The document provides an overview of the various advisory services offered by CohnReznick, including:

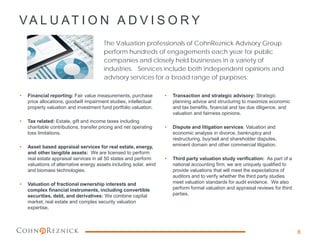

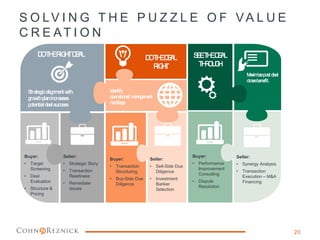

- Valuation advisory services for financial reporting, taxes, transactions, real estate, and complex instruments.

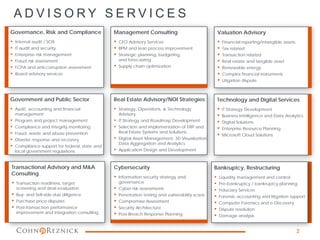

- Governance, risk and compliance services such as internal audits, IT audits, risk management, and fraud assessments.

- Management consulting services like CFO advisory, business process improvement, supply chain optimization, and budgeting.

- Technology and digital services including IT strategies, data analytics, digital solutions, and cloud implementations.