Embed presentation

Download to read offline

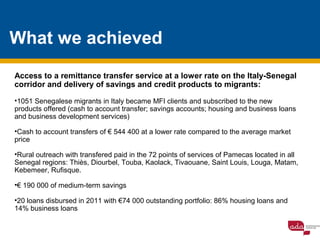

The document summarizes a remittance and microfinance program between Italy and Senegal. The program offered Senegalese migrants in Italy lower-cost money transfer services and savings/loan products through local microfinance institutions (MFIs). Over 1,000 migrants participated, transferring €544,400 at lower rates than average. Funds were paid out at 72 locations in Senegal. Migrants deposited €190,000 in medium-term savings and received 20 housing and business loans totaling €74,000. The program's success was attributed to offering products tailored to migrants' needs, culturally-sensitive marketing, competitive transfer operators, building trust over time, and gradually strengthening M