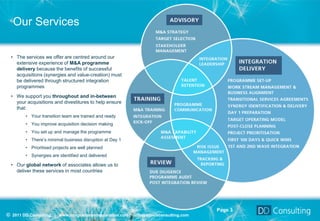

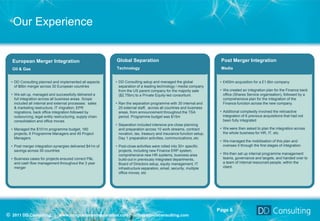

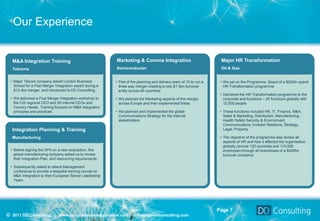

DD Consulting is a niche consultancy that specializes in M&A advisory services such as integration and separation programs. They help clients prepare for and manage change programs associated with mergers, acquisitions, and divestitures. Their team of consultants bring experience from top consulting firms and focus on transferring their skills and experiences to clients. They work with businesses across industries to deliver services centered around extensive experience managing M&A programs.