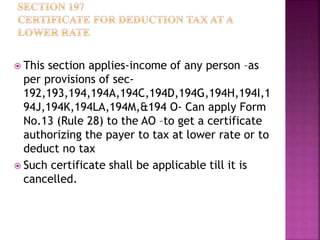

1) This section outlines the process for applying for a lower tax deduction certificate using Form 13. Such a certificate applies until cancelled.

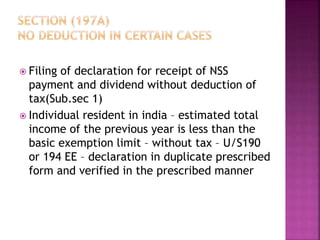

2) Individual residents in India whose estimated total income is less than the basic exemption limit can file a declaration in the prescribed form and manner to receive payments without tax deduction under Sections 190 or 194EE.

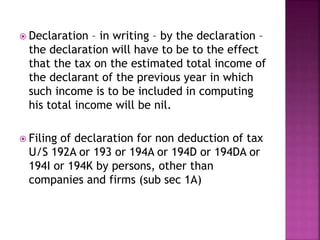

3) Filing a declaration in writing that the estimated total income for the previous year will be nil allows for non-deduction of tax under certain sections for persons other than companies and firms.