1. Bookkeeping involves recording financial transactions so a business can ascertain its financial position. Accounting builds on this by classifying, interpreting, and communicating this information to various users.

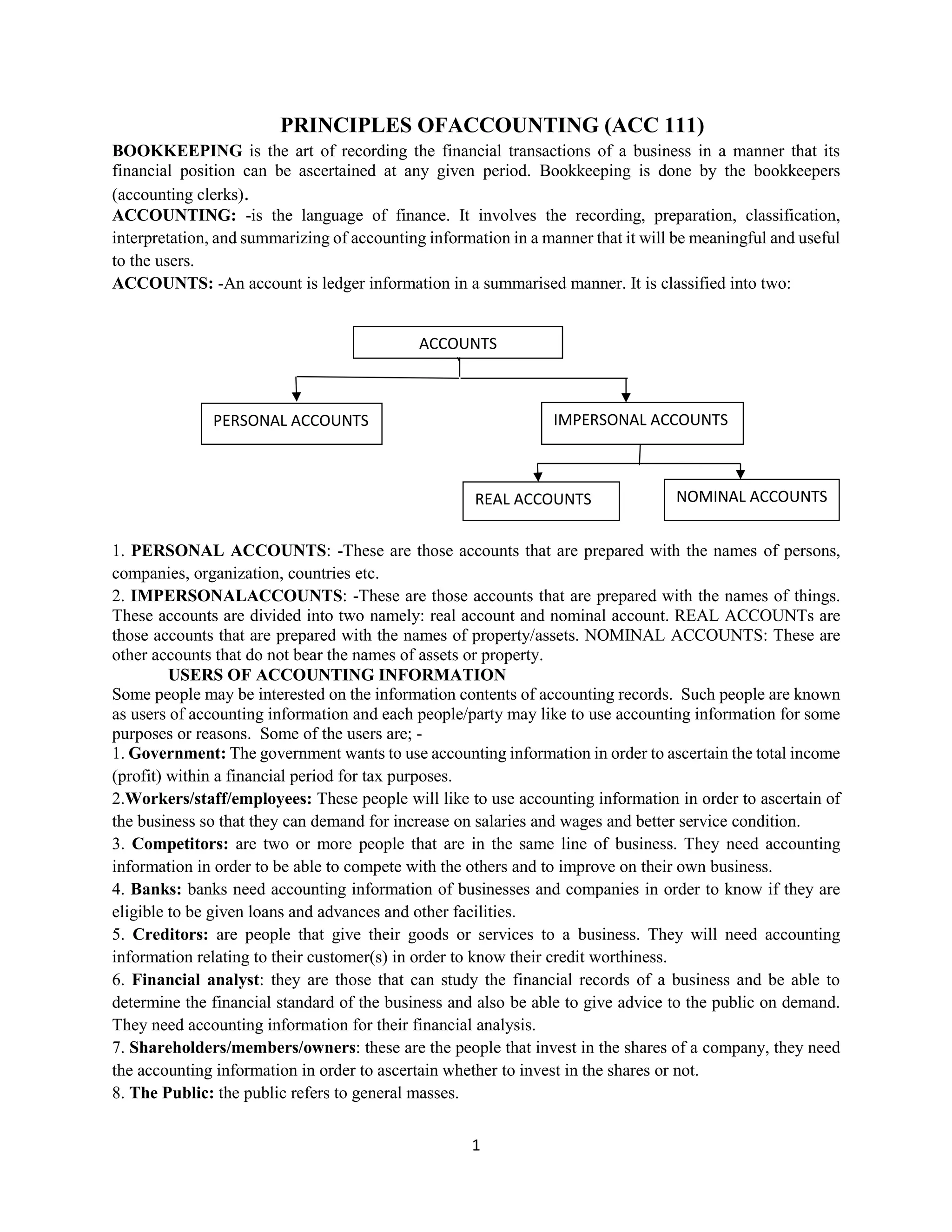

2. Accounts can be personal (related to individuals or entities) or impersonal (related to things). Impersonal accounts are further divided into real accounts (for assets) and nominal accounts (for other items).

3. Key users of accounting information include governments, employees, competitors, banks, creditors, financial analysts, shareholders/owners, managers, auditors, and investors - each with their own reasons for needing this data.