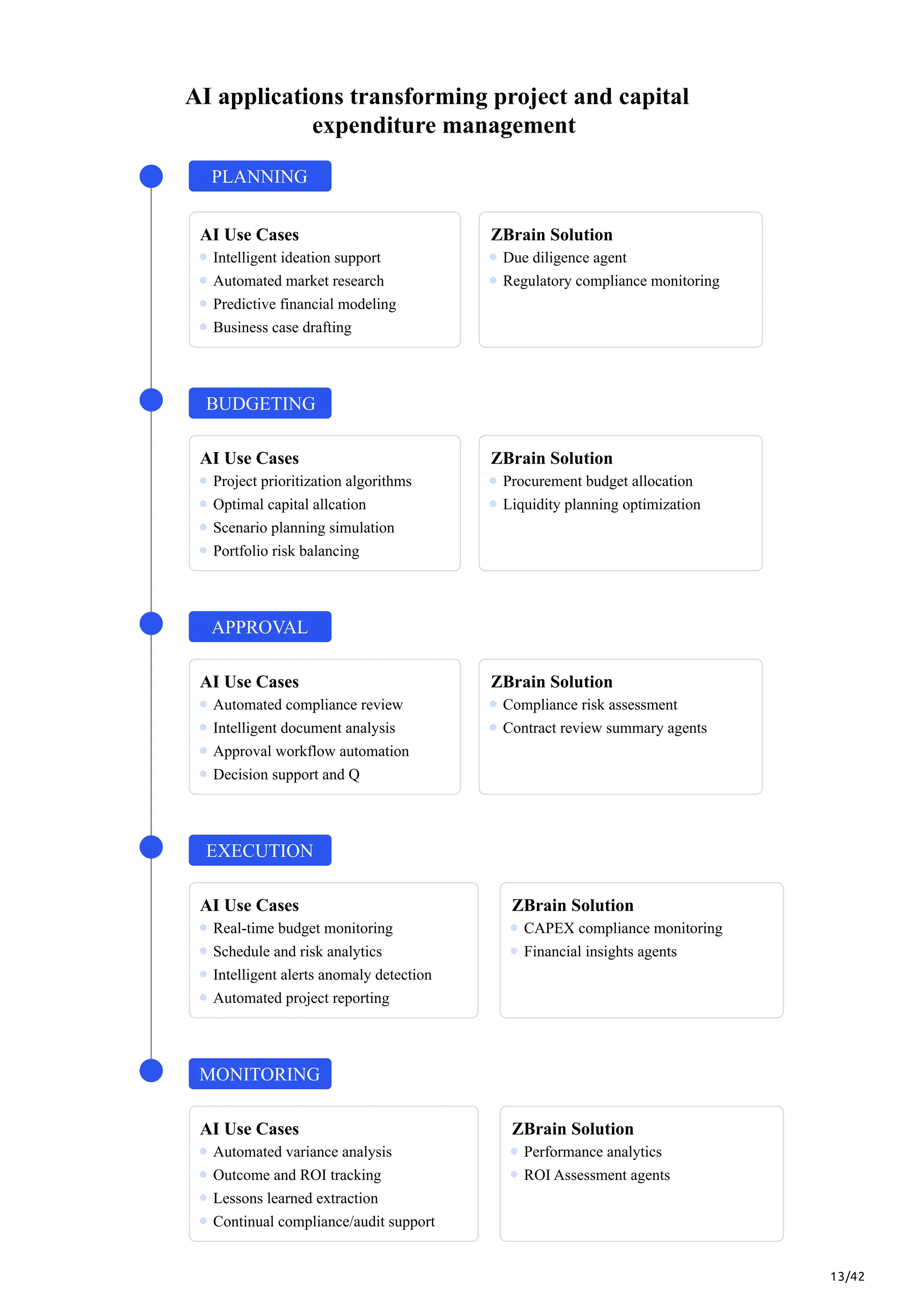

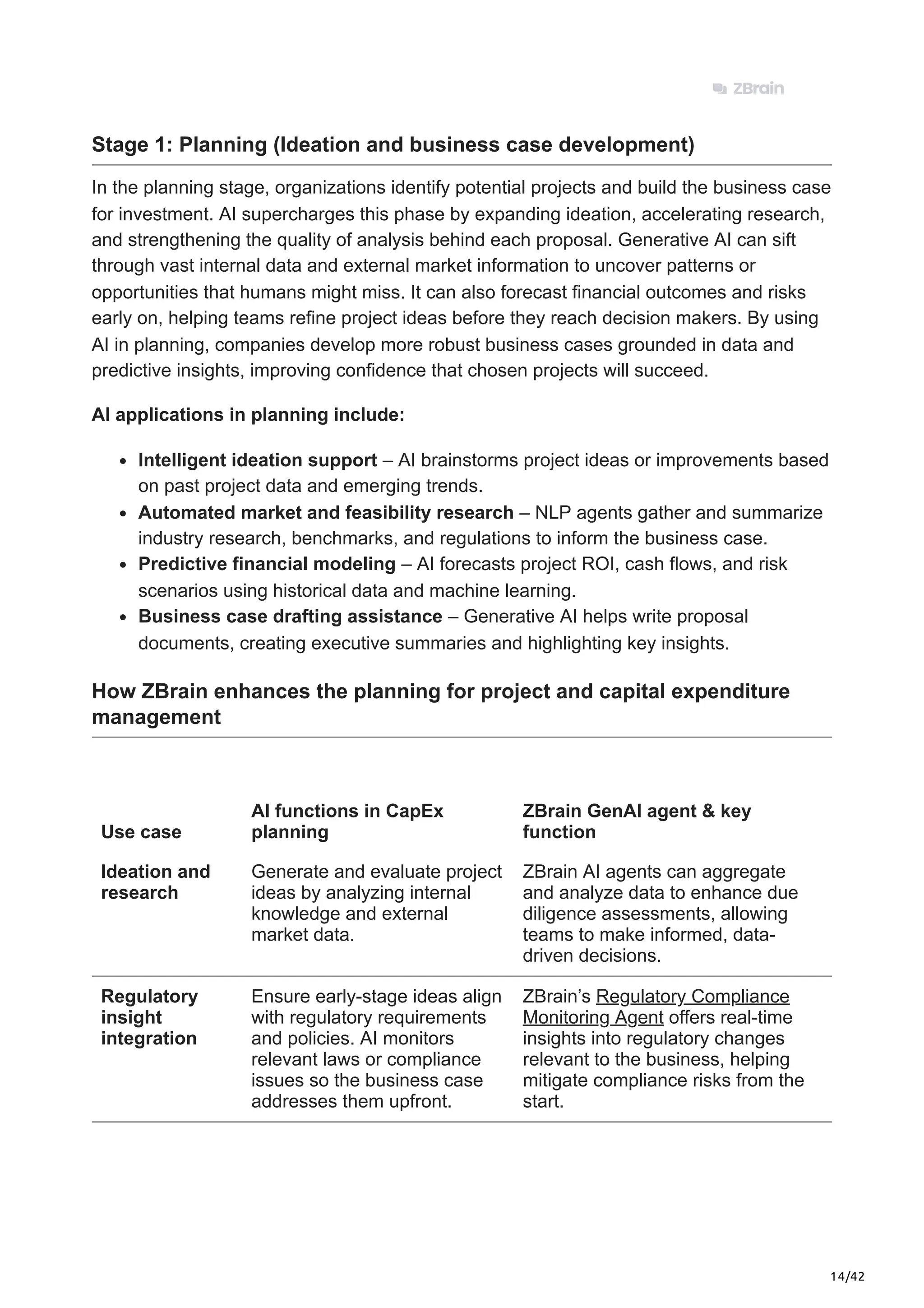

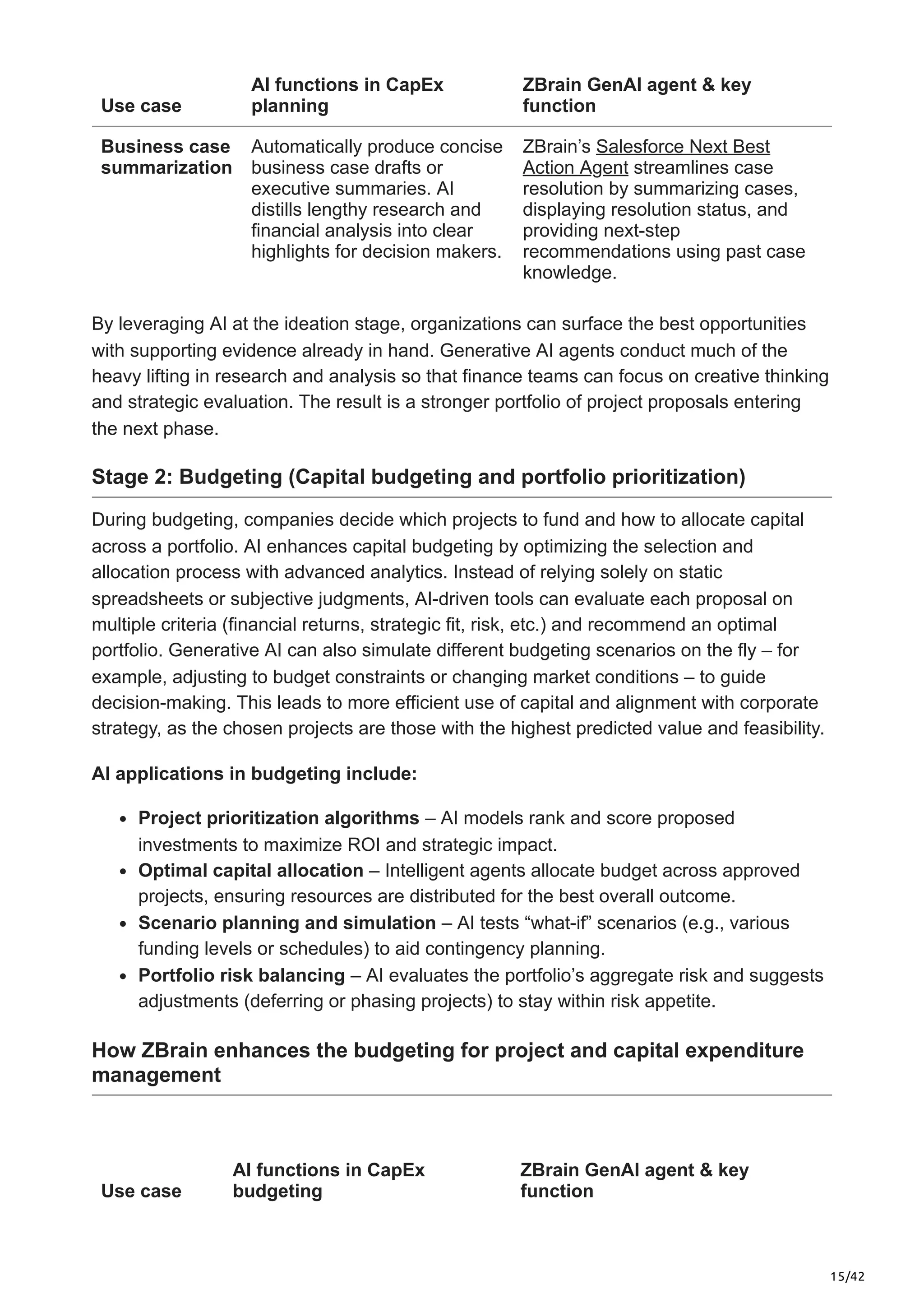

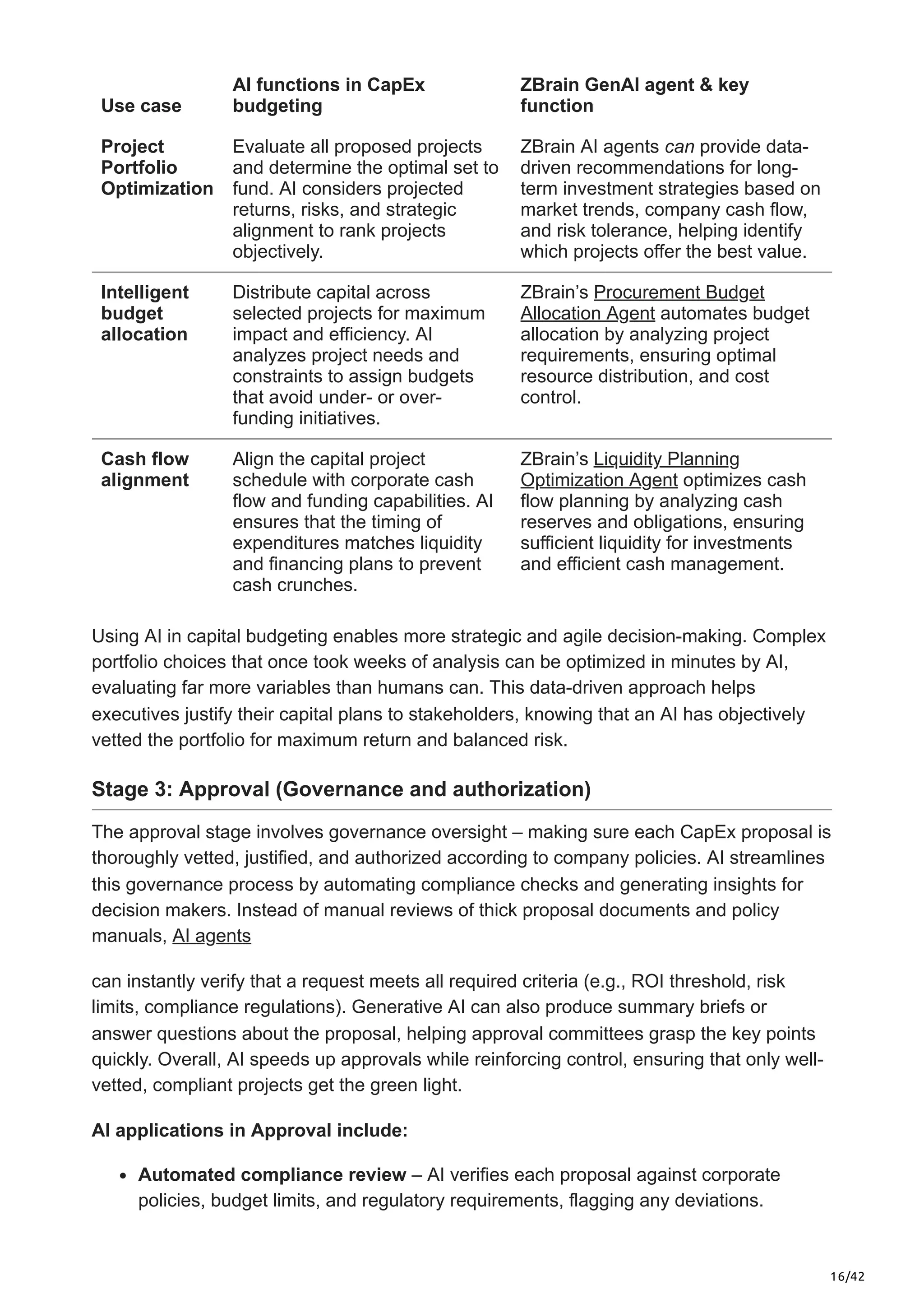

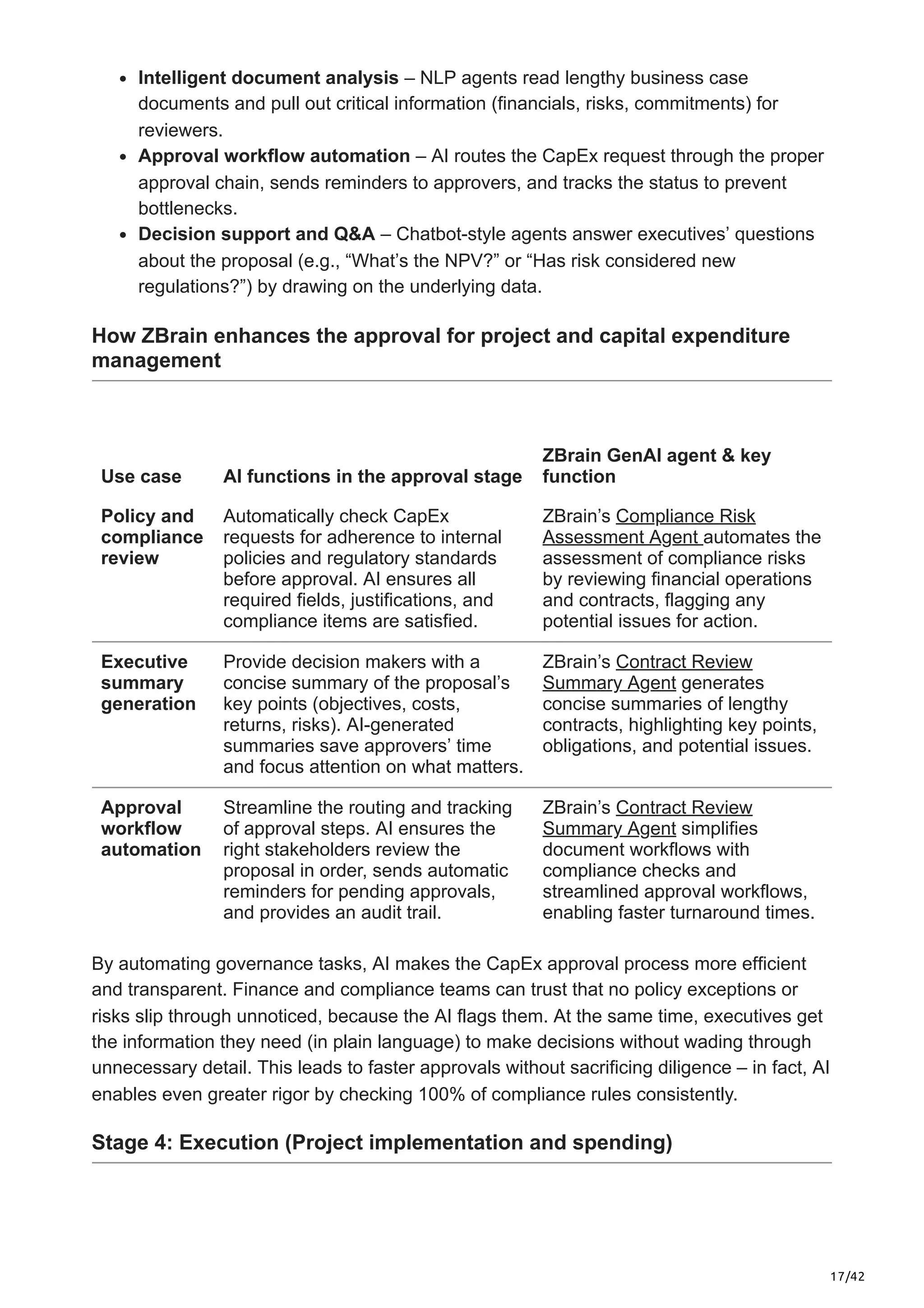

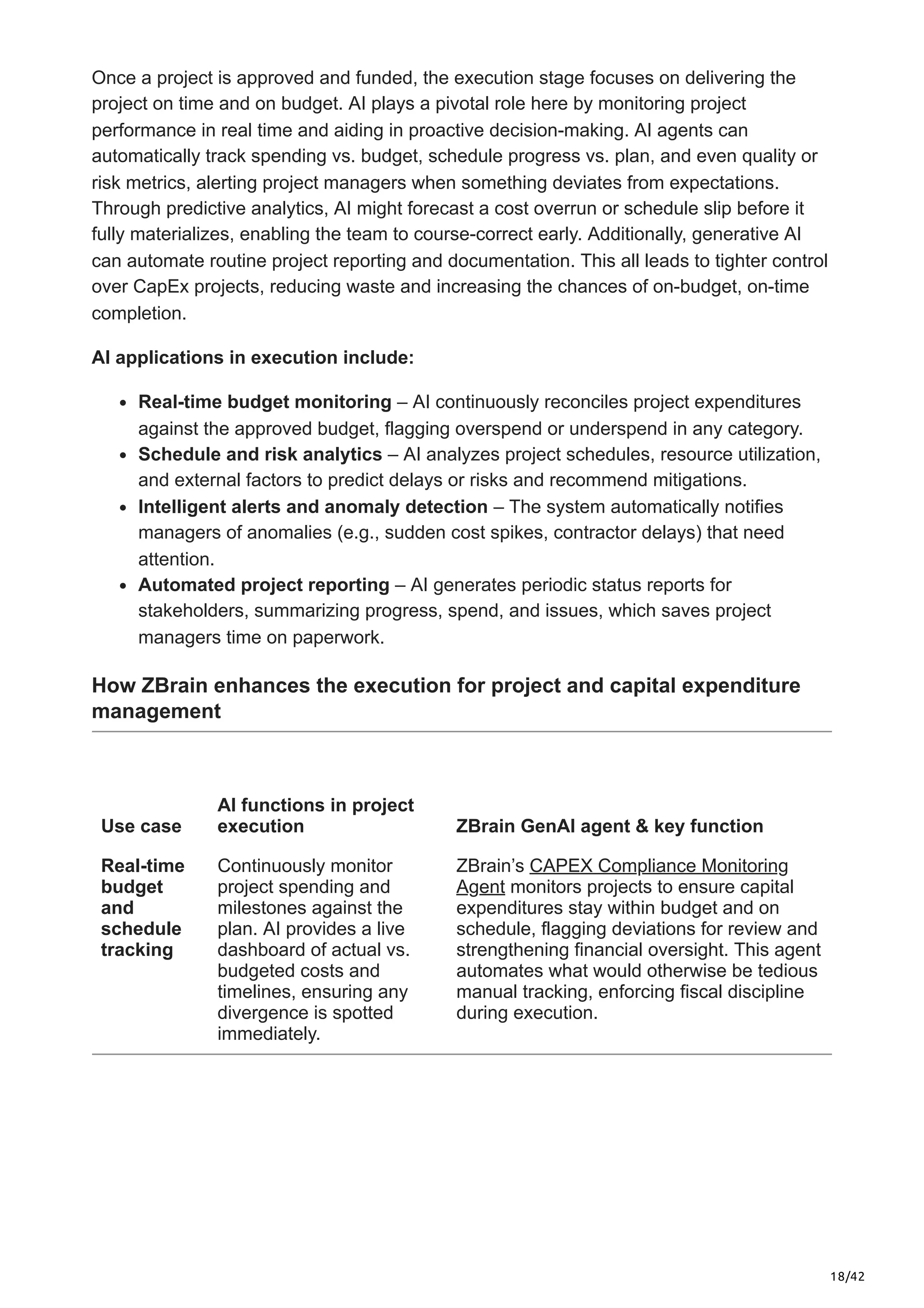

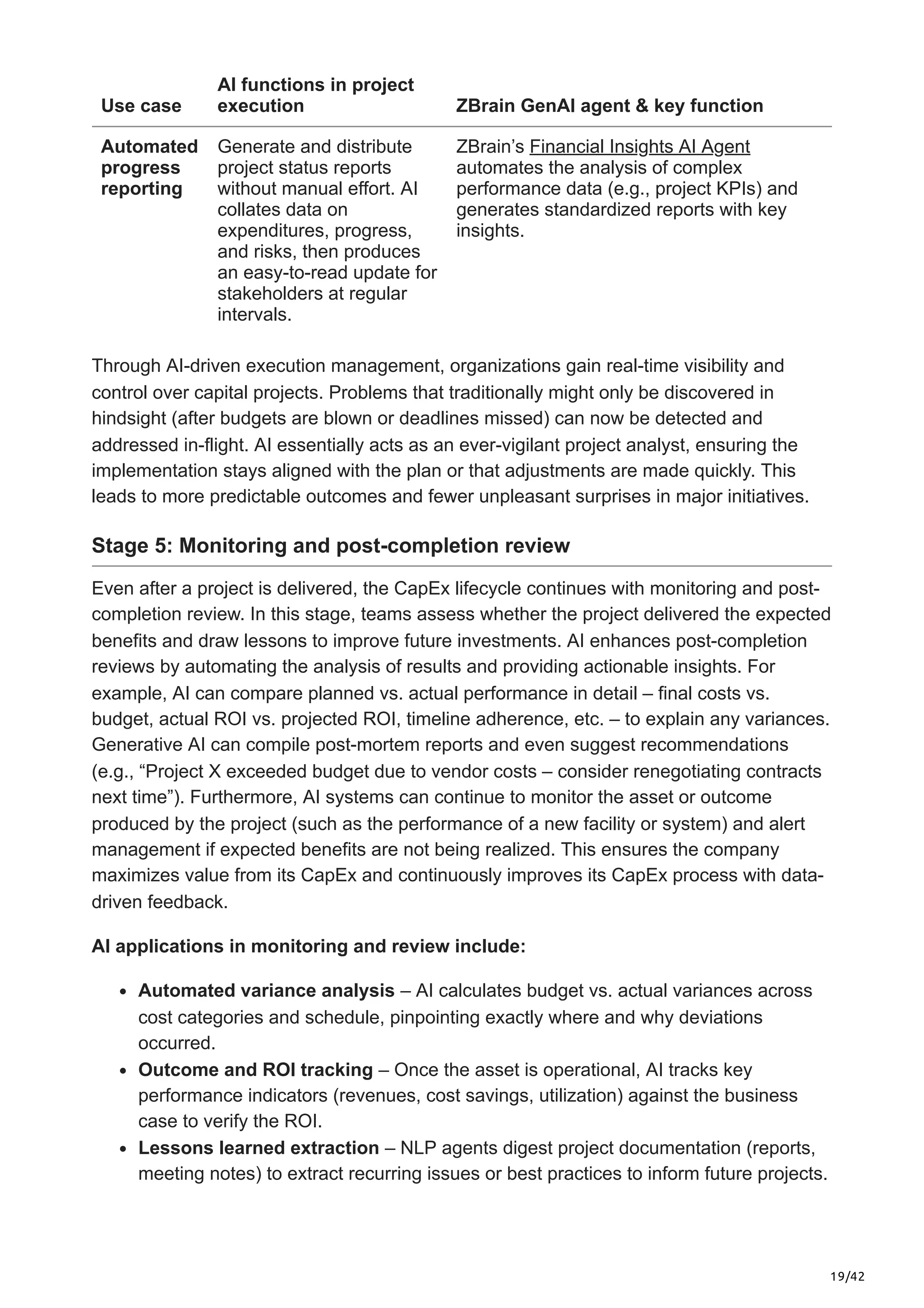

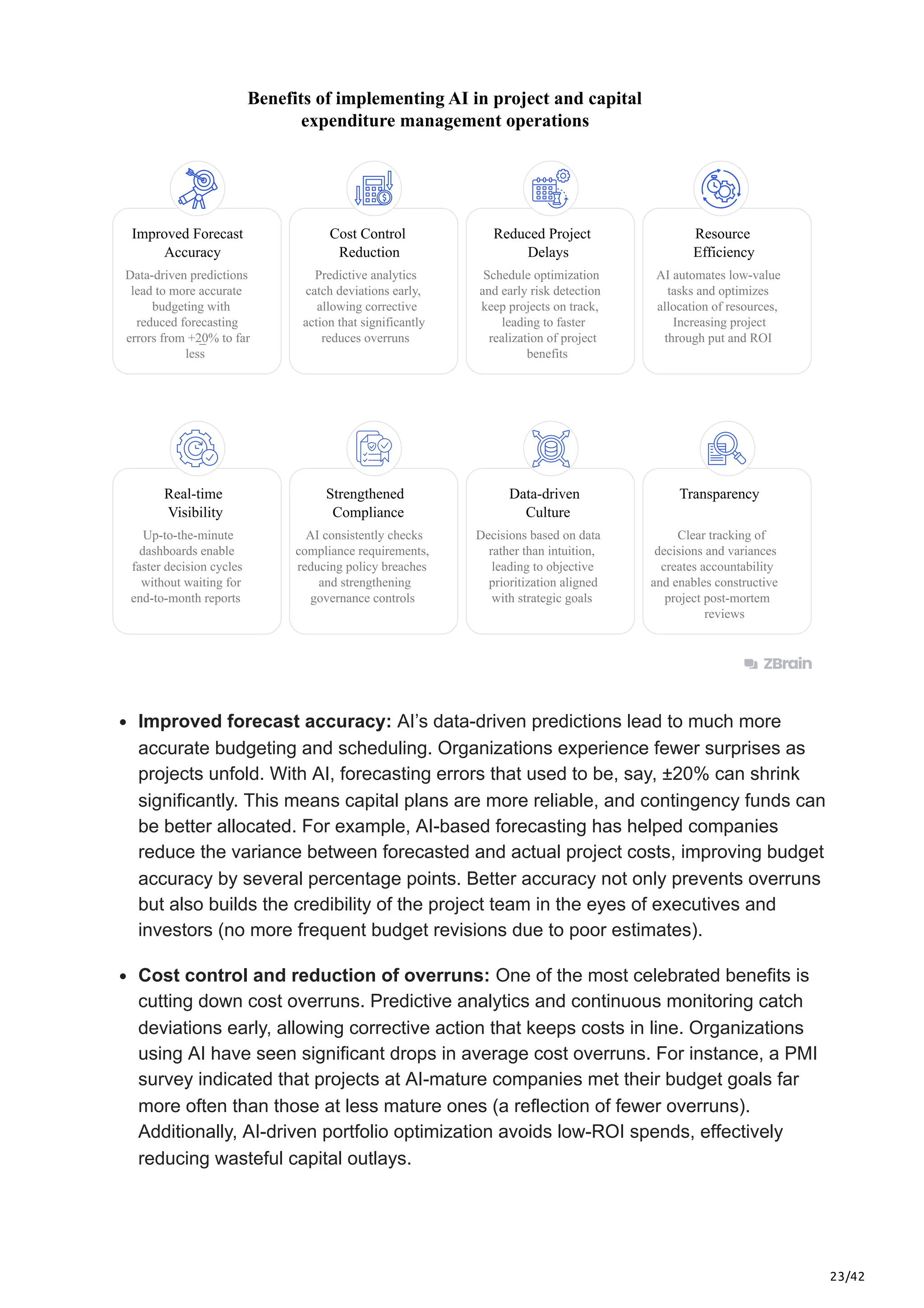

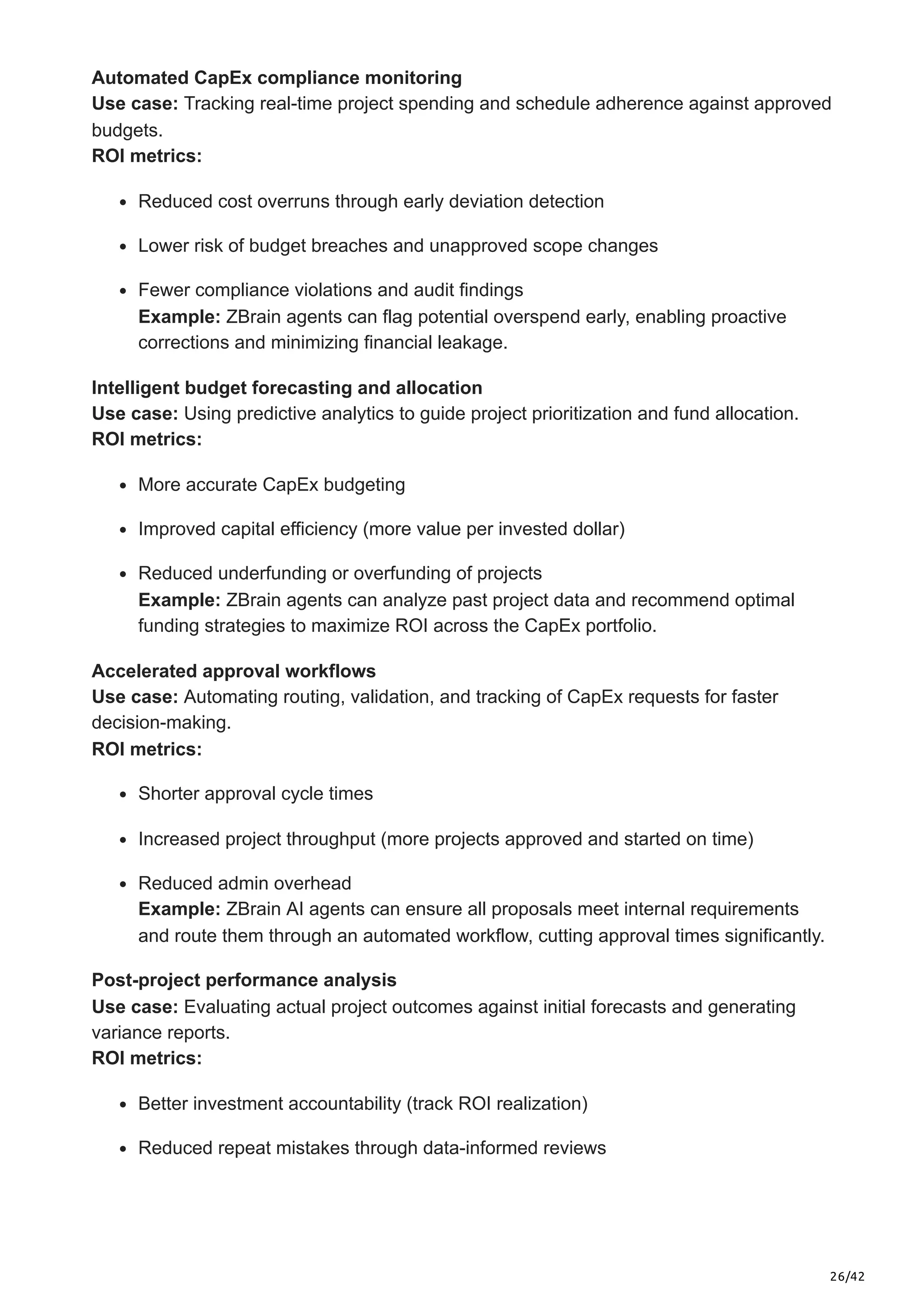

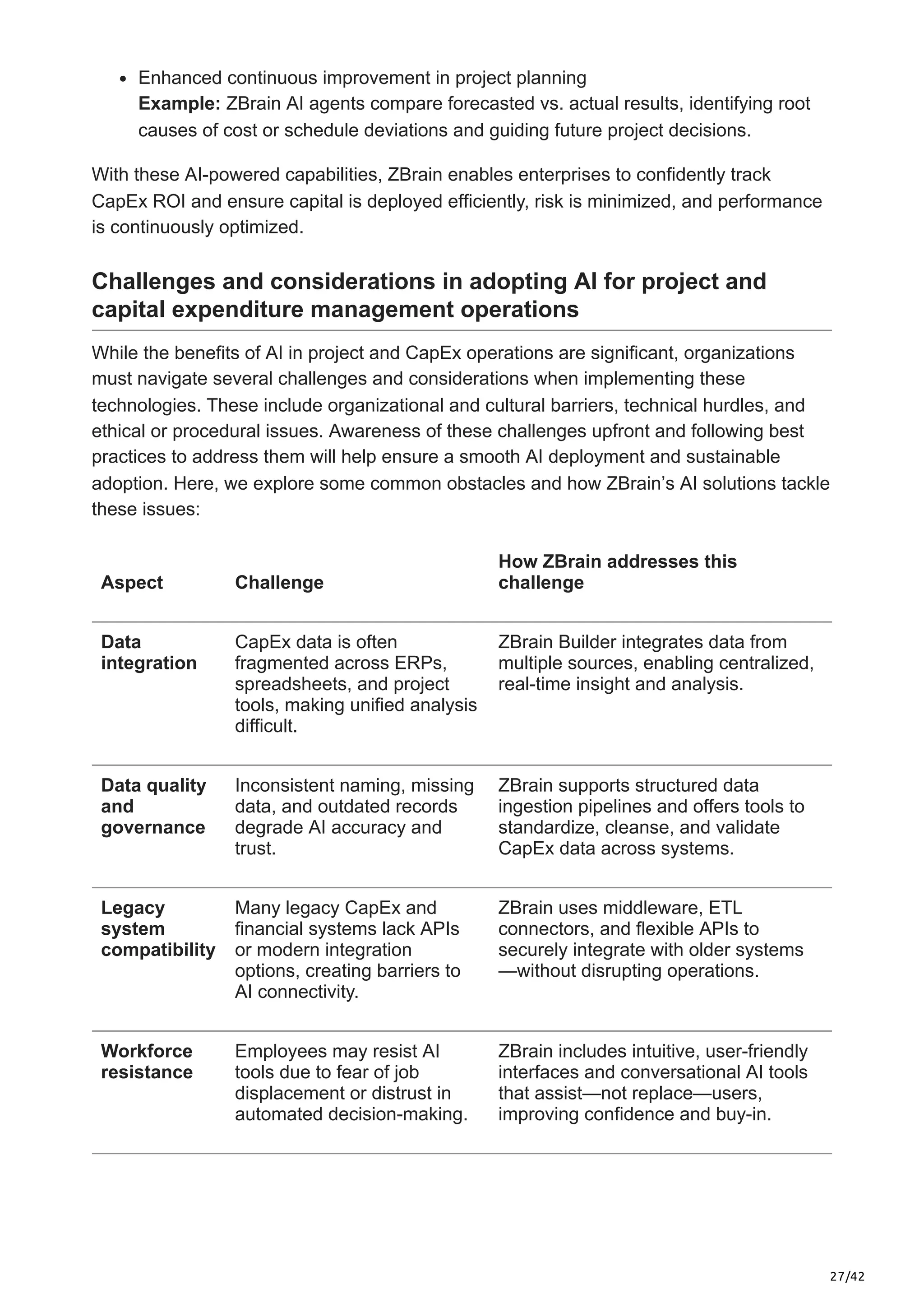

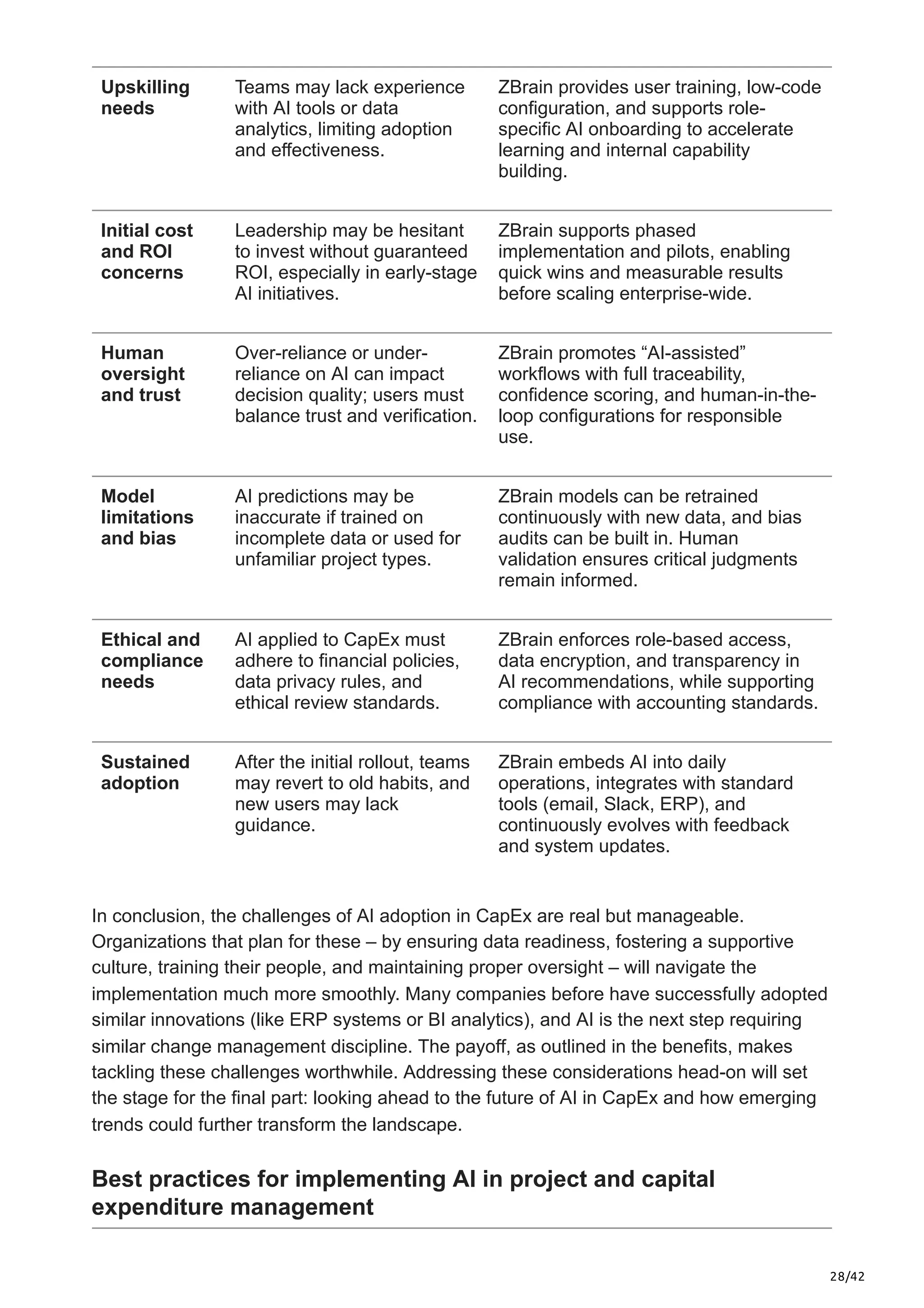

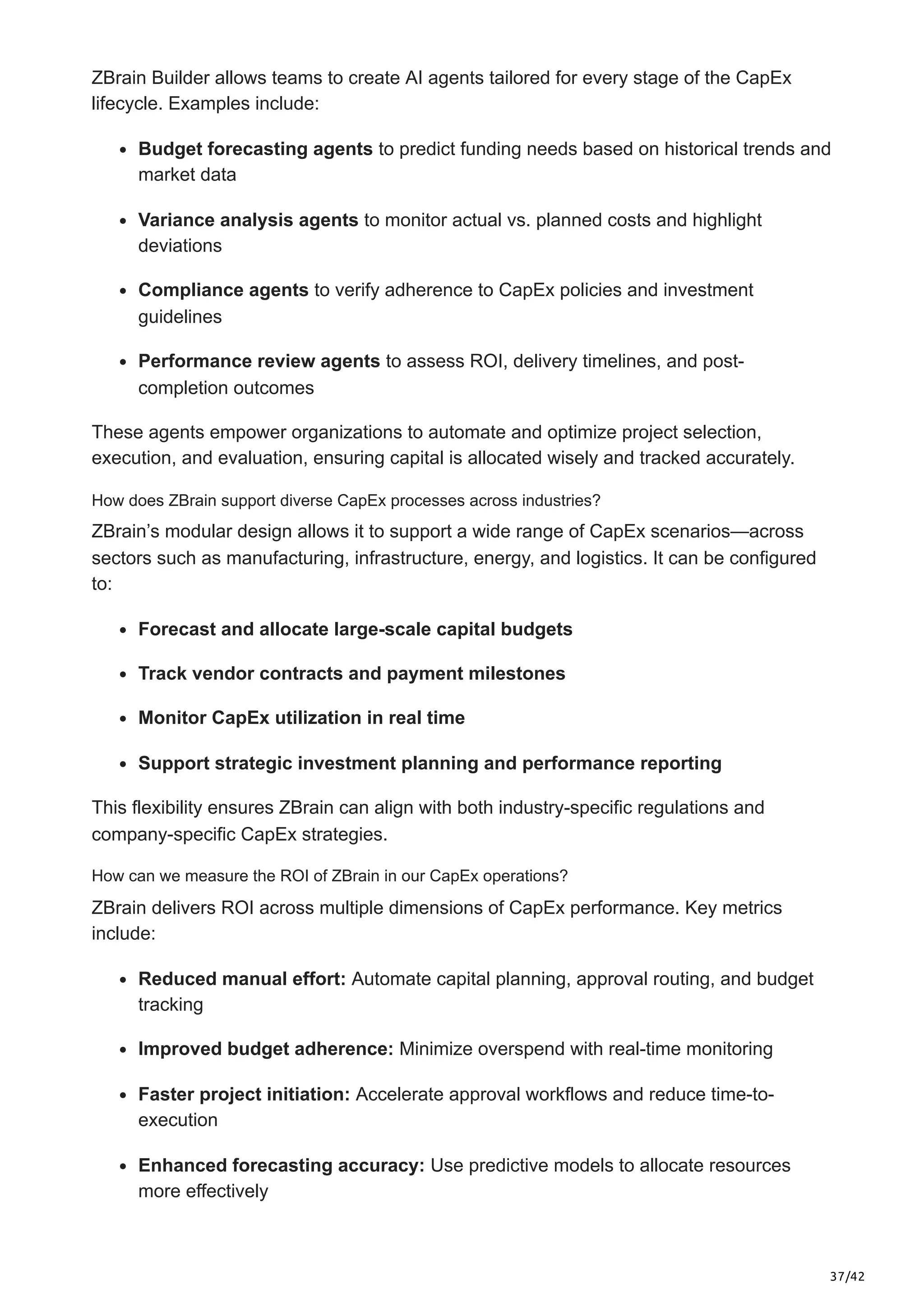

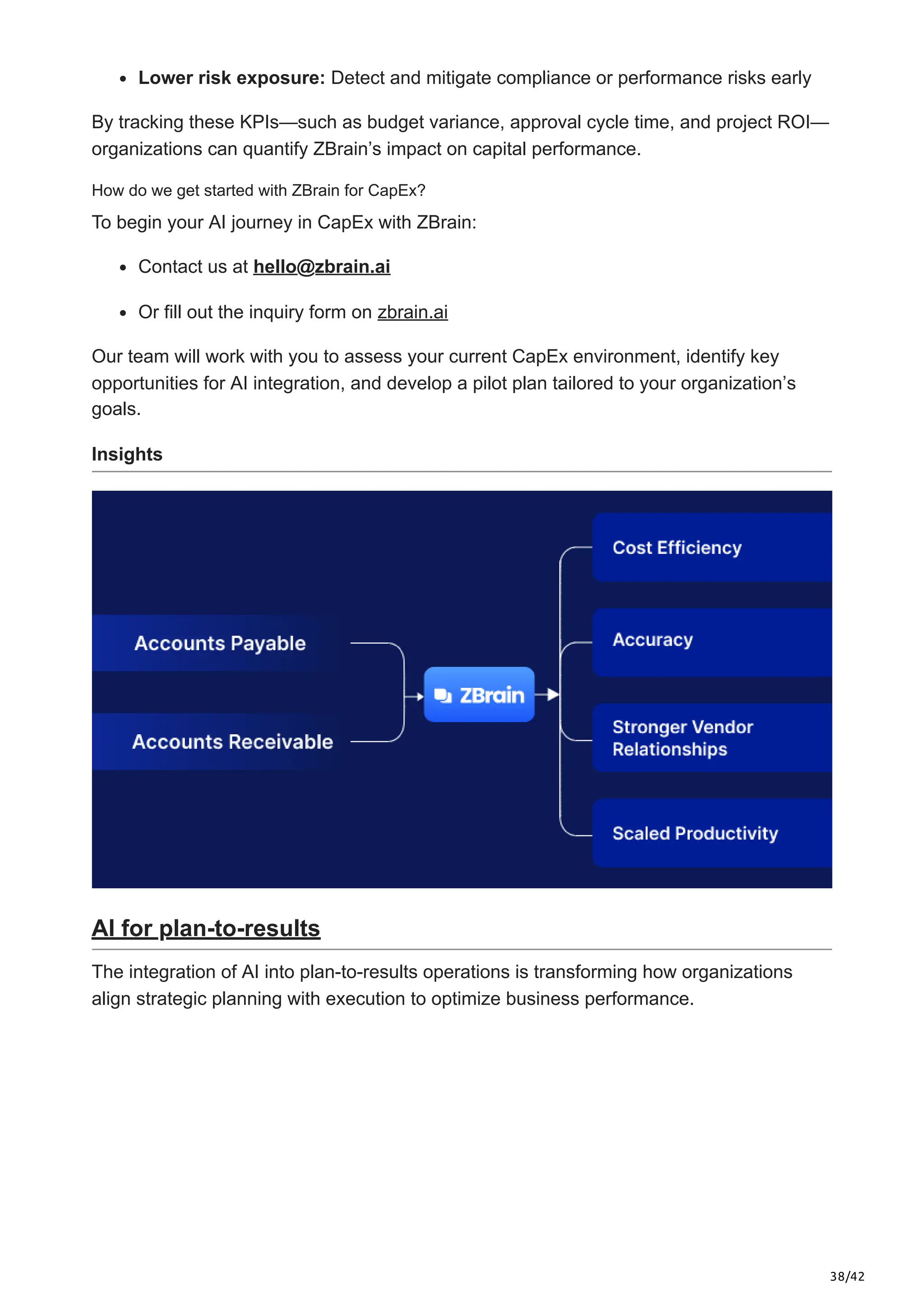

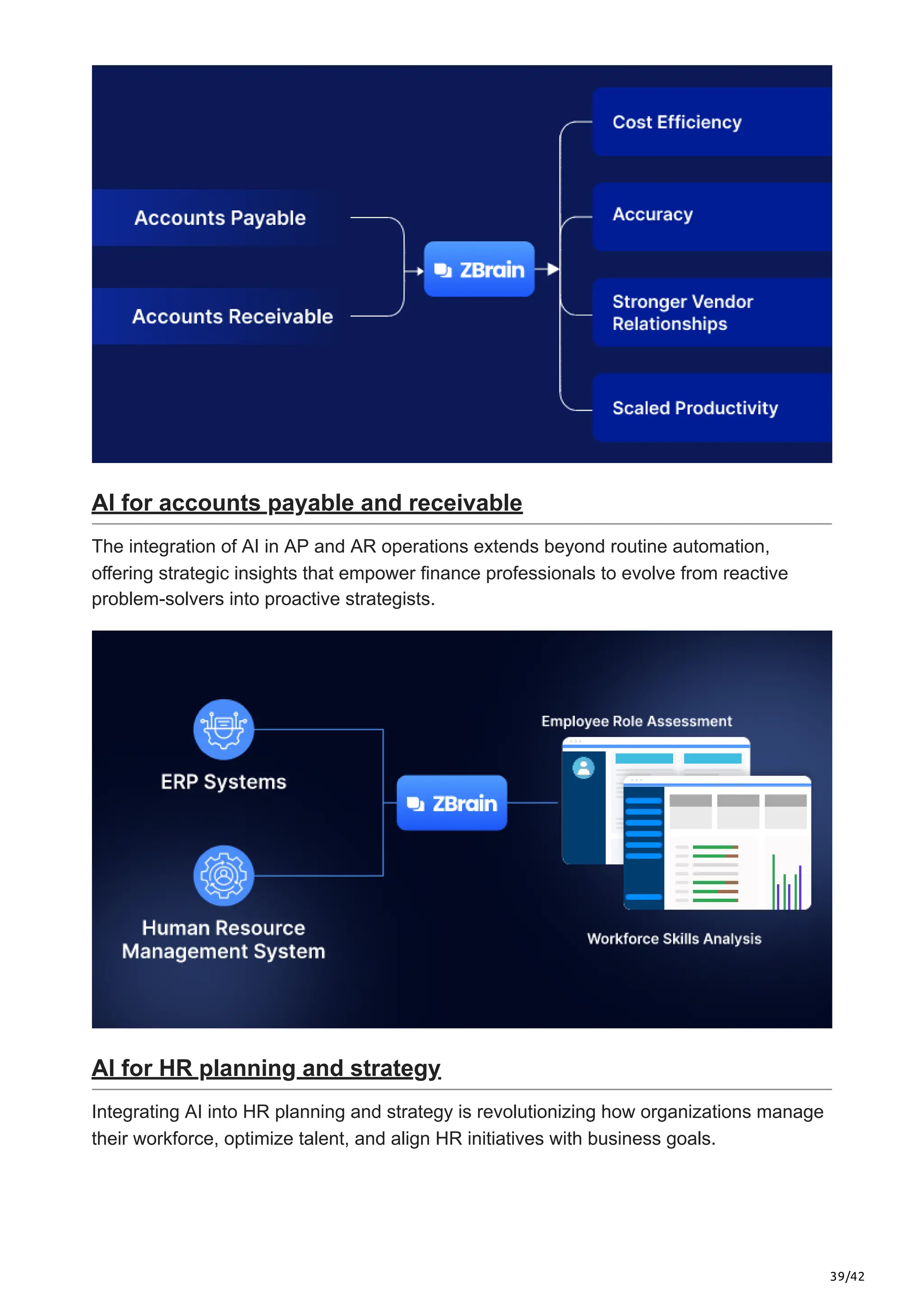

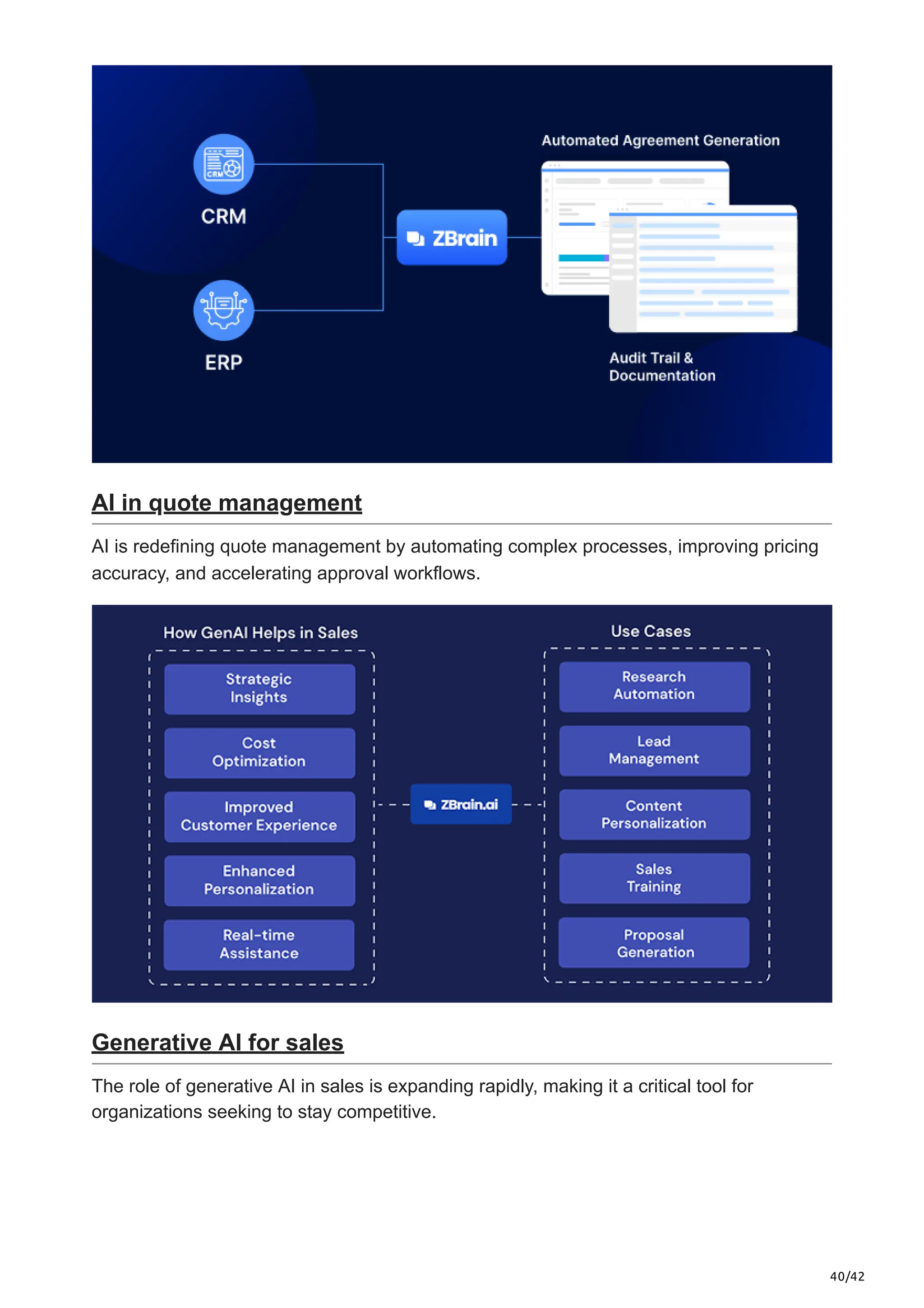

This article explores how AI is transforming the end-to-end project and CapEx process, driving smarter investments, reducing risk, and enabling greater agility. It also highlights how platforms like ZBrain help enterprises harness AI to make faster, data-driven capital planning decisions, ensuring superior ROI and strategic alignment in an increasingly dynamic business environment.