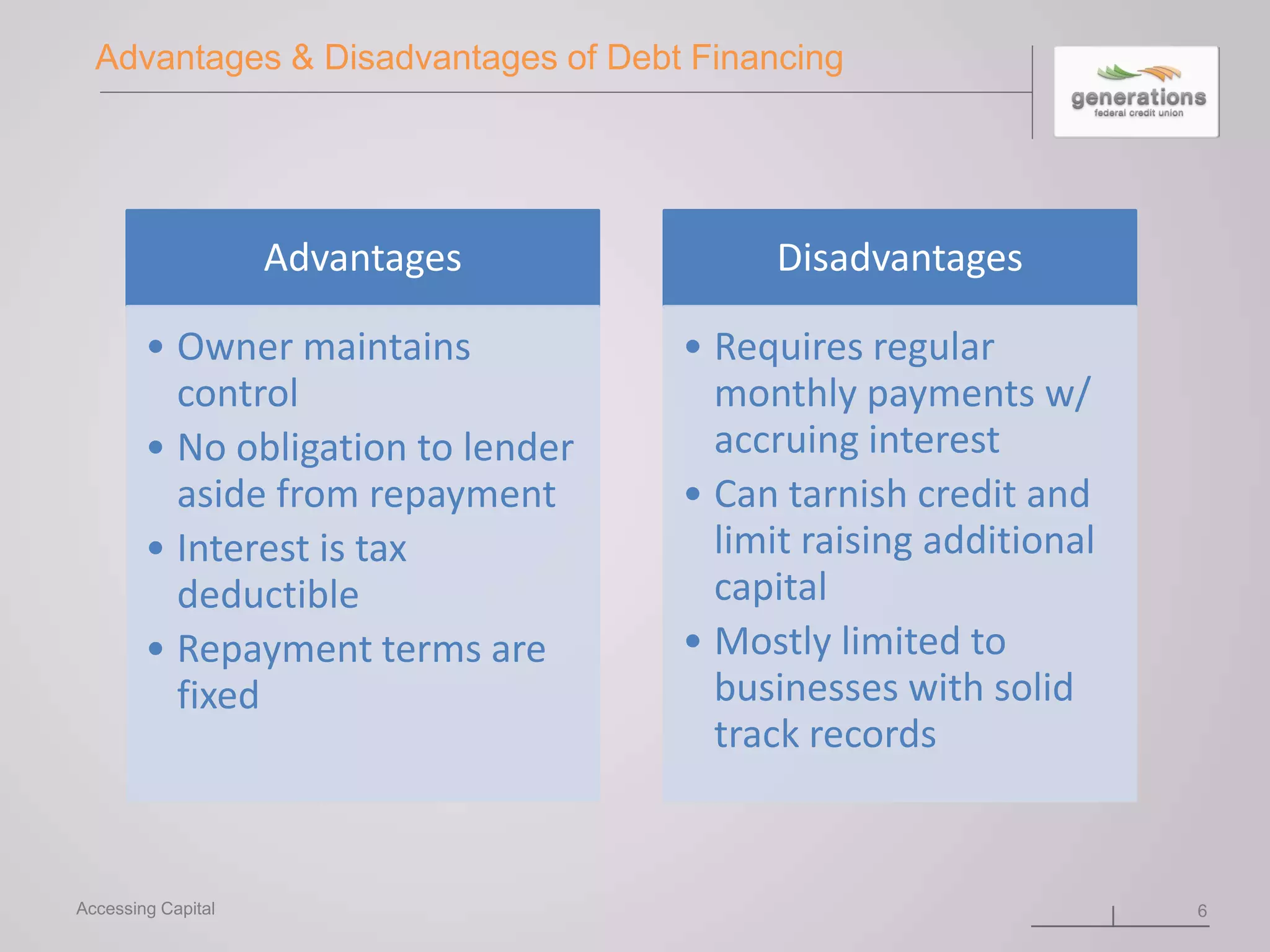

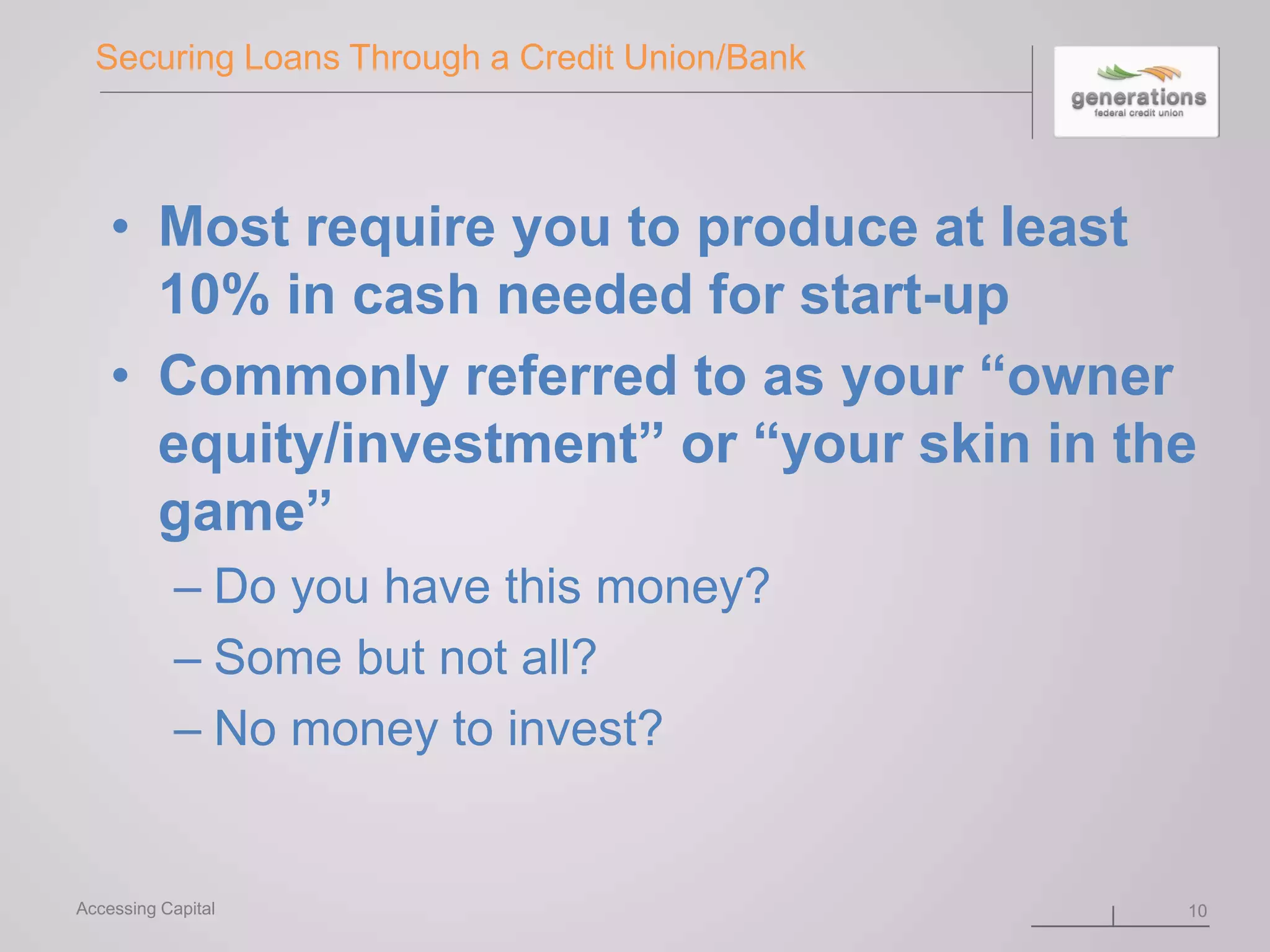

This document discusses various sources of financing for businesses, including personal savings, bank loans, equity financing, and other options. It outlines the steps to determine startup costs, anticipated revenue, and personal creditworthiness. Debt financing from banks and credit unions is described as typically requiring good credit history and being best for established businesses. Equity financing involves giving ownership in exchange for funds and is more common for startups, as it does not require debt repayment but dilutes ownership. The document advises reviewing one's personal credit profile and having owner equity of at least 10% when seeking loans. Other tips include ensuring diverse revenue sources and protecting the business with insurance.