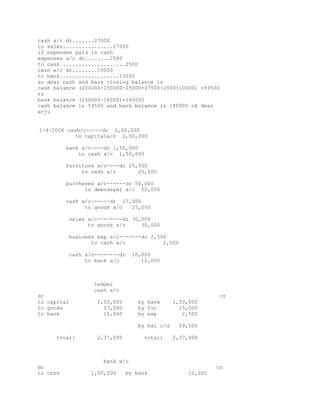

The document contains questions and answers related to accounting concepts and transactions. It discusses entries for bad debts, depreciation, journal entries for salary payments and adjustments, differences between accounts receivable and payable, accrued interest, and the treatment of investments in the financial statements. It also addresses preliminary expenses, types of invoices, the order of assets in the balance sheet, central and state excise duties, and the effect of bad debts and destroyed assets on the balance sheet.