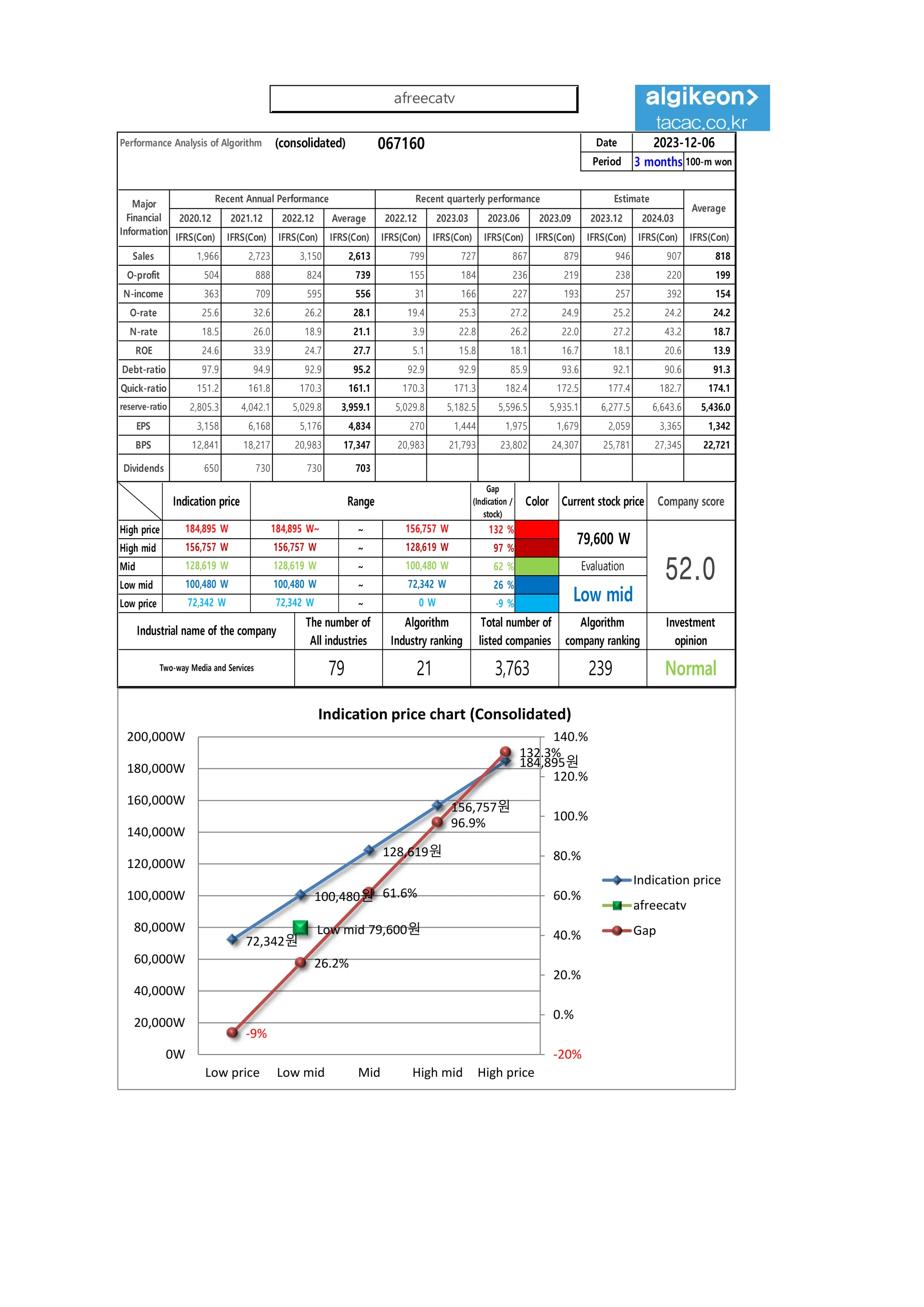

The document provides financial and stock performance data for Algorithm company from 2020 to 2024. It also includes the company's current stock price, the indication price range based on various financial metrics, the probability score of the stock price rising, and recommendations to buy 7,500,000 won worth of stock. The purchase amount is suggested to be 3,504,750 won to buy 44 stocks. A compliance notice is also provided, stating the analysis is for reference and the firm is not legally responsible for accuracy of data or investment outcomes.

![[Price for scheduled purchasing]

Arbitrarily made

Algorithm stocks Trading Strategies (consolidated) 067160 Date

Period

Gap

(Indication /

stock)

Color

2023-12-06

3 months

Current stock price Evaluation

Stock price rise

probability score

Investment opinion Prospective purchase amount

79,600 W Low mid 48.7 Normal 7,500,000 W

Suggested Purchase

Amount 3,504,750 W

Number of stocks

purchased 44

Indication price Range Buying / Selling Buying / Selling [Stocks]

High price 184,895 W 184,895 W~ ~ 156,757 W 132 % -4,636,099 W All selling

High mid 156,757 W 156,757 W ~ 128,619 W 97 % -3,397,183 W -22

Mid 128,619 W 128,619 W ~ 100,480 W 62 % -2,158,267 W -17

Low mid 100,480 W 100,480 W ~ 72,342 W 26 % -919,351 W -9

low price 72,342 W 72,342 W ~ 0 W -9 % 319,565 W 4

Stock price rise

probability score

A Sector 48.2 48.4 49.4 46.3 46.0 46.2

48.7

B Sector 33.8 52.9 38.3 46.3 38.3 54.6

Total average

2023.07.10 2023.08.07 2023.09.05 2023.10.10 2023.11.07 2023.12.05

41.0 50.7 43.9 20.8 42.1 50.4

51 % 16 %

2023.08.07 2023.09.05 2023.10.10 2023.11.07 2023.12.05

Total of

increase rate

Total score

A Sector 0 % 2 % -7 % -1 % 1 %

-8 % 49.7

B Sector 36 % -38 % 17 % -21 % 30 %

Total average 19 % -16 % -111 %

48 48 49

46 46 46

34

53

38

46

38

55

41

51

44

21

42

50

0

10

20

30

40

50

60

2023.07.10 2023.08.07 2023.09.05 2023.10.10 2023.11.07 2023.12.05

Stock price rise probability score

A sector

B sector

Total average

0% 2% -7% -1% 1%

36%

-38%

17%

-21%

30%

19%

-16%

-111%

51%

16%

-150%

-100%

-50%

0%

50%

100%

2023.08.07 2023.09.05 2023.10.10 2023.11.07 2023.12.05

Increase rate of stock price rise

A sector

B sector

Total average

afreecatv](https://image.slidesharecdn.com/afreecatv067160algorithminvestmentreport-231206040018-86dfb5d0/85/afreecatv-067160-Algorithm-Investment-Report-2-320.jpg)